This article is part of our Celebrity Tequila series. Read more about the rise of A-lister agave spirits here.

Fluid dynamics dictate that when waves collide with one another in step, they create a bigger wave, one with greater amplitude. Does the same hold true in beverage industry dynamics? Onda is about to find out. With an Instagrammable Southern California surf aesthetic, an A-list celebrity backer, and a name that literally means “wave” in Spanish, this new-ish ready-to-drink tequila soda brand sits squarely at the nexus of hard seltzer and celebrity tequila, two of the beverage alcohol business’s biggest trends. Here’s a closer look at the boutique brand, and how its spirit-based “endless summer in a can” offerings are in position to ride the wave.

A tequila-based ‘trade-up’

Onda hit shelves in select markets in summer 2020, joining the growing number of agave-oriented canned offerings from brands big and small (Cutwater, Lone River, Hornitos, Phusion Projects, Volley…) already pitching themselves to American drinkers as higher-end hard seltzer alternatives. Sales were small: According to NielsenIQ scan data, Onda sold just $42,543 of its flagship tequila soda and Paloma flavors via supermarkets, liquor stores, and convenience stores from its July 2020 launch through the end of the year (though that figure does not include orders placed via apps like Drizly and Minibar, or orders placed via Onda’s website.) Still, Noah Gray, Onda’s CEO and co-founder, sees “white space” ahead.

“Everyone is seeing the writing on the wall of tequila being the fastest-growing mature spirit base, and RTD being the fastest sub-segment of the industry,” says Gray, who launched the brand with his co-founders after doing agency-side development for beverage alcohol clients and attending business school. Like many competitors in the RTD space, Gray is hoping to position Onda as a more premium version of the hard seltzer juggernaut for drinkers in the 16 states where its cherry-red slim cans are currently available for sale. “We see [Onda] as a trade-up from hard seltzer where you’re hitting on some of the theme, convenience, and health benefits, but even higher-quality ingredients, and even better tasting liquids,” he says.

(Investors seem to agree — Onda raised $1 million in seed funding last year, and as this story was being edited, the brand closed another $5 million funding round.)

To extend the surfing metaphor, these are some pretty big waves Onda is eyeing. Start with full-proof tequila, which has become a force on its own, sans celeb: According to the Distilled Spirits Council of the United States (DISCUS), full-proof tequila sales volume in the U.S. is up 180 percent since 2002, at an average annual clip over 6 percent. The pandemic will likely only boost those figures. And thanks to this superlative growth, plus reliable production cycles and the fact that Jalisco is just a hop, skip, and a Learjet from celeb-heavy Los Angeles, stars have flocked to tequila left and right in hopes of leveraging their pop culture prominence into Clooney-style cash. “It’s what we’re calling a mass premiumization trend with even more celebrity-backed [full-proof tequila] brands, but this time the celebrities are targeting very mainstream audiences,” says Kara Nielsen, director, food & drink at WGSN, a trend forecasting firm. “The fact that Kendall Jenner is putting out a tequila, whether you love it or not, is very much showing this broad appeal of fancier, premium tequilas” to both mainstream celebs and rank-and-file drinkers alike. (Maybe not coincidentally, Onda’s first fundraise was led by an agency co-founded by an early investor in Tequila Avión, of “Entourage” fame. Huh!)

As for the RTD category, the opportunity is nascent, but by most estimations, pretty damn big. “Volumetrically, the U.S. RTD category grew over 100 percent between 2019-2020 and is now double the size of the entire spirits category by volume,” Brandy Rand, the chief operations officer of the Americas at IWSR, an alcohol market analysis firm, tells VinePair in an emailed exchange. “Given the overwhelming popularity of hard seltzers, the trend of spirit and soda RTDs will likely be a natural evolution of the ‘seltzer-like’ category.” The firm expects total RTD volumes to double by 2024, and tequila-based RTDs — which Rand says currently hold a leading 43 percent share of the spirits-based RTD market in the U.S. — to grow at a compound annual rate of 34 percent between 2019 and 2024.

That tracks with the rising popularity of ranch water, that effervescent, ill-defined, agave-oriented Lone Star State refreshment that is generating big buzz and multimillion-dollar projections despite “still introducing itself to the 49 states that aren’t Texas,” as Kate Bernot put it recently for Good Beer Hunting. It also tracks with WGSN’s Nielsen’s general expectations for tequila-based RTD products this summer, especially since most RTDs’ ABVs (including Onda at 5 percent) match up well with malt-based beverages like beer and hard seltzer. “I think it will be an alternative to hard seltzer at a party,” she says.

Of daytime drinking and digital media

Taken together, this all seems to bode well for Onda. Though he declined to share sales figures with VinePair, Gray says distributors are excited about Onda because it checks two vital boxes (tequila and RTD) heading into the summer. “When we talk to our national accounts, they tell us ‘you have the two retail sets … that are getting more shelf space, not less,’” he tells VinePair. And rather than compete with the full-proof spirit in a nightlife context, Onda, with its ‘90s-style surf aesthetic, is well calibrated for America’s post-pandemic pool parties — the sort of casual daytime occasions in which Gray aims to compete directly with hard seltzers. “Onda is incredibly laser-focused on daylight,” he tells VinePair.

