This article is part of our Celebrity Tequila series. Read more about the rise of A-lister agave spirits here.

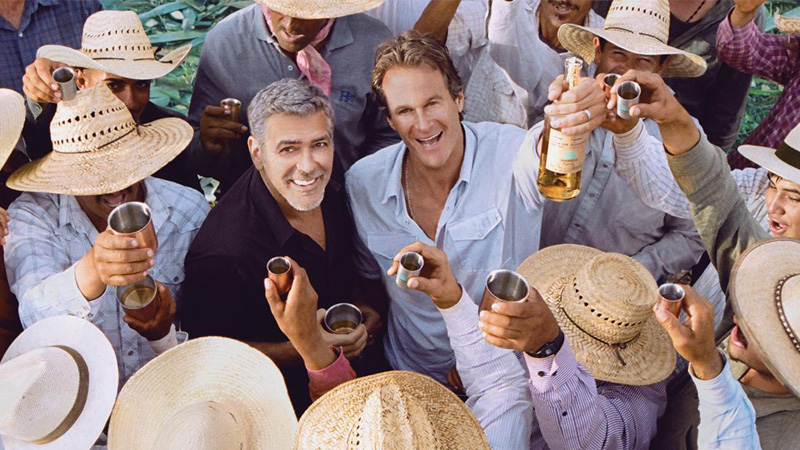

We will never truly know whether George Clooney did indeed launch his Casamigos tequila brand “by accident,” as is often described when the brand’s genesis is recounted. But one thing we can safely assume is that when he teamed up with quasi-celebrity Rande Gerber and real estate tycoon Mike Meldman, the trio could not have foreseen how lucrative their brand would become.

Within four years of launching in 2013, the world’s largest spirits conglomerate, Diageo, scooped up Casamigos for a cool $1 billion, with $700 million split between the three founders up front, and the rest dependent on sales performance.

It should be noted that Clooney was not the first celebrity to enter the tequila business, nor the first to then flip his company within years, selling to a large-scale spirits group. (See: Justin Timberlake, Tequila/Sauza 901, and Carlos Santana, Casa Noble.) But the 10-figure acquisition of Clooney’s Casamigos signaled a landmark for the category, and set out an enticing blueprint for others to potentially follow. And follow they did.

Since 2017, numerous high-profile celebrities have launched or bought into tequila brands, including Dwayne “The Rock” Johnson (Teremana Tequila), Michael Jordan (Cincoro), Sean “P Diddy” Combs (DeLeón Tequila), Nick Jonas (Villa One Tequila), Rita Ora (Próspero Tequila), Chris Noth (Ambhar Tequila), and Guy Fieri (Santo Spirit), among others.

Tequila, of course, is not the only spirits category to count celebrity owners among its ranks. But compared to gin, whiskey, and even vodka, celebrities now seem to overwhelmingly favor the agave-based distillate. At VinePair, we wondered, why is that so? Is this a trend that’s driven purely by financial incentives, whether to cash in like Clooney and company, or to profit from America’s increasing appreciation of the spirit? Or are celebrities flocking to the spirit for other, less obvious motives?

Assessing Tequila’s Appeal

With none of the aforementioned celebrity brands listed as 501(c) charitable organizations, we can conclude that dollars and cents at least play a role in the decision. It doesn’t take an accountant or a market analyst to conclude that tequila is a hot investment proposal right now. In the six years since Clooney founded Casamigos in 2013, the value of the tequila category grew 77.8 percent, reaching a total value of $6.4 billion in 2019, according to IWSR data.

Should this data be viewed with an air of caution because of the risk of over-saturation in the market? Apparently not. While it is among the fastest-growing spirits categories in the U.S., there’s still plenty of room for growth. According to the IWSR, tequila volume sales represent just 25 percent of the size of the vodka category.

But industry analysts believe there are more than just financial factors at play in the celebrity tequila trend. Brandy Rand, COO of the Americas at IWSR, says the location of where many of these celebrities are based also plays a part.

“Out of all 50 states, California leads in tequila sales volume, so there’s an innate connection between Hollywood and tequila consumption as it’s a big part of the food and drink scene,” she says. “The prevalence of Mexican culture in California and proximity of Mexico is also a big part in this, as many celebrities own homes and vacation there. So there’s a more personal connection to the land and experience of consuming tequila where it’s produced.”

