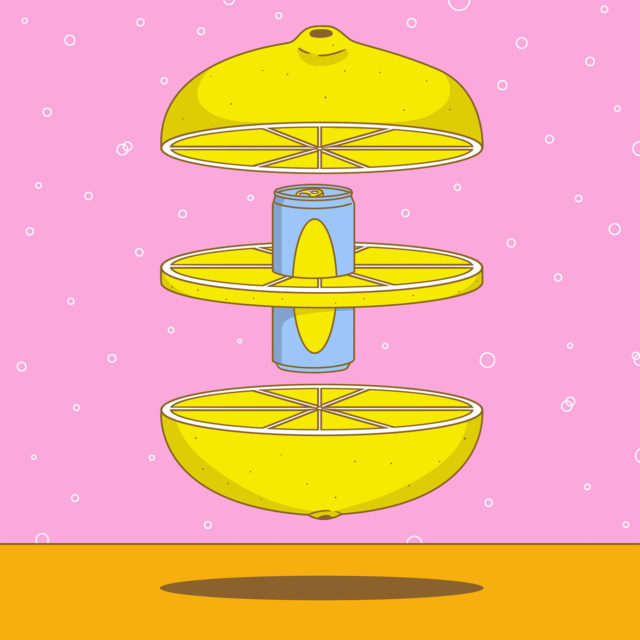

When Truly launched its line of lemonade hard seltzers last January, I admit to being skeptical. Lemonade simply didn’t seem to fit the narrative surrounding hard seltzer’s meteoric rise. With their lightly flavored, low-calorie portfolios, brands like Truly and White Claw had captured the imagination of health-conscious drinkers weaned on La Croix and Spindrift. How could lemonade’s bolder, sweet-and-sour profile fit into this equation?

Any skepticism surrounding lemonade hard seltzer’s viability was soon swatted away, though. By the end of the year, Truly Lemonade had notched up over $300 million in sales, according to Nielsen data. Not only was Truly’s 12-can Lemonade Mix Pack its highest-grossing product in 2020, it became the third-highest-grossing hard seltzer on the market, capturing 10 percent of the category’s sales. Lemonade, it was abundantly clear, had struck a chord with hard seltzer drinkers.

Unsurprisingly, the success of Truly Lemonade has not been lost on its rivals. Twelve months since its debut, all the nation’s major breweries and producers have since announced lemonade hard seltzer hybrids. Most are set to launch between now and April.

With the already crowded hard seltzer space set to take on a similarly bloated subsegment, the question changes from, will drinkers embrace lemonade hard seltzer, to how can brands compete in such a congested, still-nascent space? Beyond that, how has lemonade proven so successful?

What’s Fueling Demand for Lemonade Hard Seltzer?

It should be noted that when Truly Lemonade launched, there were other reasons to raise an eyebrow — if not for its appeal, then at least the motives behind its launch. Rather than simply being a flavor innovation, the product appeared to be a calculated assault on one of Truly’s biggest rivals.

Mark Anthony Brands, the parent company of the leading hard seltzer brand White Claw, also happens to own the Mike’s Hard Lemonade line of RTDs. It seemed plausible that it was more than a mere coincidence that the two leading seltzer producers now had competing hard lemonades.

When I spoke with Casey O’Neill, Truly’s founder and senior product development manager, in February last year, she dismissed this idea and said hard lemonade and lemonade hard seltzer were two completely different products.

The aim with Truly Lemonade, she said, was to bring the bolder flavor of lemonade to the seltzer space without the inherent sweetness and calories of the examples that already existed on the market. (Mike’s Hard Lemonade?) The brand also felt it had strong evidence of consumer demand for one such hybrid product.

“Something we found very interesting is that 64 percent of hard seltzer drinkers see hard lemonade as the most similar beverage in the alcohol space,” O’Neill said. “From our perspective, that spiked the idea that there is this need for a lemonade flavor profile [within hard seltzer].”

Reflecting on the launch and the last 12 months in a more recent email exchange, O’Neill writes, “Truly Lemonade felt like a total bullseye.” And yet, she adds, everyone at the brand has been surprised by the scale of its record success.

O’Neill’s view that lemonade hard seltzer is its own unique product has certainly borne out. Rather than competing with each another, recent sales figures show that the two styles of hard lemonade can coexist, and even succeed side by side. During Truly Lemonade’s breakout year, sales of FMB (fermented malt beverage) lemonades such as Mike’s Hard didn’t just remain steady, they grew 14.9 percent to $496 million, according to Nielsen data.

Still, market analysts point out that while these are two different products that appeal to different types of drinkers, Mike’s Hard Lemonade did play a role in Truly Lemonade’s success.

“Mike’s Hard Lemonade still continues to grow and is one of the most widely known RTDs,” a spokesperson for drinks market analyst IWSR states. “Potential consumers are more willing to try a flavor they are familiar with, such as lemonade, which is bringing in new drinkers to the seltzer category.”

Dave Williams, vice president of analytics and insights at BUMP Williams Consulting, agrees and adds that there was further proof of concept in the beer space, and the popularity of styles like shandies and radlers.

Beyond the popularity of lemonade, Williams offers two other fundamental reasons for Truly’s success. “Not only were they first to market, but they did it right — straight out of the gate with a fantastic product,” he says.

March Madness

Twelve months on since Truly Lemonade’s launch, all signs point to a huge year for hard seltzer lemonade, with every single major producer looking to take a slice of the citrus pie.

On Jan. 18, AB Inbev launched the Bud Light Lemonade Seltzer extension — its third launch in the space of a year. Molson Coors, which owns the Vizzy brand, is set to debut its new line in April. And while the exact dates have not been confirmed, it seems that release will either follow or quickly be followed by lemonade seltzers from Constellation-owned Corona. Most excitingly, Mark Anthony Brands has announced that it will launch a Mike’s Hard Lemonade seltzer “in a big way” in March. (That’s right, hard lemonade is coming full 360.)

It’s easy to see these products as an unimaginative attempt to emulate Truly’s success, but Williams and IWSR analysts say such flavor extensions are part and parcel of segments like seltzer, and a necessary means for keeping consumers engaged.

With the number of options set to roll out in the coming months, brands cannot expect record sales simply by virtue of offering a lemonade hard seltzer. But there are lessons to be learned from Truly’s tale beyond proven demand for the product.

When we look at the short history of hard seltzer as a whole, Williams says latecomers to the space each took a chunk out of White Claw and Truly’s market shares, but with each new release it became an “incrementally smaller bite.” Launching a lemonade quickly will therefore be a bonus, so on this count, Bud Light appears to be winning.

On the flip side, brands face the danger of rushing to market too fast without perfecting their products. It’s all very well getting consumers to try something new, but driving repeat purchases relies on quality, Williams says. “If you have that quality level where you can stand out within what is becoming a quickly crowded space, that’s how you keep drinkers in your family,” he adds. (This is something Truly is all too familiar with, having carried out a very public reformulation campaign of its standard hard seltzer line in October 2019.)

All things told, we likely won’t know who the major winners and losers are within lemonade seltzer for at least another year. From the narrative perspective, the prospect of a Mike’s Hard and Truly showdown is enticing. Will Truly’s one-year head start count for more than Mike’s two-decade presence in the hard lemonade space?

One thing’s for sure: While 2020 served us all a fat bunch of lemons, 2021 will be the year of hard seltzer lemonade.

This story is a part of VP Pro, our free platform and newsletter for drinks industry professionals, covering wine, beer, liquor, and beyond. Sign up for VP Pro now!