If you’re looking for a villain in the quietly unfolding drama between Italian and Australian winemakers over the use — and in fact the very meaning — of the word “Prosecco,” you could make a viable case for Paris Hilton.

In 2007, Hilton signed on as the celebrity face of RICH Prosecco, a canned sparkling wine that offered club kids and aspirational young adult consumers a slice of affordable luxury (the can was gold) for roughly $3 per serve. Hilton — at the time near the zenith of her reality television stardom — embarked on a publicity blitz, featuring in a flashy advertising campaign, making club appearances, and dropping mentions of her favorite canned party wine on the “Late Show with David Letterman” (“It’s like Italian Champagne,” she told him in one interview).

Italian Prosecco producers grudgingly tolerated Hilton’s party-girl persona and the references to “Italian Champagne.” Some disapproved of the Prosecco name’s placement within hyper-sexualized advertisements (in one ad Hilton is nude but for some gold body paint, for instance). Most bristled at the very notion of canning a low-quality expression of Prosecco, fearing it would cheapen the wine in the minds of consumers. But for Gianluca Bisol, president of producer Bisol1542, it was Hilton’s visit to what is now one of Prosecco’s DOCG regions in the Alpine foothills north of Venice that delivered the final insult.

“There was a video on the internet of [Hilton] in our hills with this horrible can,” says Bisol, whose family has made Prosecco in those same hills since the 16th century. “In a certain way, we have to say thank you to Paris Hilton. It’s thanks to this that we realized, all together, that this was a problem.”

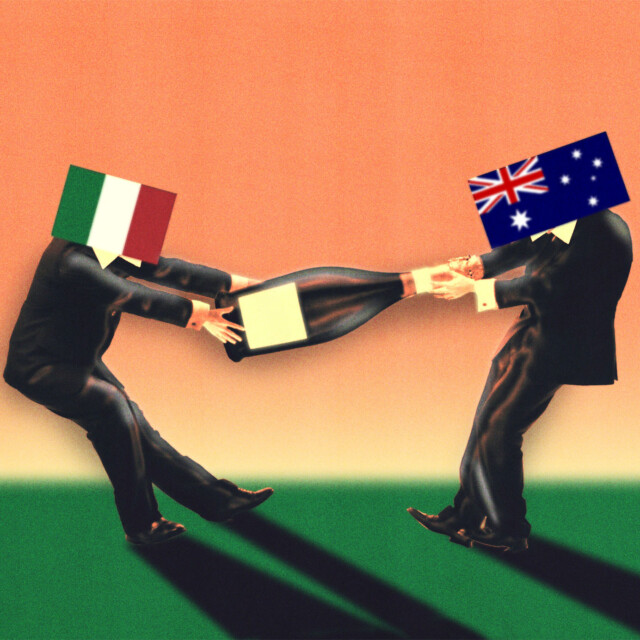

In the late 2000s, the region’s producers made a concerted collective effort to protect the integrity of the Prosecco brand, establishing a new and expanded Prosecco DOC appellation across a broad swathe of northeastern Italy and defining new rules around what can and cannot be labeled “Prosecco.” Nearly 15 years later, those efforts have created a significant sticking point in major bilateral trade negotiations between Australia and the European Union. Australian winemakers — who have produced wines from the Prosecco grape since 2001 — want to continue labeling their wine using the term. Italian producers insist “Prosecco” is a protected geographical designation rather than the name of a grape — a critical aspect of this dispute — and wish to use a pending E.U.-Australia free trade agreement to force Australian producers to drop the word from their labels.

With hundreds of millions of dollars hanging in the balance, the outcome of these negotiations, which could conclude as soon as next month, is no small matter for Prosecco producers in both countries. And in inking a deal, trade representatives will attempt to resolve a thorny issue baked into the larger appellation system: What happens when a grape is also a place (and also a wine)?

Like Italian Champagne

Prosecco (the grape) made its way to Australia in the late 1990s, taken there by the Dal Zotto family of Valdobbiadene, one of Prosecco’s historic places of cultivation, and now one of its three DOCG regions. The Dal Zottos planted their first Prosecco vines in 1999 in the King Valley in Australia’s southeastern state of Victoria, and the trajectory of Australian Prosecco has since tracked that of its Italian counterpart. Prosecco now grows in 20 regions across Australia and has evolved into a particularly valuable component of the nation’s wine industry. For growers, Prosecco grapes fetch the second-highest prices of all white wine grapes — second only to Riesling. For producers, both domestic consumption and export value are growing by double digits. At the end of 2021, sales value reached more than $200 million AUD (more than $130 million USD).

Italian producers sowed the seeds of their current disagreement with Australia in 2009, when they moved to secure an expanded protected geographic designation under Italy’s E.U.-recognized DOC (Denominazione di Origine Controllata, or “controlled designation of origin”) system. Though Italians have produced sparkling wines in parts of northeastern Italy for centuries, by the 2000s Prosecco had become a major global seller, prompting growers across the region to turn toward cultivation of the variety. As designed, the new DOC would protect Prosecco’s “made in Italy” brand and keep a lucrative export market for inexpensive bubbly — now produced across nine provinces in the northeastern Italian regions of Veneto and Friuli — rooted on Italian soil.