The celebrities themselves also lean into the idea of having a certain “connection” with tequila. U.K.-based singer Rita Ora, shareholder and chief creative partner at Próspero Tequila, says she’s “always been a tequila girl at heart.” Menswear designer John Varvatos, who launched Villa One Tequila with Nick Jonas in 2019, says, “We’re both tequila drinkers, me for most of my adult life.”

It took just one sip to convince Chris Noth, a.k.a. “Mr Big” from “Sex and the City,” to buy a controlling share of Ambhar Tequila in 2018. “I tasted it once and I knew I wanted to be involved,” he says. When Cincoro CEO Emilia Fazzalari co-founded her tequila brand with Michael Jordan and three other NBA stars, she says the motivation was never to create a “celebrity-endorsed” product. “My partners and I really just had a shared love of tequila,” she says.

The Importance of Authenticity

By all accounts, enjoying tequila played a major role in entering the industry as a brand owner or founder. This is not just an important reason for getting into the business, but is also crucial for creating a product that will be successful.

In 2016, a global survey conducted by communications agency Cohn & Wolfe found that nine out of 10 consumers would reward a brand for its “authenticity.” More than half the consumers surveyed said they would recommend that brand to others, while 49 percent said they would “pledge loyalty” to the brand.

Let’s just put it out there that the “authenticity” of a celebrity-owned tequila brand is a nuanced topic. Carlos Santana is the only tequila-associated celebrity to have been born in Mexico, and the others may not have much of a tie to the country or to its distilling traditions. They’re not investing to build distilleries, or distilling these products themselves. Heck, they may not even have ever visited the distillery.

But some celebrities look to create authenticity in another way, saying that they founded their companies because of a genuine love of the spirit. In that case, the message certainly seems more believable when it applies to a grassy, herbaceous tequila over a less flavorful vodka, for example. For consumers, the perception of authenticity may also increase when the celebrity owns the brand (rather than just being a paid spokesperson), and when they claim to have had some role in the product’s creation.

“As with most things, authenticity and a true reason to believe are what often sets the great brands apart,” says Ann Moran, project director of Chicago-based consultancy firm Thoroughbred Spirits Group. “Great brands evoke emotion. Great celebrities know how to do this, too.”

The Intangible Benefits of Owning a Tequila Brand

The exploration of authenticity may seem like a digression into how to create a successful tequila brand, rather than looking at why a celebrity would launch one in the first place. But the two are linked: Without success, launching a tequila would essentially be an expensive labor of love. But with success comes more than just financial gains.

“We’re talking about two kinds of benefits to the celebrity: One is that there’s clearly potentially a financial benefit, but there’s also this other intangible benefit, which is brand enhancement,” says Kermit Daniel, a Ph.D. economist and consultant who previously taught at the Wharton School of the University of Pennsylvania. “They’re going to be correlated in the sense that the more successful the brand is, the better it is for both kinds of value.”

With Hollywood culture so driven by image and status, it makes sense that a celebrity would want to be associated with a spirit that is “cool.” Does tequila fit that bill? For some bartenders and drinks media, perhaps tequila has ceded that crown to something more esoteric, like mezcal. But for the rest of the country? Almost certainly yes. Let’s not forget this is one of the fastest-growing spirits categories in the U.S. And regardless of whether tequila itself is cool, owning or launching a tequila brand adds your name to a conversation that also includes George Clooney, Michael Jordan, and The Rock — the third most-followed individual on Instagram.

“Image can be an incredibly valuable asset, even if it’s very hard to monetize,” says Daniel.

If Not Tequila, What Else?

The final motivation for entering the tequila market could come from a production standpoint. Given that — across the board — celebrities are working with contractors to produce their tequilas, they don’t need to build a distillery or plant crops of agave and wait seven years for them to mature. But they can still be involved in the process somewhat. Cincoro’s Fazzalari says she and her co-founders tasted “thousands” of tequilas over a three-year period before finally settling on the formula for their brand.

Once the production formula has been finalized, getting to market can be relatively quick. In the case of blanco tequila, there are no lengthy barrel-resting periods involved. As for añejo, it is a relatively young aged spirit compared to many whiskeys or rums. “Capital expenditure is much more economical than other categories,” says Thoroughbred’s Moran.

What about gin and vodka? Perhaps they’re just lacking in one vital ingredient: the George Clooney factor.

This story is a part of VP Pro, our free platform and newsletter for drinks industry professionals, covering wine, beer, liquor, and beyond. Sign up for VP Pro now!