We’re keeping this month’s Takeaway brief for two very good reasons: (1) November Audience Insights data reinforced the trends we’ve been seeing since Labor Day across all categories; and (2) we’re now in the “D” part of OND, and we’re all quite busy.

On the spirits side of things, whiskey and Cognac continue to shine. Bourbon (#1) was up a bit YoY, on the back of very strong performances in October and September. Generic Whiskey (#2) was up double digits, as were Irish Whiskey and Rye Whiskey.

One question that we saw asked a lot this month: How will Cognac (#7)’s incredible summer momentum continue as we move into its traditionally stronger time of year?

To which we now answer: Great —to the tune of +65% YoY.

Champagne (#1) showed continued resilience in November. Cabernet Sauvignon (#2) continued to surge to its second consecutive record high of monthly interest. Chardonnay (#4) and Red Blends (#7) also exhibited remarkable strength.

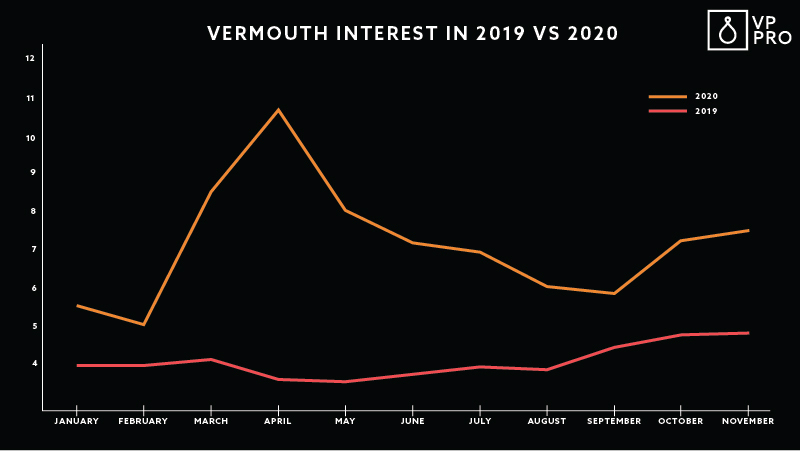

Per our in-alpha-testing Cocktail Insights product, OND, and in particular December, is the strongest time of the year for the Martini. On that theme, we continue to see Vermouth post dramatic YoY gains, even as we enter months with tougher YoY comps.

Finally, on the beer side of things, Hard Seltzer (#1) continues to maintain its separation from the rest of the field, seeing about the same level of interest we registered last November — which was in fact 70% of the “Summer of White Claw” peak. At the time, more than a few folks were wondering whether the winter would show that Hard Seltzer was just a fad. It’s hard to believe it’s only been a year since then.

This data is sourced from VinePair Audience Insights, which offers revolutionary real-time visibility into alcohol trends. Our indexes track the popularity of the 65 most important types of wine, beer, and spirits in the U.S. marketplace. Built upon the largest, proprietary collection of real-time first-party data about consumer alcohol preferences, VinePair Audience Insights empowers you to make smarter, faster marketing, purchase, and investment decisions. All data in this report is based on our inCategory Interest SubScores. inCategory Interest SubScores measure relative audience interest for a given type of wine, beer, or spirit against its peers within its category. Click to learn more about VinePair Audience Insights.

This story is a part of VP Pro, our free content platform and newsletter for the drinks industry, covering wine, beer, and liquor — and beyond. Sign up for VP Pro now!