This data is sourced from VinePair Audience Insights, which offers revolutionary, real-time visibility into alcohol trends. Our indexes track the popularity of the 65 most important types of wine, beer, and spirits in the U.S. marketplace. Built upon the largest proprietary collection of real-time first-party data about consumer alcohol preferences, VinePair Audience Insights empowers you to make smarter, faster marketing, purchasing, and investment decisions. All data in this report is based on our inCategory Interest SubScores.*

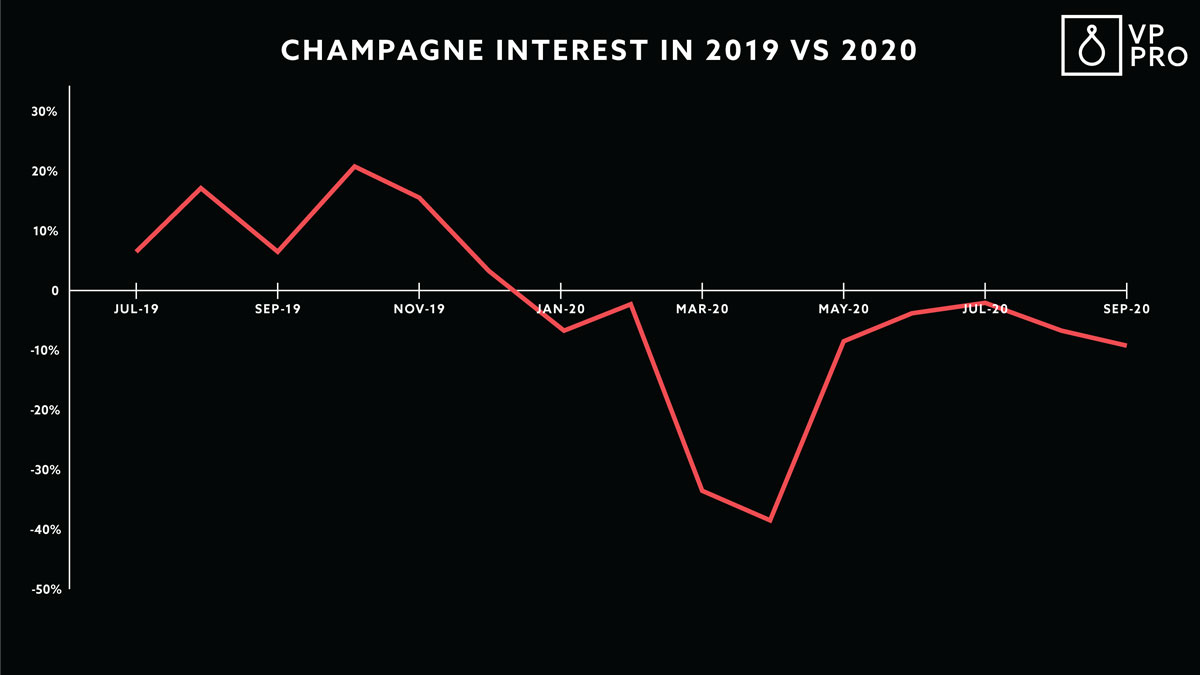

Last month’s takeaway covering summer 2020 showed consumers flocking to the comfortable and the familiar. VP Pro Audience Insights data for September 2020 revealed a similar story, with Cabernet Sauvignon (#3) continuing its surge in interest: America’s favorite red varietal jumped a huge +55 percent YoY to its highest interest level in our tracking series, finishing out the month behind only Rosé (#1) and Champagne (#2). Interest in Champagne continues to stabilize after sharp drops in the early days of Covid lockdowns.

The only thing we see possibly standing in front of Cabernet making big gains in its traditionally stronger months of fall and winter is election-related uncertainty. Will consumers flock to Champagne to celebrate their favored outcome? Or substitute stronger spirits if political chaos persists well past election day? (Interestingly, according to recent survey data, Democrats skew toward Champagne while Republicans oversample for Cabernet Sauvignon.)

Other “comfort food” varietals that continued to post big gains include Chardonnay (#5) with +58 percent YoY; and Red Blends (#10) increasing +48 percent YoY.

