Would you believe that a banana-flavored bourbon is one of the fastest-growing whiskey brands on the market? Upstart brand Howler Head has gone from 0 to 60 — or from 0 to 50,000 9-liter cases, as the case may be — in 2021, its first full year. All it took was the obvious step every new whiskey takes on its path toward growth: a partnership with the UFC, of course.

As the official flavored whiskey of the UFC — a core, and some would say, necessary sponsorship if there ever were one — Howler Head is following in the footsteps of alcohol brands ranging from Proper No. Twelve to Modelo by using the MMA league as a turbo booster for its growth.

Howler Head’s ascent was so great and so rapid that one of the conglomerates has already come calling. Campari acquired a 15 percent stake in the brand for $15 million this August, with call options dependent upon brand performance to fully acquire the brand starting from 2025. “Through its deep relationship with UFC, Howler Head has a huge worldwide fanbase ready to enjoy this fantastic bourbon,” a Campari Group spokesman told VinePair.

“Through my work at William Grant [as its former CEO], I had interacted with Campari Group’s CEO Bob Kunze-Concewitz fairly often,” says Simon Hunt, now the CEO of Howler Head parent company Catalyst Spirits. “When I started working with Howler Head at Catalyst Spirits, I knew Campari would be an outstanding partner.”

The move enables the brand not only to continue scaling up, but to meet the demand that’s already evident in the market. “Campari’s investment will be used to accelerate the global expansion of Howler Head so we can reach the UFC fans around the world who message us daily asking when the product they have seen on the UFC broadcasts, and heard UFC president Dana White talk about, will be available in their market,” Hunt says.

In the case of Irish Whiskey Proper No. Twelve, MMA fighter Conor McGregor’s involvement in the brand made it both a behemoth and an outlier, and one with a unique path to success, capitalizing on his own presence in the UFC to partner with the organization. The brand’s purchase options were called in, and McGregor and Co. cashed out, with Proper No. Twelve now fully owned by Becle, the parent company of Jose Cuervo, which is represented stateside by Proximo Spirits. Howler Head had an even stronger inside track than that, though: UFC’s White is a co-founder of the brand. White isn’t one to watch somebody else get filthy rich and not follow suit, of course.

You have to imagine White sitting around one day and realizing, “Wait a minute, I can have somebody else make a whiskey for me, do all the work, and then I can sell it at scale directly to the audience I already have full access to, and make a fortune on top of my fortune? Sign me up!”

The UFC Is a Boozy Fighting Force

The UFC is the undefeated heavyweight contender of alcohol advertising right now, and that strength and track record are tied directly to its audience, a demographic that’s a near-perfect fit for the industry. “We are the 18 to 35, 18 to 49, that’s an amazing sweet spot for us,” says Paul Asencio, UFC’s head of partnerships.

“We crush it, more so than any other sport,” Asencio continues. “We are the youngest median age of any sport — baseball, football, hockey, basketball — which is 37. So, that is tremendously attractive to the Modelos of the world, which is our official beer in the U.S. Then we’ve got Jose Cuervo and Howler Head as well, as our spirits partners.” He also confirms a new official vodka partner is set to join the stable, though the deal hasn’t been finalized as of the time of this writing.

It’s not just the youth of the audience; it’s their proclivities. According to data provided by ESPN’s ad sales research expert Christian Debonville, 22 percent of UFC fans go to bars and clubs, compared to 17 percent of the general population. Two in three drink alcohol, and beer and whiskey are their favorite categories. UFC fans are 32 percent more likely to cite “going out” as a priority, and 13 percent of UFC viewing on ESPN’s linear [broadcast television] networks is out of the home, indicating opportunities to buy the booze they’re seeing advertised right at the bar.

Not only that, but UFC fans are 57 percent more likely than the average respondent to have a “positive disposition towards sponsors.” When you add in the fact that the UFC fan base is one of the most rapidly growing in the country, with a total of 110 million fans (including 13.5 million new ones over the past decade) this is dream demographic territory. A mass group of passionate, young, thirsty advocates who are primed to tune in and take a suggestion on what to drink.

“We’ve been saying since day one, which was January 2019 when we began our exclusive partnership with them, the research showed what a social audience it is,” says David May, senior manager of sports brand solutions with ESPN sales & marketing. “Social in every sense of the word.”

That means voicing opinions on social media, embracing technology, going out together to watch fights, and embodying the notion that a UFC fight is an event worth celebrating. Debonville’s numbers back that up, with 31 percent of UFC fans citing “it’s a social way for me to connect with my friends,” and 23 percent saying “it’s a social way to connect with my family.” Connect with your friends and family with a few rounds of Modelos, or shots of banana-flavored Howler Head, perhaps?

