Sidling up to the refrigerator for a beer looks a lot different today than it did five years ago. In years past, you might have chosen between a resiny commercial IPA or a spontaneously fermented ale from a local craft brewery. There might have been a 6-pack of Pabst Blue Ribbon, or perhaps a rogue Bud Light Lime, left behind by previous guests.

During Dry January, you might have even chosen a non-alcoholic beer, like O’Doul’s or Clausthauler. But increasingly, “better for you” beer options — those with low and no alcohol, calories, and carbs — are finding ways into our homes, with Americans buying more of them than ever before.

Low-calorie and non-alcoholic craft and commercial beers have been on the rise since early 2018, when global companies such as Heineken International and Mikkeller began releasing labels like Heinieken 0.0 and Drink’in The Sun. Around that time, strictly non-alcoholic craft breweries, like Athletic Brewing Company and Surreal Brewing Company, also entered the market.

But 2020 sparked a turning point. The year saw dozens of commercial and craft breweries, from Bud Light to Brooklyn Brewery, launch and expand NA beer offerings. These releases contributed to 39.5 percent growth in the non-alcoholic beer category year-over-year, according to Nielsen. Interestingly, even no-calorie beer saw a surge of 113.5 percent growth, while light beer saw 9.1 percent growth, Nielsen reports.

Why did these beers garner so much interest in 2020? Some of the newest forays into the non-alcoholic and low-alcohol, low-calorie space are delayed initiatives coming to fruition at exactly the right time. Those who saw consumer interest in the healthy-ish beer space in years prior are honing research and development on new brands — and we’re buying them.

Low-calorie and non-alcoholic brews in particular are launching into a market primed for their release. Consumers are more concerned with personal health and wellness than they were in 2019, a result of increased health anxiety surrounding the Covid-19 pandemic. In a year full of idiosyncrasies and unpredictable consumer behavior, the “better-for-you-beer” category found an audience ready and waiting to jump aboard.

A Long Time Coming

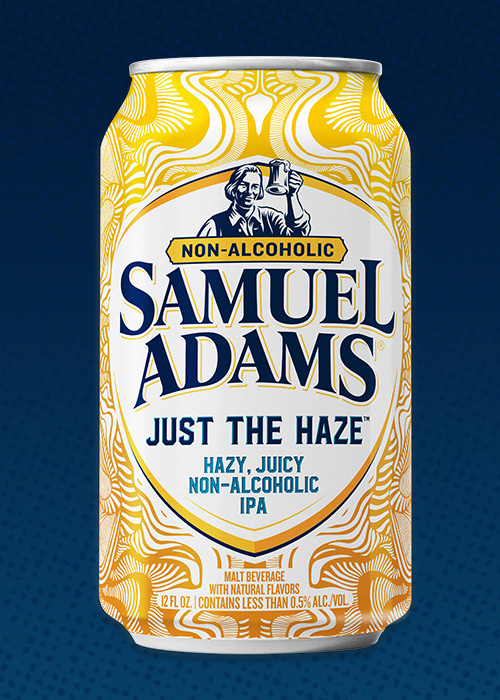

Recent “healthier” beer releases may appear to be reactions to market growth amid the pandemic, but at Samuel Adams, non-alcoholic beer research and development began more than two years ago. Its non-alcoholic Just the Haze New England IPA, a juicy, citrus-forward ale brewed with Citra, Mosaic, and Sabro hops, launched in January 2021.

“There are a lot of things going on culturally, and there are all these drivers that are so far beyond what we could have ever anticipated when we started this development work,” Christina Hahn, Samuel Adams research and development brewer, says. “It’s really quite the convergence.”

Samuel Adams drinkers may remember one of the brewery’s first forays into the world of beer for health-and-fitness- minded drinkers: 26.2 Brew, a limited-release endeavor from parent company Boston Beer Co., which worked with the Boston Athletic Association to create the low-ABV golden ale spiced with coriander. But while 26.2 was designed to celebrate hard athletic work and achievement, Just the Haze is a “pacer” beer, created to appeal to a wider variety of drinkers — from athletes and expecting parents to 9-to-5ers who want a clear-headed morning after watching Monday Night Football.

“If there’s a beer occasion, this beer fits,” says Hahn. “It’s been really interesting to share it with friends and family and brewers across Sam Adams, just seeing how well it integrates into people’s everyday lives.”