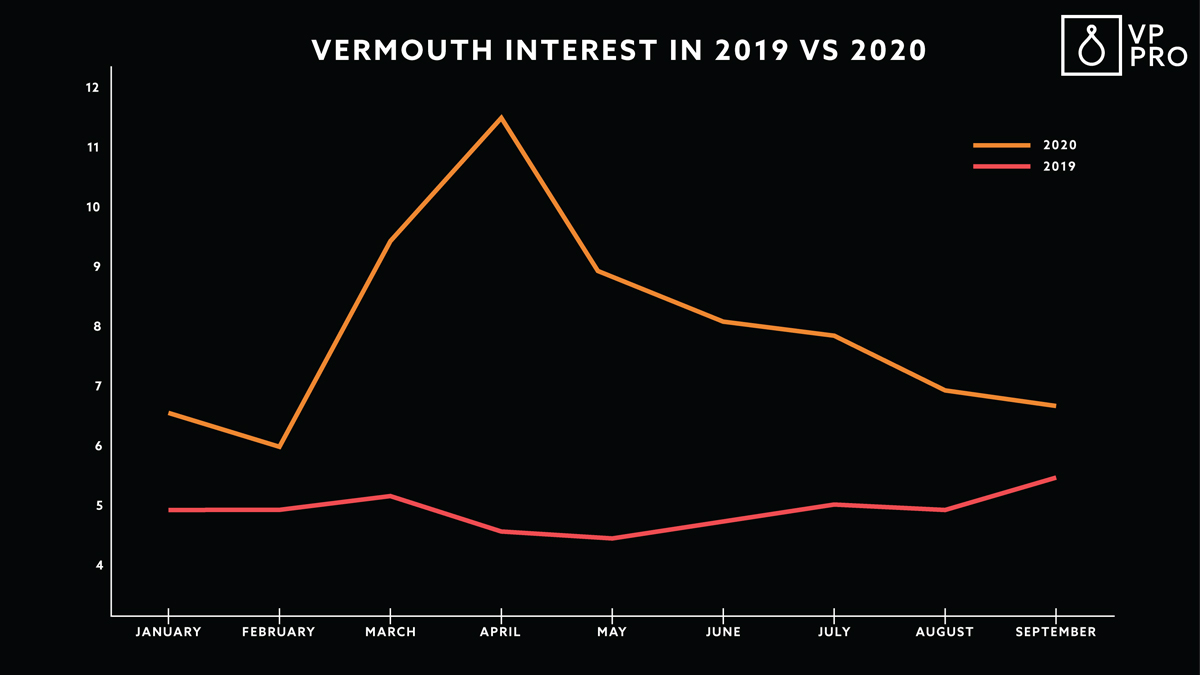

Consumers continued to seek out information about Vermouth, with home cocktail making maintaining relevance while restaurants and bars remain open in limited capacities. Looking at monthly interest in Vermouth in 2020 vs. 2019, we can see that interest remains highly elevated.

On the spirits side of consumer interest, Bourbon (#1) kicked into high gear in September showing +20 percent YoY. Cognac (#8) continues to show impressive strength with +81 percent YoY. Soju is another interesting emerging (in the U.S.) spirit to watch. If you’ve been watching Sunday Night Football on NBC, or the NBA playoffs on Disney’s ABC/ESPN networks, and live in the New York or Los Angeles media markets, you’ve likely seen ads for the category leader, Hite Jinro. These ads have been airing since August — in that time frame, we’ve seen Soju post two of its best monthly YoY jumps in interest on record, albeit off a small base.

Finally, we turn to beer: Macro (#2) and Mexican (#3) Lagers saw big jumps in interest in September. These are, however, well behind Hard Seltzer (#1) which continues to dominate consumer interest. While many consumers have become familiar with Hard Seltzer, rapid innovation continues to drive elevated interest. While it’s hard, and even futile to keep track of all the new products and line extensions in the Hard Seltzer space, some recent notables include: Topo Chico, Michelob Ultra, Bud Light Platinum, and new flavors for Bud Light Seltzer. And of course, Mark Anthony Brands will be bringing the entire FMB craze full circle by releasing a Mike’s Hard Lemonade Seltzer next March, according to recent reports.

*inCategory Interest SubScores measure relative audience interest for a given type of wine, beer, or spirit against its peers within its category. Click to learn more about VinePair Audience Insights.

This story is a part of VP Pro, our free content platform and newsletter for the drinks industry, covering wine, beer, and liquor — and beyond. Sign up for VP Pro now!