Disclosure: Back in 2021, I bought some shares of Boston Beer Company stock. I had a little spare cash from a consulting gig, and it seemed like a fun experiment. Though Wall Street’s view of the House That Sam Adams Built had cooled considerably since its pandemic heyday, the firm had just signed deals with Beam Suntory and Pepsi, and Truly had cornered nearly a third of the United States’ still fairly frothy hard seltzer market. What the hell? I figured. Let’s see where this thing goes.

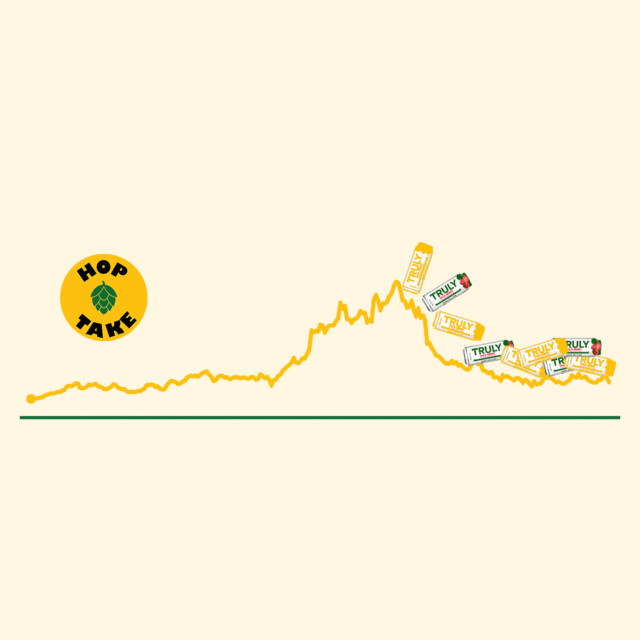

The answer, as it turned out, was down. Way down. When I bought in, Boston Beer Company (BBC), which has been listed on the New York Stock Exchange under the ticker symbol SAM since the company’s 1995 public listing, was trading around $575 per share. Twelve months later, when I sold the stock and started writing this column, it was flailing around in the low $300s. The “fun experiment” turned into a real-life lesson for yours truly about catching falling knives, the upshot being: You should not do that! It’s fine, I’m fine. I wasted time agonizing over proper disclosures, and lost a little beer money, but I gained a lot of appreciation for the mystery and majesty of our big, beautiful, financialized economy, and isn’t that what it’s all about, really? (NB: If you’re wondering why I no longer disclose owning SAM stock in my coverage of the company or its brands, that’s why: I don’t own it anymore, or stock in any other beverage company, either.)

It’s an infrequent Hop Take column that focuses on a beer company’s stock performance — or my own, for that matter. But reading through the transcript of BBC’s full-year 2022 earnings call from last week I found myself thinking about $SAM’s tumble over the past couple years, and what BBC could have done to avoid it. I keep coming back to Truly, and investors did, too — by my count, seven of the first 10 questions from analysts on the call focused on the brand’s considerable recent decline, which is outpacing hard seltzer at large. They asked whether it could hold its shelf space. They asked how its spirits-based and full-proof line extensions would attract drinkers in already crowded segments. They asked why White Claw’s market share was growing while Truly’s was shrinking.

What the hell happened to Truly? I think it’s a question worth answering, both because the brand’s struggles coincide with the stock slide of the country’s biggest craft brewer, and because the performance of BBC’s beyond-beer portfolio is a bellwether for how other breweries might navigate the transition to “total beverage.” So let’s talk about it! Though it never quite achieved parity with White Claw, Mark Anthony Brands’ category leader, Truly was a winner in its own right through the end of last decade. Back then, the brand looked unstoppable, and BBC was keen to ride the lightning. “Truly continues to generate triple-digit volume growth and we are continuing to expand package and draft distribution across all channels,” chief executive David Burwick said in a press release wrapping up the brewer’s 2019 performance. BBC did $1.25 billion in sales that year, a 25 percent increase over 2020 that was attributable in part to its hard-charging hard seltzer. In 2020, Truly’s newly introduced Lemonade did $300 million in off-premise chain retail alone, according to Nielsen IQ scan data. In spring 2021, BBC was projecting annual hard seltzer growth at 60–90 percent, and projecting Truly to outperform the segment. Burwick and BBC co-founder/chairman Jim Koch told analysts the solid recent rollout of Truly Iced Tea, plus upcoming fruit punch and higher-ABV line extensions, would keep the money printer brrrrrr-ing. “The bigger you build the base, I think the more incremental it can become when you bring new things to the base,” the CEO said. (BBC declined Hop Take’s request for an interview for this column.) Everything was coming up Truly.

Things did not carry on like this! In fact, virtually from that day forward, Truly has descended into a self-inflicted brand identity crisis exacerbated by the hard seltzer category’s substantial slowdown, taking its parent company’s stock with it. Over the rest of 2021, the brand became an allegory for the unsustainable effervescence of the segment at large. It was tough to watch. By late July 2021, BBC was warning Wall Street it had “overestimated” hard seltzer demand; by September, it had pulled the annual financial guidance to investors it had issued in July. In October 2021, CNBC reported that BBC planned to destroy “millions of cases” of Truly that it had produced to meet demand that never materialized. “We were very aggressive about adding capacity, adding inventory, buying raw materials, like cans and flavors, and, frankly, we overbought,” said Koch, explaining the company’s earnings miss on the quarter that had just closed. Brewbound calculated that the move cost the company over $102 million in obsolescence charges, equipment impairments, and contract terminations.

