If hyped-up hazecans have a cultural and commercial analog in jaw-droppingly expensive Jordans (and I think they do), what’s the sneaker equivalent of non-alcoholic craft beer? More importantly, what can it tell us about the direction of that rapidly growing segment?

The answer to the first question is obviously “the keyboard jockey’s shoe du jour,” Allbirds. Since hitting the internet in 2016, the ascetics-as-aesthetics Silicon Valley brand has seduced bros on both coasts with the much-touted comfort of its deliberately bland sneakers, the sustainability bona fides of its supply chain, and #disruptive aura of its direct-to-consumer business model. As to how your humble Hop Take editor arrived at this considered and entirely correct opinion, for that, dear reader, we go to brunch.

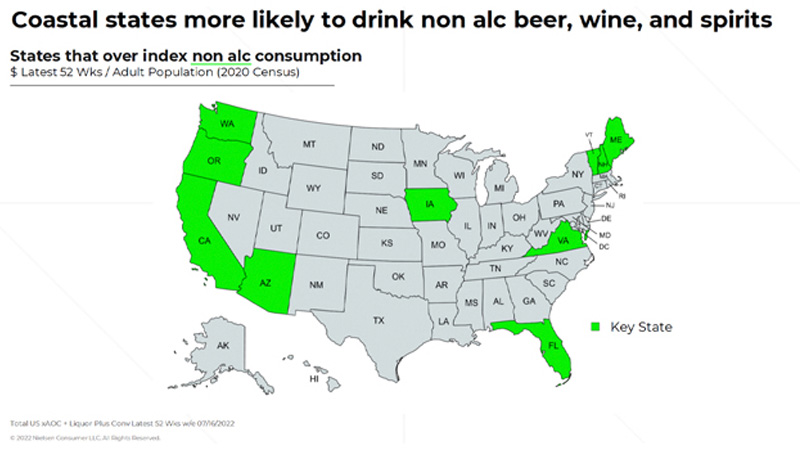

Not long ago, I met up with an old college friend in the West Village. This pal — I’ll call him Mike — has a successful career in the financial sector and at least half a dozen magnificent quarter-zip sweaters. He golfs, he dates, he takes in the occasional Broadway show. (As a point of fact, he doesn’t wear Allbirds, but he definitely falls within the target demo.) Mike is Put Together™, in other words, and when it came time for drinks, he ordered a non-alcoholic IPA from Athletic Brewing Company. I paid the order little mind in the moment. But a few weeks later, as I read through Brewbound’s breakdown of the latest NielsenIQ report on non-alcoholic beer, wine, and spirits, I realized something was still nagging at me about it. This map identifying states where drinkers’ N/A purchases outstrip the national index threw my vague nit about Mike’s choice into sharper focus:

Of course Mike drinks N/A craft. It’s an ergonomic, low-consequence option for his cosmopolitan, calculated, well-coiffed lifestyle. But is it possible that the segment’s popularity among Mike-like drinkers is hurting the segment’s appeal beyond the glow of America’s glittering first-tier cities? To wit: NielsenIQ’s scan data (of all N/A segments’ off-premise performance, not just beer) shows most drinkers are 45 to 54, with household incomes that exceed $100,000, living in “prosperous cities and suburbs” where they go out and spend more than the hoi polloi. Not exactly a populist’s portrait of these United States, that!

Athletic’s charismatic co-founder and chief executive Bill Shufelt isn’t convinced that sober curiosity on the coasts among upwardly mobile, white-collar, and mostly white consumers undermines non-alcoholic beer’s cultural reception elsewhere. “I understand the temptation to dismiss the growth of non-alcoholic beer — and adult N/A beverages more broadly — as nothing more than a fad concentrated on the coasts,” he tells Hop Take via email, before adding that customers of Athletic’s powerful e-commerce channel skew younger than the supermarket shoppers NielsenIQ’s scanners clocked. “We’ve faced skepticism from the beginning and we take great pride in converting critics into believers.”

For what it’s worth, I’m generally a believer in the N/A beer segment. American drinkers are clearly thirsty for more, and more interesting, non-alcoholic drinks. Athletic in particular has done a spectacular job quenching that thirst. Founded in Connecticut in 2017, its beers taste genuinely great, which is a big part of the reason the firm was just named Inc. Magazine’s 26th fastest-growing company in the U.S., and just opened a new 150,000-barrel production facility. “We have not seen a geographic rate-of-sale or adoption difference in different regions,” Shufelt says, noting that because Athletic drives the majority of N/A craft beer sales and launched on the coasts, the over-indexing isn’t so surprising. “Maybe more of the map will be filled in next year,” he muses.

Or maybe sober-curiosity will remain the domain of liberal coastal elites in the near term?

“Have you checked out that new non-alcoholic bar” sometimes has the tonality of “Have you read that new article in The New Yorker?”

