After Prohibition was repealed in 1933, the U.S. needed a new way to regulate the manufacturing, distribution, and sale of alcohol. The new system would ideally help manage consumer consumption and simplify government tax collections on alcohol. With these concerns in mind, the three-tier system was created to prevent sole ownership across production, distribution, and retail.

As a result, in the beverage industry, all alcohol products go through three hands (so to speak) before reaching the consumer. But it’s been almost 90 years past Prohibition and the drinks space has drastically changed, so we’ve tapped Sean O’Leary, a Chicago-based lawyer specializing in wine and spirits law, to better understand how this system works and its relevance today.

The Basics

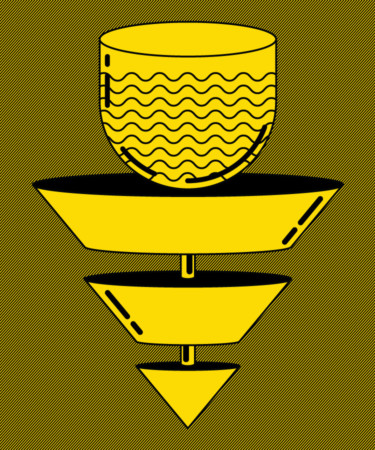

“The three-tier system refers to how the product is procured. The manufacturer is forced to sell to a wholesaler who sells the products to the retailer, who then sells them to the public,” says O’Leary. But the lines get blurry from state to state, as each has its own laws pertaining to alcohol distribution by way of the 21st Amendment. When it comes to the three-tier system, it’s imperative to look at what happens at the state level. As O’Leary explains, each state has its own “fence” of liquor regulations that enforces the system differently.

Still, the three tiers continue to be the guiding principle for distribution throughout the United States. In short, the system tries to strike a balance between control and access by placing an independent intermediary between producers and retailers. Its purpose? To provide checks and balances with the intention of leveling the playing field for all those involved.

To fully understand what happens at each tier, it’s important to know the key players: producers, distributors, and retailers.

Tier 1: Producers/Manufacturers

Tier 1 involves all producers including brewers, distillers, vintners, and importers of foreign alcoholic beverages. At this level in the system, the products are manufactured and then sold to a distributor, generally at a 50 percent price increase. This sale moves the products on to tier 2.

Tier 2: Distributors/Wholesalers

Distributors are at the intermediate tier of the system. In some cases, wholesalers act as the intermediary. For the manufacturers, distributors handle the logistics such as storage, transportation, and marketing of the products. Distributors should also offer a network of contacts and relationships with retailers that producers do not necessarily have, and are able to shop products to an array of retailers and businesses.

Tier 3: Retailers

Retailers are the last tier before reaching consumers and include licensed locations like bottle shops, liquor stores, restaurants, and bars. However, there are exceptions in which some states allow for the sale of alcohol in grocery stores with additional permits. At this final level of the system, retailers ensure that alcoholic beverages are only sold to those of legal drinking age.

Beer and Spirits vs. Wine

Although this system was made to govern alcohol distribution, different types of alcohol moving within the system are subject to different rules. “Beer, wine, and spirits are handled differently, mostly due to how they are vertically integrated with customers and the accessibility which is dictated by state laws,” explains O’Leary.

In the case of beer and spirits, the rules vary depending on producer size. “Large beer producers, such as Budweiser, are forced to sell to wholesalers because they have the capacity to transport and market their products to a vast amount of retail outlets,” says O’Leary. But larger is not always better, as big brewers and distillers are dependent on this partnership and forgo the ability to run their own operations.

“The idea is that there should be no vertical integration from beer or liquor producers to customers,” O’Leary says. “But these days we have craft breweries and distilleries with taprooms that operate much like a winery tasting room.” And though the concept is the same, only recently with the rise of these craft facilities are beer and liquor producers able to receive the same direct-to-customer sale privileges that wineries and vineyards have had for years.

Pros and Cons

By regulating ownership at each level, the three-tier system should benefit the market by increasing the variety of options at retailers and encouraging competition for distribution. It also allows for smaller, lesser-known brands to market their products at a national level in order to increase their awareness and sales. And the three levels ultimately keep alcohol sales traceable by tracking products from manufacture to retail in a chain of custody.

However, despite its intended benefits, the three-tier system is often criticized for facilitating massive markups; as a result of the journey from producer to retailer, consumers end up paying a 150 percent (or more) markup per bottle. These compounded prices can have especially negative effects on smaller producers.

The Future

There’s no denying that the industry has changed dramatically since the debut of the three-tier system. Among other things, the proliferation of direct-to-consumer (DTC) sales has led many to reconsider whether the policy is still viable.

The process of selling wine online — be it through a winery’s website or a subscription club — has remained opaque for winemakers whose product goes through importers, distributors, and retailers before reaching the customer’s table. With an uptick in consumer complaints, some organizations are speaking out; in 2018, VinePair reported that the National Association of Wine Retailers (NAWR) was taking steps to make wine sales more accessible online in an effort to evolve the distribution system for the changing times.

Regardless, the three-tier system is still how most producers get their alcohol to retailers and customers. Understanding how the system works is fundamental for industry professionals and even consumers, especially as the drinks space continues to change.