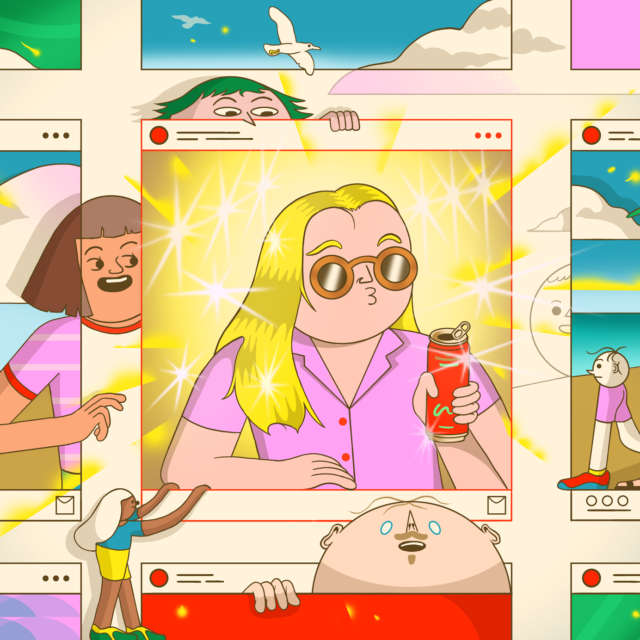

Nielsen cautions that given the newness and growth of the RTD category, it’ll take some time to shake out. “They’ll be premium ones and less premium ones,” she says. “I think it’s gonna be crowded and probably a little confusing for a while.” But even a packed field with blurry lines may be advantageous for Onda, in a way. Unlike every other tequila-based RTD vying for shelf space and attention this summer, the brand has a celebrity co-founder in Shay Mitchell, a telegenic actor best known for her star turn in “Pretty Little Liars.” With 29.8 million Instagram followers, 5.9 million TikTok followers, and enough A-list cachet to generate Onda-oriented headlines from non-beverage outlets (WWD, Nylon, Refinery29…), the actor certainly has the built-in audience and platform savvy to help the brand stay visible in an increasingly competitive category.

“With Shay, we have one of the people who understands the new age of digital media better than anyone on the planet,” Gray says.

In a chaotic market with lots of noise, Mitchell’s star power could help Onda stand out where all the usual marketing levers (premium packaging, a strong story, perceived ingredient quality) simply can’t. The operative word there is could, because there’s just not much precedent for how celebrity backing influences an RTD brand’s sales — if it does at all. But if Onda’s two beverage bellwethers are any guide, the brand may benefit from Mitchell’s involvement.

On the full-proof tequila tip, between 2018 and 2019, IWSR recorded a whopping 31.7 percent volume surge among brands endorsed by influencers. And in the hard seltzer space, where celebrity-backed products are still relatively new, rapper Travis Scott’s collaboration with Anheuser-Busch InBev (a malt-based, “agave-spiked” offering called CACTI) blazed a promising trail, selling out at some retailers on the day of its release and leaving ABI scrambling to ramp up production.

When it comes to tequila-based RTDs, though, Nielsen thinks the right pairing could work. A country music star from the Southwest throwing their name behind a ranch water brand, for example. “For a canned tequila beverage [to draft successfully off a celebrity’s involvement], I still feel like it would have to have some authenticity for it to really resonate with consumers,” she says. “It would have to be a good match.”

Fame vs. focus

It also has to be the right arrangement. “Every deal is different,” Jeffrey Kobulnick, partner at Brutzkus Gubner Rozansky Seror Weber, told VinePair earlier this year about celebrity-based deal structures in the beverage alcohol space. Depending on whether the business relationship is an endorsement, a licensing deal, or a joint venture, the star’s involvement may vary widely. One general principle holds true for any such deal, though: The celebrity’s participation is key to success. “I have actually worked on deals … where the celebrity has to post a certain number of times a month” to fulfill the contract, Kobulnick says.

Mitchell posts about Onda fairly regularly on both her Instagram and TikTok accounts, and, according to Gray, is closely involved in shaping the brand’s strategy. “Shay has been part of this team and this business from its very earliest days,” says Gray when asked about Mitchell’s business arrangement with Onda. “She is a business owner. … It’s not the kind of relationship that historically was more common [in the alcohol space] where it’s the licensing of an image, or a marketing campaign.”

https://www.instagram.com/p/CJezRbzFee_/

Mitchell herself was not made available for an interview with VinePair, and via a representative, declined to answer emailed questions about her involvement with the brand, citing international travel with family and being “busy with a couple big projects.”

Regardless of Mitchell’s level of involvement in Onda’s day-to-day operations, having a fully bought-in celebrity on board doesn’t guarantee sales on its own — in RTDs, full-proof spirits, or any other category. Even CACTI, with Scott’s star power, has stumbled a bit since its white-hot launch; as VinePair’s Josh Malin noted in a recent edition of the VP Pro newsletter, CACTI’s overall share of the U.S. hard seltzer market, according to IRI scan data, spiked to 4.4 percent the week following its release, but then ebbed to 2.3 percent a couple weeks later. Scott, for his part, has been posting about the hard seltzer plenty.

But to Gray, Mitchell’s content is instrumental in building Onda’s own cohort of loyal drinkers. “We’re seeing a ton of engagement with Shay on her channel, and on ours as well,” he says. “We’re a young brand, but we feel like the community that’s starting to build around us is excited about the drink.” For now, Gray is intent on taking advantage of the full-proof tequila halo effect, plus any malt-based FMB fatigue, to turn Onda into this summer’s premium hard seltzer alternative. “Longer term, I think there’s a ton of opportunity to explore different ABV levels, something higher proof, or that uses a different tequila, maybe a reposado instead of the blanco,” he says. “But right now, we’re very focused on the core blanco sparkling tequila proposition, and expanding our flavor universe.”

To that end, in mid-May Onda released two new flavors — blood orange and watermelon — just in time to catch the wave of post-pandemic pool parties and unquenched quarantine thirst over the horizon.

This story is a part of VP Pro, our free platform and newsletter for drinks industry professionals, covering wine, beer, liquor, and beyond. Sign up for VP Pro now!