My father worked in the beer industry many years ago. He always, always sought out his beer on draft, insisting that the stuff from the keg tasted fresher, smoother, more premium than the stuff from the bottle. And don’t even think about canned beer. The horror!

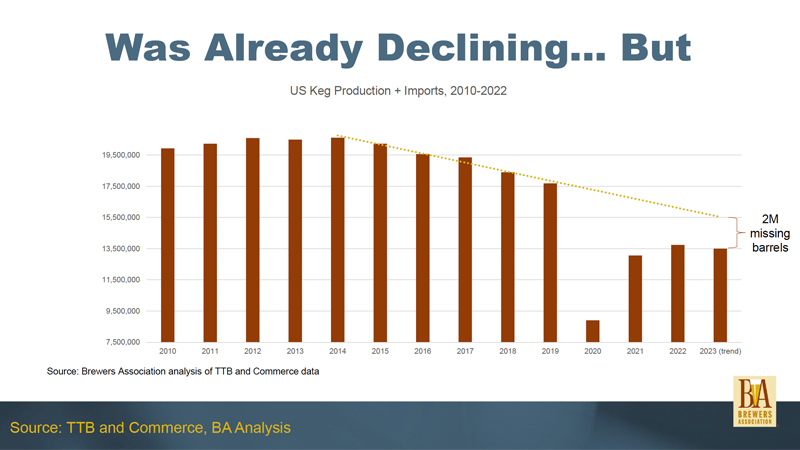

Times have changed, as they always do. For one thing, Dad drinks Natural Light by the 30-pack these days, for reasons unknown. For another, the received wisdom that beer always tastes better on tap appears to be increasingly unreceived by the American drinking public. Starting in 2014, the American beer industry has been steadily losing draft volume, and the pandemic hammered the format for obvious reasons; less obviously to those outside the industry, the lockdown draft downturn had an outsized impact on the craft beer category, which over-indexes on tap. Worse yet, while packaged beer has mostly stabilized at levels that track with the pre-pandemic period, draft has not. Taking into account keg beer’s slide in the Before Times, the latest data still show millions more barrels — or half-barrels, as it were — missing from draft’s already rough numbers.

“Draft beer never really came back from the pandemic,” Bart Watson, the Brewers Association’s chief economist, said plainly during the trade group’s midyear update last week, where he shared the above analysis he’d performed on keg production and import data from the Alcohol and Tobacco Tax and Trade Bureau (TTB) and the United States Commerce Department (DOC). His numbers are astonishing. From approximately 17,500,000 barrels (bbls) of kegged beer in 2019, the format plummeted to around 9,000,000 in 2020; if the year-to-date trend holds, 2023’s total will wind up at 13,500,000 bbls or so. That’s more than a 20 percent decline from just four years prior, and around 15 percent less than what the data from 2014 to present suggest it should be. We may have finally flattened the Covid-19 curve over the past few years, but this one seems to be steepening.

Why? I followed up with Watson earlier this week to pose that very question to him, and true to Watsonian economic fashion, he told me it was a little of Column A, a little of Column B (and C, and D…) “Some of the reasons [draft] has declined [include] different composition of shops, different strategies of those retailers that still exist, and different customer habits,” he says. Three and a half years out from the start of the pandemic, those trends “aren’t accelerating, which is good news. But [draft] is not coming back, which is the bad news.”

The badness of said news varies depending on which data you’re looking at, and how you slice it, as the vagaries of data dictate. The bar sales platform BeerBoard has tracked a 4.5 percent decline in draft sales year-to-date across its network of on-premise clients, which includes major chain restaurants like Buffalo Wild Wings and T.G.I. Friday’s, chief marketing officer J.C. Whipple tells Hop Take. (Packaged products were up 25 percent in the same period.) And while Untappd’s data, based on user-reported “check-ins,” shows that overall consumption across all formats is slightly down from pre-pandemic levels, draft is not particularly laggard. “[D]raught check-ins as a percentage of total check-ins has recovered to pre-pandemic levels,” Trace Smith, chief executive of Untappd’s parent company, Next Glass, tells me via email.

Regardless of the size of the decline, it’s not borne equally by every brewery. Roughly 80 percent of beer sold in the United States is sold in off-premise retail in either bottles or cans. (Or party kegs, I guess. Or bag-in-a-boxes. But always packaged, save for those hopelessly bougie post-gentrification supermarkets that serve draft beer in statistically negligible volumes.) Thus, the old industry wisdom that brands are built in the on-premise — the low-volume but high-touch domain of draft — while businesses are built in the off-premise, where packaged beer reigns. Craft brewers for years benefited from this dynamic, leveraging superior storytelling about their ingredients, ownership, and production methods to pitch themselves at bars and restaurants, where drinkers are primed for discourse rather than pressed for time like they tend to be picking up a 6-pack at the grocery store.