That the hard seltzer market — a legitimate phenomenon that had exploded onto the American drinking scene just a few short years prior — lost momentum is not BBC’s fault, or Truly’s. (Shareholders, not including your humble Hop Take columnist, alleged that the company had misled them by painting an overly rosy picture of the segment in a lawsuit filed September 2021. A federal judge disagreed, tossing out the case in December 2022.) But the company isn’t entirely blameless in its golden goose’s nosedive, either. BBC’s management of the brand has been a real mixed bag. For every Truly triumph, there’s been a Truly tribulation — or several.

Truly Lemonade: triumph! Truly Iced Tea and Fruit Punch: tribulations. Signing global superstar Dua Lipa to promote both the brand at large and its seasonal Poolside mix-pack in particular: triumph! Celebrating the introduction of real fruit to original flavors with ads showing the cans crawling with fruit flies, grossing people out while reminding them that the Trulys they’d been drinking this whole time were flavored with not-real fruit: tribulations. Extending the brand into the spirits-based canned cocktail space with Truly Vodka Seltzer Soda: triumph! Not getting it to market until this month, giving E. & J. Gallo’s High Noon and Anheuser-Busch InBev’s NUTRL ample head starts: that’s a tribulation, from where I’m sitting.

Nowhere is this one-step-forward/two-back dynamic more apparent than in BBC’s shifting approach to innovation. The brewer entered this decade ready to “optimize the incrementality” of Truly, which is corporate speak for “getting existing drinkers to buy more, slightly different versions of it.” Barely two years later, and it’s pretty clear that BBC innovated its once-hot brand family into dysfunction: All that innovation — all that incrementality — confused the hell out of the American drinking public. As Burwick admitted to analysts earlier this month, “We’ve innovated arguably a little bit too much and not built the core business enough.” This is corporate speak for “we went absolutely hog-wild,” and nobody is arguing otherwise. According to IRI scan data analyzed by Brewbound, volume of the brand family was down over 22 percent in off-premise retail in 2022 compared to the previous year, with Punch and the once-mighty Lemonade down big. (For contrast, the entire hard seltzer category was down around 17 percent in volume last year.) Truly Margarita, which splashed onto the scene in January 2022, won’t come close to matching its rookie numbers, either: BBC says its year-over-year comps will account for 60 percent of the overall brand family’s decline in the first quarter of 2023.

What will the rest of the year bring for Truly? Can BBC stay out of its own way long enough to turn the formerly hot hard seltzer around, or will it crush the brand family with more unforced errors? We’ll see in due time. Analysts will be watching closely — as should Twisted Tea fans, considering the two-decades-old flavored malt beverage surpassed Truly in off-premise retail scans earlier this month. The new golden goose in Boston is bright yellow with blue trim and a whole lotta potential. Hope for triumph, prepare for tribulation, shareholders.

🤯 Hop-ocalypse Now

Will 2023 be the year of spirits-based statehouse battles? It sure is shaping up that way. Just a few weeks after lawmakers in North Dakota squashed a bill that would’ve realigned taxes on canned cocktails to be more equivalent to those on beer and wine, legislators in both California and Texas each put forth ready-to-drink bills of their own. Both of those proposals focus on expanding retail access for spirits-based beverages, rather than tax equivalency, but that doesn’t mean that brewers, guilds, distributors, et al. have to be, like, happy about it, either. And they won’t be. Is your state’s beer industry ready for this battle? Because it’s comin’.

📈 Ups…

Manhattan Beer Distributors took delivery of its first-ever fully electric terminal tractor… A tie-up of Golden State stalwarts as Drake’s Brewing Co. acquires Bear Republic’s brand and recipes (not its physical locations, though)… Cisco Brewers’ mainland location in New Hampshire gets a $6 million canning line as Anheuser-Busch InBev targets 50 percent volume growth for Nantucket brand… Kansas City Chiefs QB Patrick Mahomes inspires upset letters-to-the-editor for post-Super Bowl victory chugs (lol, lmao)…

📉 …and downs

Brewers Association chief economist Bart Watson predicts “unsustainable” U.S. hop market will get tighter… The BA’s 2022 revenue was still down from pre-Covid totals… New York’s new recycling bill has brewers worried… Ohio’s Platform Beer Co., a 2019 Anheuser-Busch InBev acquisition, is reportedly shutting down… The Sazerac Company, maker of major malt-based “beer” brand Fireball Cinnamon, is facing a class-action suit over that SKU, and now another over malt-based Southern Comfort, too… That Bud Light ad everyone thought was dece from this year’s Super Bowl sorta resembles a viral video from 2020, seems not great… The New York Times has tuned in to alco-pop regulatory concerns…

This story is a part of VP Pro, our free platform and newsletter for drinks industry professionals, covering wine, beer, liquor, and beyond. Sign up for VP Pro now!