Or is it more age demographic-driven? https://t.co/TjvYAO4mrY

— Michael J. Miraflor (@michaelmiraflor) September 25, 2022

Still, commerce and culture are in dialogue, not lockstep, and there’s something innate to the idea that N/A craft beer is a product for the pedigreed. A statistical snapshot doesn’t tell the whole story of the American drinking public’s sentiments toward N/A craft beer. In fact, nothing really does: The category has existed meaningfully for less than a decade. (Sorry O’Doul’s.) I don’t even think alcoholic craft beer — itself maligned for a dozen years as a byword for the post-hipster decadence of creative-class gentrifiers — is an accurate cultural comparison. Craft beer’s stereotype as an affectation of Pitchfork commenters and Moleskine-toting MFAs has endured in part because the things that set it apart from macrobrewed alternatives — flavors, labels, provenance, etc. — are fundamentally matters of taste, one of the most unintelligible and powerful class signifiers there ever was. N/A craft beer, on the other hand, offers a more concrete value proposition. Yes, it tastes good, and also it won’t give you a hangover. The Athletic beer my friend Mike ordered is function reverse-engineered into an approximation of form. Commercially, that makes it a brilliant product, and Athletic’s sales have soared apace in recent years. But it (and the rest of the N/A craft beer field) occupies a different cultural lane than the alcoholic beverage it apes. N/A craft beers are lager as a lifehack, #productivity via pale ale, Soylent but make it stout.

Which brings me back to Allbirds. The sneakers became a Merino-wool marker for rest-and-vest tech types and Patagonia-vested finance guys thanks to their utilitarian looks and vertically integrated approach to the footwear business. Allbirds “appealed to app developers and venture capitalists obsessed with innovation,” according to Wall Street Journal fashion columnist Jacob Gallagher. In a New Yorker essay on the shoes’ “algorithmic emptiness,” cultural critic Rachel Syme tracked the “meticulously boring” shoes’ growing popularity beyond the Bay Area among “Park Slope dads … and pretty much every overworked, weary thirtysomething you see on the New York subway.” (Not coincidentally, prime candidates for N/A craft beer conversion!) Start-uppy disruption of tangible consumer goods had yet to be sullied by the DTC collapse that would soon play out, and Allbirds rode that breeze.

But the shoes’ righteous appeal with knowledge workers would turn out to be a double-edged sword, earning the brand an aura of coastal elitism at odds with the vast American middle. Though Allbirds’ business was borne from e-commerce, this disconnect bears out in real life, too: According to its website, over 60 percent of its U.S. stores are located in just nine coastal states. The sneakers themselves are “glorified slippers,” argued writer Kyle Chayka in The New Republic, not cut out for the vagaries of life beyond the concrete jungle. They’re “most useful if all you do is pad around an office all day, and even then you should still avoid inclement weather. They’ll support your feet for a few hours at a standing desk but not a service job.” Put another way: Yes, Allbirds’ function-as-form approach plays with a certain type of customer, but not everyone, so if that core customer’s needs or values change, the brand’s fortunes may well follow. Enter the pandemic, which sent city-dwellers scattering to suburban and pastoral redoubts, and enter an Allbirds stock selloff. “If Silicon Valley decides style and virtue-signaling are less valuable when working from Idaho, Allbirds will continue to struggle,” predicted Reuters’ opinion writer Jennifer Saba.

That’s not to say that middle America doesn’t want or need functional, stylish footwear — just that Allbirds’ success shodding the country’s digital gentry saddled it with those customers’ cultural baggage. What does any of this mean for N/A craft beer? Certainly not that middle America doesn’t want, need, and deserve more innovative booze-free beverages. Nor that drinkers between the coasts and beyond cities’ limits will reject firms like Athletic just because they’ve pegged the subtle branding cues that convince metropolitan millennials to pay more for less. But… might they? Sure, man! Of course! Culture is powerful stuff, and beer — alcoholic or otherwise — is not exempt. (There’s a reason Coors Banquet is sponsoring “Yellowstone,” Kevin Costner’s stupendously popular Big West/small government soap opera, as opposed to, say, “Bridgerton.”) Thus, the Allbirds paradox: How does N/A craft beer continue to cultivate core coastal customers without coming off as oxymoronic pretension or effete curiosity to the rest of the country?

At Athletic, Shufelt understands the challenge, but points to the broad demand for N/A craft beer, its tiny share of the overall beer market, and his firm’s own limited penetration into that market, as indicators that any coastal containment is temporary. “As we continue adding new placements with major national retailers, we are confident that drinkers in America’s heartland will come to know and love our brews,” he tells Hop Take. Given his track record, I wouldn’t bet against it.

Of course, whether the broader segment finds its footing in America’s middle remains to be seen.

🤯 Hop-ocalypse Now

Tectonic shifts continue apace in the National Football League’s advertising landscape, where games are now airing weekly with nary a beer commercial to be seen thanks to restrictions imposed by Thursday Night Football streaming partner Amazon Prime. Is this a tactic to destroy the Budweiser Clydesdales’ livelihoods so they’re forced into grueling gigs at one of Amazon’s St. Louis warehouses? Hmm!

📈 Ups…

Mexico-h my God, the U.S. imports a lot of Mexican lager these days… Nittany normalization in effect as Penn State greenlights stadium beer sales… Regional recyclers are now tackling the PakTech plastic paradox… Sierra Nevada has 500k barrels in new capacity coming soon… O.G. Milwaukee Brewing Co. will live on as Eagle Park Brewing brand…

📉 …and downs

Bang Energy CEO continues Having A Normal One™ with former partner Pepsi… Bummer for Beantown booch-heads as Flying Embers shutters Boston outpost… CO2 shortage worsens thanks to Mississippi volcano problemo… Faubourg Brewing (née Dixie) goes Dutch with private-equity “powerhouse”…

This story is a part of VP Pro, our free platform and newsletter for drinks industry professionals, covering wine, beer, liquor, and beyond. Sign up for VP Pro now!