It was an industry strength that has lately become a potential weakness: Watson says roughly 30 percent of draft beer sold nationally these days falls into the BA’s “craft” category, leaving the segment’s producers particularly vulnerable to shifts away from the format. “For the overall beer business, draft is less than 10 percent, so certain players are just going to care less about this,” he tells Hop Take. “But for craft brewers, particularly some business models, this is really a key part of their business.”

Taprooms and brewpubs have been a silver lining for brewers on the draft front. Per the BA’s midyear analysis of data from the software platform Arryved and the polling firm Harris, respectively, at-the-brewery sales and on-site visits are both trending slightly up year-over-year. In these venues, kegged beer is at its freshest, and staffers have opportunities to hand-sell pints with education and storytelling. But while the shift looks promising for individual brewers hoping to take more direct control of more of their revenue, it’s a drop on the barmat in the aggregate. “That makes up a very small percentage of the gap” that draft is losing out on, Watson says. In his presentation, Watson highlighted a steady decline in the format’s share of craft beer’s overall final sales to domestic purchasers (FSDP) totals, a measure of how much craft beer is actually getting bought by rank-and-file drinkers like you and me. It’s going down, no two ways about it.

Smith finds some complementary inferences in Untappd’s national figures. “We’ve seen brewery taprooms continue to steal share over check-in volume from bars. This is not true of restaurants, which have maintained steady share,” he says. In other words, draft beer that you used to order at your neighborhood bar, you’re now drinking at your local brewery — if at all. (This is an important moment to point out that Untappd’s data, by virtue of being generated by users who opt into a beer app, is going to be more representative of beer enthusiasts than the drinking public at large. So even though this sounds like an affirmation of, say, New Jersey bar owners’ worst fears, I encourage my fellow former statesmen to take it with a grain of salt, and maybe a deep breath or two.) Suburbs also appear to have recovered faster on draft check-ins than city centers, which were hit hard by the pandemic, are home to fewer taprooms, and have mostly struggled to come up with good reasons why newly remote workers should bother returning to them. Neither Smith nor Watson had data to confirm my hypothesis that spirits’ growing share of overall alcohol sales may be coming at the direct expense of draft beer — i.e., people are drinking cocktails when they would’ve otherwise grabbed pints — but both allowed it was plausible. That could be another factor driving the format’s current swoon.

Where it’s headed is hard to say. But if you place the same premium on draft beer like my father used to (before he got his latter-day, and completely inexplicable taste for canned Natty), make sure to savor the flavor, and evangelize accordingly. And if you’re a brewer who sees value in the brand-building power of kegged beer, go and do likewise. After all, we’ve got a lot of draft dodgers out there.

🤯 Hop-ocalypse Now

How? HOW, dammit?! Athletic Brewing Co., launched in 2017, isn’t quite a household name at this point, nor is nonalcoholic craft beer as a style. But both are well on their way. And yet the brand is still getting sweetheart, “gee, whiz, what’ll they think of next?”-style coverage from major mainstream media outlets! Stories like this feature that “GQ” just published are good for Athletic, and to some extent the segment writ large, but they’re also basically color by numbers at this point considering how well trod the company’s origin story is. I’m not saying Athletic is due for, or deserving of, a takedown; I am saying it receives a helluva lot of good press for being a 6-year-old brand in a small-share niche that’s enjoyed good press for basically all six of those years.

📈 Ups…

Maui Brewing Co. has launched a cause beer to benefit wildfire relief efforts… It’s not listed in press materials, but a Dunkin’ rep has since confirmed that the brand’s new Spiked line will have some caffeine… The latest Bureau of Labor Statistics stats indicate beer is still outpacing inflation, but slowing…

📉 …and downs

Private-equity roller-up Made by Water abruptly shuttered Catawba Brewing Co. locations in Charlotte and Wilmington, N.C., this week… At mid-year, Brewers Association-defined craft beer volume is down 2 percent compared to 2022 year-to-date… Gallup’s latest poll shows more Americans than ever are drinking liquor, even though beer remains supreme (for now)…

This story is a part of VP Pro, our free platform and newsletter for drinks industry professionals, covering wine, beer, liquor, and beyond. Sign up for VP Pro now!