Every once in a while in the American beer business, there comes along a truly groundbreaking new product. Corona almost single-handedly created the Mexican import segment in the ‘80s. Four Loko almost single-handedly created a national crisis in the aughts. Twisted Tea has been around since 2001, but it has only hit its stride more recently — and what a stride it is. It’s one of those groundbreaking products. Liit, a new hard tea line extension from an old also-ran brand, is not. But when the game is stealing share and stacking cash, you follow the leader.

Last August, Canadian cannabis conglomerate Tilray Brands acquired eight beverage marques from Brazilian Bud Light-bungler Anheuser-Busch InBev. The fire sale included a bunch of craft breweries from the macrobrewer’s gluttonous, 10-figure-ish buying spree of the 2010s, a mothballed energy drink line, and Shock Top.

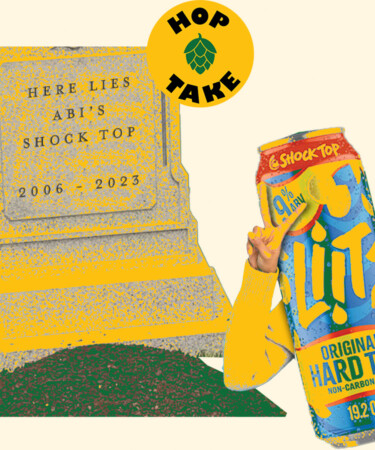

Shock Top! The beer, a brazen, decade-late knockoff of Blue Moon, first hit shelves in 2006, peaked in 2017, and had been hemorrhaging volume ever since, at least according to off-premise scan data analyzed by Brewbound when news of the sale broke last summer. Who would actually acquire Shock Top in 2023? And why?

It’s the very question I tried to answer with VinePair managing editor Tim McKirdy, who joined the Taplines podcast (subscribe, leave a review, tell your friends, thank you) a week after the deal was announced for a special episode to work out the potential implications of a Tilray-backed Shock Top future. He hypothesized that the brand’s irrelevance, both within ABI’s portfolio, and in America’s beer aisles, actually gave its new owner a better shot at squeezing value out of it. I argued likewise, noting that because Tilray pulled the Shock Top out of the bargain bin (it paid just $85 million for all eight brands, a ~$160-per-barrel song compared to the frequent four-figure per-barrel acquisitions of last decade’s heyday), it had a relatively clear path to penciling it out.

“Now the question is, ‘What can Tilray do to clean it up, to make it look cooler, to get the stank of corporate, ABI, sort of reverse-engineering off of it, and turn it into something that you’d like to drink?’” I told Tim last August.

One of the things Tilray did in the intervening months is what everybody and their mother in the beverage-alcohol industry did. It took one look at the stupendous success of Boston Beer Company’s (BBC) Twisted Tea, took another look at that brand’s staggering ~90 percent of the lucrative and growing hard-tea segment, and began devising ways to siphon off some of that share. And would you look at that: In January 2024, Tilray announced the upcoming release of Shock Top Liit, a new 9-percent alcohol-by-volume non-carbonated hard tea. It hits shelves this month. ABI fail-stank, begone!

Tilray’s Shock Top isn’t the only legacy beverage brand to try to peel away cases from Twea. New Belgium Brewery launched Voodoo Ranger Hardcharged Tea last year. Also in 2023, mid-major malt-liquor maker AriZona Beverage Company rolled out an alcoholic crossover of its iconic Great Buys; PepsiCo did likewise with Lipton via a contract arrangement with FIFCO USA; the Beast Unleashers at Monster Beverage Company teased a hard-tea brand, Nasty Beast, which has since hit the market.

The opportunity is so attractive that BBC is even doing a distilled double-dip, rolling out a vodka-based R-tea-D (sorry) called Suncruiser last month. Combine all those high-profile, big-budget entrants, plus hard tea-first players like Loverboy, plus-plus a parade of regional and specialty spinoff brands, and you’re talking about a rapidly crowding segment indeed.