Of course, Boston Beer isn’t the only brewing company celebrating its forays into the NA space. Other breweries find themselves on a similarly felicitous timeline. Bootstrap Brewing in Longmont, Colo., which began developing its non-alcoholic Strapless IPA in autumn 2019, released the brew in November 2020. The beer is brewed with magnesium, potassium, sodium, and chloride. According to Steve Kaczeus, the brewery’s owner and brewer, Bootstrap wanted to create a great-tasting beer that appealed to both non-alcohol drinkers and athletes. “It’s intended to be a beer for everyone to enjoy, no matter what their lifestyle is,” Kaczeus says.

For some exclusively non-alcoholic breweries, 2020 brought exponential growth. Anaheim, Calif.’s Bravus Brewing Company, founded in 2015, saw an almost 300 percent increase in direct-to-consumer sales — despite not changing its marketing strategy, says founder Philip Brandes. “We haven’t been able to make this stuff fast enough,” Brandes says. Bravus moved in September from Newport Beach to a larger facility in Anaheim to improve production capacity, and over the holidays it released Gravitas II, a limited release and the world’s first barrel-aged, non-alcoholic beer.

Some breweries have opted to launch low-calorie beers into the pandemic market. Anheuser-Busch launched Budweiser Zero, a low-calorie, non-alcoholic, and low-sugar beer, in March. The company worked closely with Dwayne Wade to create a drink that both athletes and everyday Budweiser drinkers can enjoy.

Monica Rustgi, VP of marketing for Budweiser, says that millennials in particular have driven the brew’s success since it rolled out in March, and that it is “poised for more growth.”

In January 2020, Anheuser-Busch’s Chicago-based Goose Island Beer Co. introduced So-Lo, its first low-calorie and low-ABV IPA. Keith Gabbett, Goose Island brewmaster, says it performed “extremely well” in terms of volume during a local test run. “We knew we were onto something and wanted to give everyone a chance to try it, so we made So-Lo IPA available nationally at the beginning of [last] year,” says Gabbett. “It’s a good thing we did.”

In a year in which many retailers pared back on new craft releases in favor of beers they knew would sell in bulk, many newer low-calorie IPAs worked their way into American refrigerators. Among the best-selling was Paso Robles, Calif.-based Firestone Walker Brewing Company’s Flyjack, which sold close to 15,000 barrels (over 200,000 cases) in retail in 2020. A few thousand miles away, Comstock, Mich.-based Bell’s Brewery launched Light Hearted Ale in January 2020, which ended the year as the brewery’s fourth-best-selling beer.

“We thought [Light Hearted Ale] could finish the year as our No. 3 or 4 beer, but the fact that it did in a pandemic, with limited media support and limited displays and programming behind it, just shows how much more potential it has this year,” says Scott Powell, Bell’s Brewery director of marketing. “We couldn’t be more excited about how well it performed with the limited resources we gave it.”

Looking Beyond ‘Healthier for You’ Beers

Low-calorie, low-alcohol, and non-alcoholic beer launches may be on the uptick, but health, fitness, and beer have long had an interconnected relationship: Runners frequently celebrate the end of a race with a crushable can; beer companies such as Bloomington, Ind.-based Upland Brewing, are known to sponsor amateur cycling teams; and local breweries often host annual 5K fun runs, such as Mayflower Brewing Company’s holiday-themed races in Plymouth, Mass.

More recently, breweries have found more creative ways to draw in a newly health-conscious consumer without sacrificing flavor or ABV.

In September, Lawson’s Finest Liquids of Waitsfield, Vt., launched a Strava club for cycling fans to help publicize the release of their Little Sip IPA, a 6.2 percent ABV ale with notes of grapefruit and pineapple. After completing a waiver, participants can track and log their bike rides, which enters them into competition for brewery swag.

“This was just another outlet for getting in front of folks,” Katie Butler, Vermont brand and key account manager for Lawson’s, says. “We knew that one of our target demographics for this beer was the person who is out and about, running and hiking and enjoying the weather,” all of which ultimately became pandemic-friendly activities. In a consumer market riddled with health anxiety, these initiatives are inclined to drive even more drinkers toward the “better for you” beer category, to be sure. They also reflect an increasing inclination to balance our beer-loving lifestyles with more mindful choices, be that buying a non-alcoholic coffee stout for the first time; joining a local brewery Strava club; or giving that low-calorie IPA option from a favorite brewer a chance. In all cases, drinkers have more variety and more high-quality, health-conscious options now than before 2020.

This story is a part of VP Pro, our free platform and newsletter for drinks industry professionals, covering wine, beer, liquor, and beyond. Sign up for VP Pro now!