The only problem was one of nomenclature. Fundamentally, wine appellations are geographically designated areas tied to place rather than grape varieties. Winemakers in Burgundy or Champagne can, through international recognition of their protected designations, prohibit producers in California or Chile from labeling their wines as “Burgundy” or “Champagne.” But they can’t outlaw the use of grape variety names like Pinot Noir or Chardonnay. Italian Prosecco wines had long been made from grapes widely recognized by the name “Prosecco,” making the term itself fair game for producers globally.

So the Italians simply changed the name. In 2009, “Prosecco” the grape vanished from the Italian winemaking vernacular, replaced with the name “Glera,” a fairly esoteric synonym for the same variety. Overnight, “Prosecco” ceased to describe a grape variety — at least for the Italians — and instead described a style of sparkling wine and a region named for the tiny Italian-Slovenian border town of Prosecco. A full decade after Australian producers planted their first Prosecco grapes, Italy declared “Prosecco” a protected geographic term.

“In my mind, Glera is one of the most delicate grapes in the world in terms of flavor,” Bisol says, arguing that Prosecco as it’s understood by most consumers is a uniquely Italian wine. “These flavors are really influenced a lot by the area in which the wines are cultivated,” he adds, and when tasting Australian wines from the same grape he finds flavors inconsistent with Italy’s signature profile, likely due to variations in soil and climate.

Questions of quality aside, Prosecco is big business these days. Italy’s Prosecco DOC sold more than 638.5 million bottles last year, netting some $3.2 billion. More than 80 percent of that was exported, with nearly 20 percent going to the U.S. alone. It’s clear to see why Italy wants a monopoly on the Prosecco name and control over its brand image.

But it’s equally easy to understand why Australian producers feel Italy’s after-the-fact rebranding of Prosecco as a region rather than a grape is something of a rug pull. Moreover, Australian producers worry that codifying Italy’s manipulation of the “Prosecco” term in a major international trade deal could produce unforeseen ripple effects.

“There’s absolutely real concern amongst our industry at the moment,” says Lee McLean, chief executive of trade organization Australian Grape & Wine. “In the context of the E.U. free trade agreement negotiations, if our government gives up our right to use that grape variety name we think it sets a concerning precedent for a number of other grape variety names in Australia.”

What’s in a Name?

The Australian Prosecco boom has proved a bright spot for a wine industry battered by brutal retaliatory Chinese import duties imposed in response to — wait for it — a trade dispute. In some cases those tariffs reached 200 percent, prompting a nearly 20 percent decline in total Australian wine exports last year (China is Australia’s largest export market). While the industry at large took a hit, domestically produced Prosecco wines thrived, sustaining thousands of jobs and contributing to nearly $180 million (USD) in economic output generated by King Valley tourism alone. Winemakers there have in turn invested countless millions in the necessary infrastructure for Prosecco production.

An inability to label their wines “Prosecco” — should that come to pass — doesn’t mean that all goes away, McLean says, though it would create a degree of confusion among consumers that would likely dent overall sales. Australian producers could follow the Italians in calling their wines “Glera” — “that’s pretty unpalatable to most Australian producers I’ve spoken to,” McLean says — or simply call them “Australian sparkling wines.”

But Prosecco aside, allowing wine regions to unilaterally (and retroactively) bring grape variety names under the protection of geographical indications represents a much larger threat to Australian and other non-European winemakers. McLean cites Italy’s recent success in protecting the grape variety name Vermentino, a name used in many countries that have historically cultivated the Vermentino grape. (Many French wineries, for instance, now label their Vermentino wines using the synonym “Rolle.”)

“That’s a signal to us that if we lose the right to use the grape variety name ‘Prosecco,’ what’s next in terms of that precedent?” he says.

McLean sees no indication that Australian trade negotiators will bend on the issue, but Italy’s efforts to protect the Prosecco name elsewhere already have Australian producers feeling the pinch. A recently signed trade agreement between the E.U. and New Zealand includes the term “Prosecco” in a list of European appellation terms that New Zealand has agreed to protect. As a result, Australian Prosecco’s principal export market will soon be closed to non-DOC wines labeled as “Prosecco.”

“It’s not just because I’m Italian, but I think the Italians are probably right in this case,” says wine expert and educator Filippo Bartolotta. “The problem is, if I put myself in the Australians’ shoes, I understand: What else do you call it?” For Australian winemakers who have invested millions in Prosecco production in order to sell Prosecco wines to consumers, the loss of that labeling term creates both frustration and confusion alongside a potentially significant loss of sales.

“When you have an appellation that has the same name as the variety, that’s complicated, it’s a mess,” Bartolotta says. “Prosecco is a bug in the system.”

This story is a part of VP Pro, our free platform and newsletter for drinks industry professionals, covering wine, beer, liquor, and beyond. Sign up for VP Pro now!