“Today, everybody is piling into [hard tea] — there’s literally hundreds of new competitors,” BBC co-founder and chairman Jim Koch told analysts in February during the company’s earnings report for full-year 2023. “I don’t see much traction from the vast majority of them. … I don’t see a strong No. 2 emerging.”

Koch’s confidence aside, if one does, I doubt it’ll be Shock Top Liit. Tilray is rapidly expanding its beverage portfolio in the U.S., and it’s got its work cut out for it as it tries to integrate its newest acquisitions, which have boosted its beverage-alcohol revenues but walloped its margins. Its designs on the American drinks business are ambitious as hell, and frankly, a little scattered, too.

“We’re doing innovation in two or three months, what a lot of companies do in five or six years,” Tilray U.S. beer division president Ty Gilmore told Brewbound’s Justin Kendall recently, unveiling a half-dozen line extensions, packaging refreshes, and entirely new brands that the firm will put in front of customers this year. The rapid-fire rollouts may help Tilray in the short term. Catching up with Twea is a marathon, though, and that demands brand-building at depth. Whether the firm can keep sustained focus on Liit while expanding its portfolio’s breadth remains to be seen.

Of course, because hard tea is just one play among many, Tilray doesn’t have to try to catch BBC in the segment. It doesn’t really have to catch any competitor in any segment, really, so long as it consistently builds out chunks of growth in all of them. You can see this strategy at play with another copycat “innovation” from another Tilray acquisition: 10 Barrel Brewing Company’s Pub Ice, which the former ABI ward in Bend, Ore., introduced earlier this year. Despite its clunky name and brazenly derivative nature, the thesis behind the flavored malt beverage is sound enough. Go see if you can steal some Smirnoff Ice sales, wouldja?

If Pub Ice can pick up even a few percentage points, Tilray could make real money. According to scan data crunched by Sightlines editor and Feel Goods market analyst Bryan Roth, Smirnoff’s FMB portfolio did $560 million in chain retail sales last year. “But its flagship ‘Original’ was down and nobody is really playing in that same ‘Ice’ space,” he wrote on social media last month. “Incremental sales are incremental sales.”

This is not the sexiest way to run a beer business, but the beer business isn’t very sexy at the moment, particularly not at Tilray’s size. The firm is trying to marshal a mounting drumbeat of sales out of a portfolio of under-loved and poorly positioned brands; follow the leader is the name of the game. The facts on the ground are: Hard tea is hot, Shock Top is not. If Tilray can make Liit even lukewarm, that’s a win.

🤯 Hop-ocalypse Now

Speaking of BBC — the House that Samuel Adams Built released its annual report last week, and buddy, this ain’t Sam’s house no mo’. Among the investor-facing facts and figures packed into the filing’s 98 pages is a frank admission that “[a]pproximately 85 [percent] of the Company’s 2023 volume is in the Beyond Beer category.” Trade types have known for years that the company’s fortunes were uncoupled from the sales performance of Boston Lager (et al.) Still, the fact that just 15 percent of Boston Beer’s liquid these days is actual beer is Truly something. It’s hard to Twea-lieve, really. All right, all right, I’ll Hard Mtn Dew less.

📈 Ups…

The Bruery a) still exists and b) is expanding to Idaho, that’s nice… Congrats to all of the Brewers Association’s 2024 Industry Award Winners… The National Beer Wholesalers Association recorded the biggest uptick in monthly middle-tier order volume since 2021…

📉 …and downs

U.S. retailers spent almost $1.57 billion less on Anheuser-Busch InBev products in 2023 than the prior year… District 9 Brewing, the Charlotte-based corporate sibling of embattled sales/distro/whatever platform Bevana, has filed for bankruptcy… Only four of the top-20 craft brewers recorded volume growth last year, yeesh…

This story is a part of VP Pro, our free platform and newsletter for drinks industry professionals, covering wine, beer, liquor, and beyond. Sign up for VP Pro now!