“Our fans in general versus every other sport, the way they are watching, consuming, going to these events, on a daily basis, is second to none,” Asencio says. “They’re incredibly engaged. And all of those things wrapped together is what makes it incredibly attractive for [advertisers] to do business with us.”

The UFC also bills itself as a one-stop shop of sorts for its partners. “The UFC, by the way, is the league, the teams, and the players association all wrapped into one,” Asencio says. That removes a great deal of red tape versus needing to sign separate deals, for instance, with LeBron James, with the Los Angeles Lakers, with the NBA, and with NBA International, for the same theoretical activation.

Then consider that certain NFL inventory is becoming unavailable to alcohol partners, á la Amazon Prime, which doesn’t currently allow alcohol advertising. The UFC, though? All in. The first sports league with a CBD deal, the first with a crypto deal, and willing to slice and dice its inventory to showcase a still- untapped number of different types of alcohol.

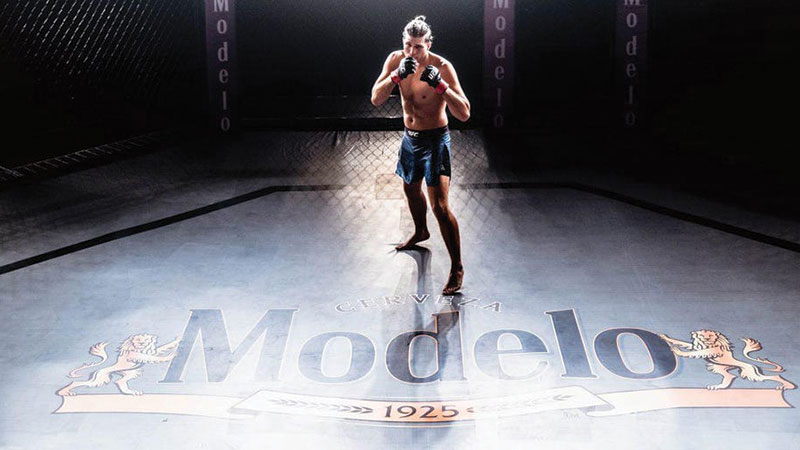

The year-round schedule of UFC programming is another focal point for its partners. “The event structure of the UFC allows for Modelo to drive momentum in markets across the U.S. with differentiated national and local programming through featuring digital, social, broadcast and retail extensions,” says Rene Ramos, a vice president of marketing with Constellation Brands, Modelo’s parent company in the U.S. “We treat this as an ‘always on’ opportunity throughout the year, which is unique compared to other major sports leagues with fixed seasons. We’re never off and our teams can pulse UFC programming as opportunities present themselves.”

Modelo is the official beer partner of the UFC in the U.S., with a deal reported to be in the low eight figures annually. According to Asencio, that places it among the UFC’s top five partners, with brands including Crypto.com, Draftkings, Monster, and VeChain. “They are one of our best partners, by the way,” he says. “They have our fighters in national commercials. They do a great job of letting the world know that we are in a partnership together.”

Modelo isn’t shy about touting its association with the organization, with a perfect tagline all cued up and ready to go. “It has been a seamless fit from day one because we share values around hard work, perseverance, resilient attitude and celebration — all of which is part of our ‘Fighting Spirit’ mantra,” Ramos says.

On the ESPN side, May concurs. “I will say that from day one, in January 2019, Modelo has been an unbelievable partner to us,” he says.

The results speak for themselves, with Modelo becoming the No. 1 imported beer in America and the No. 1 growth beer brand. “Over the past two years, Modelo has grown market penetration — the percentage of households who are buying — by 17 percent and is currently the only brand in the category growing both penetration and top-of-mind awareness among this audience,” Ramos says. “The UFC has played a key role in introducing and building on that general market audience.”

It’s made Modelo a force not only as an import, but as one of the biggest of big boys on the beer block. “Modelo’s explosive growth to the No. 2 beer in the U.S. by dollar sales has been bolstered in a large part due to our portfolio of strategic partnerships and the longstanding partnership with the UFC has been a key driver,” Ramos says.

Modelo wasn’t the first brand to see this type of success with the UFC, of course. Conor McGregor and Proximo Spirits launched Proper No. Twelve in September 2018, with the help of spirits entrepreneur Ken Austin, and within years it became the fastest-growing Irish whiskey in the U.S., and one of the largest Irish whiskey brands in the U.S., period. The full acquisition of the brand by Proximo was said to be worth up to $600 million.

And who’s the official tequila partner of the UFC? You might think former WWE wrestler and megastar The Rock’s Teremena Tequila (also founded with help from Ken Austin) was a natural choice. Dana White himself had even Tweeted about the brand in the past, offering up a video recipe for a “UFC Mana-Rita.” But Jose Cuervo is the UFC’s tequila partner — you know, the brand housed under Becle and distributed in the U.S. by Proximo, of course.

“Our work launching Proper No. Twelve demonstrated the power of the UFC fan base, and while it wasn’t the sole reason we decided to enter a partnership with UFC for Cuervo, it provided key insights and a close relationship with the inner workings of the sport that benefited our UFC sponsorship in its first year,” says Lander Otegui, SVP of marketing at Proximo Spirits. “It was clear to see how dedicated UFC fans are to their sporting heroes and they are extremely loyal to the products those fighters endorse.”

Cuervo’s three-year deal with the UFC, signed in July 2021, is said to be in the “mid-seven figures” annually. That’s a step below the Modelo tier, but a sizable investment nevertheless. “It marks the first time Cuervo has entered into a sponsorship agreement with a national sports platform — previously, we only partnered with local sports teams,” Otegui says. “We’re incredibly pleased with how the Cuervo brand has been received by the UFC universe and have seen more consumers enjoying Cuervo across new occasions.”

Howler Head’s Unique Fight Plan

Howler Head, meanwhile, is a brand that hit the market at a key time. Flavored whiskey accounts for more than 20 percent of off-premise whiskey sales, according to NielsonIQ numbers reported on by Wine & Spirits Daily. IWSR spirits analysis places the category at a 23 percent share of total whiskey sales, with future growth on tap in the years ahead. It’s a top-heavy landscape, with 20 brands accounting for 98 percent of total sales, and Howler Head is among its quickest risers.

The juice itself is two-year-old bourbon produced by Green River Distilling Co., which in July was acquired by the kings of contract distillation and brand creation, Bardstown Bourbon. While Dana White is now officially termed a co-founder, really he came on as an early investor. “Howler Head was started back in 2020 by Wooler brands, now Catalyst Spirits, in Ventura, Calif.,” Hunt says. “Dana White was introduced to the brand very early on and loved it. He came on board as a founder and a partner soon after.”

With White in the mix, there was a clear line into the UFC’s market, and the same growth strategy that Proper No. Twelve, Modelo, and Jose Cuervo have been using. “When Dana White and the UFC came on board it took things to a completely new level,” Hunt says. “Howler Head is now one of the fastest-growing brands in any category in the U.S. In the last 52 weeks ending July 30, Howler Head is up over 100 percent in the off-premise. It is the fourth-biggest flavored whiskey in terms of revenue growth in that time period.”

The brand now expects to sell over 100,000 cases in its second full year in the market, a sales level that wouldn’t have been achievable so rapidly on the strength of banana-flavored whiskey alone. “Dana White has proven an incredible partner in building awareness and consumer pull for the brand,” Hunt says. “His passion is infectious and he is a critical element in Howler Head’s success.”

With Bardstown’s Green River handling production, the brand also has the keys to unlocking instant scale, along with full customization and control of its product without the need for any expertise or infrastructure. It’s like a bourbon brand Build-A-Bear workshop, and if you throw cash at the project from the start, you can come out swinging in the way an upstart craft distillery never could. The UFC’s dedicated fan base then provides the fuel to that fire.

A Stylistic Matchup Too Strong to Miss

That coveted target market of UFC fans is too big, and too demographically delectable, to fail. And the league’s hand-in-hand work with its television partner, ESPN, allows for seamless integration across league partnership and into television advertising.

“There is no more sponsor-friendly production crew than the folks at the UFC who oversee their live fight card programming,” May says

With presenting sponsors for fighter intros, for bout decisions, for tales of the tape, and more, the options are endless. “So we’re never going to run out of in-content time sponsorable inventory,” May says. “But from the standard stuff to getting more creative around brand taglines and thematics, there’s nobody better.”

You better believe that pays dividends to partner brands, and offers them creative pathways toward increasing consumer engagement. “Beyond our shared values and alignment of our diverse and growing fanbases, we work hard to launch first-of-its-kind programming and explore new ways to engage with consumers to drive brand awareness, love, and growth,” Ramos says of Modelo.

“The amazing thing about Howler Head is that through our partnership with UFC, we give consumers a reason every single week to enjoy our brand, because there is a UFC fight every week,” Hunt says. “[W]e can tell folks to buy a bottle to enjoy the UFC fight, and when they do, their spirits choice is reinforced by all of the Howler Head branding they are exposed to during the actual fight and on social media. It is truly an amazing platform for a brand.”

It’s the secret sauce of UFC sponsorship and advertising, and it’s what made the league the ultimate growth hack for beer and spirits brands. “There is simply no bigger worldwide entertainment platform, no other spirits brand has the ability to tap into a nearly 700 million global fanbase and the massive 198 million social media reach that we have through UFC,” Hunt says.

“I would argue that we do it better than anybody,” Asencio says.

And who’s going to argue with him?

This story is a part of VP Pro, our free platform and newsletter for drinks industry professionals, covering wine, beer, liquor, and beyond. Sign up for VP Pro now!