In 2018, rare bottles of bourbon, Japanese whisky, and single-malt Scotch broke worldwide auction records. No fewer than three Scotch whiskies sold for more than $1 million apiece.

There’s clearly money to be made in top-shelf dark spirits, which explains why smart producers, marketers, and collectors are now betting on a rum boom. “I’ve personally seen a lot of bourbon guys who are liquidating their collections, and buying rum,” says Jan Warren, a veteran New York bartender and portfolio specialist at La Maison and Velier, a global spirits distributor.

“It’s no big secret that all the money has moved to super-premium and high-end brands,” says spirits writer Wayne Curtis. “Everyone is scrambling to get there so they don’t get left behind.”

The Distilled Spirits Council defines super-premium rum as bottles priced at $35 or more. In 2018, the category grew nearly 30 percent. It’s now valued at $179 million, a small-but-not-insignificant chunk of the $27 billion U.S. spirits market.

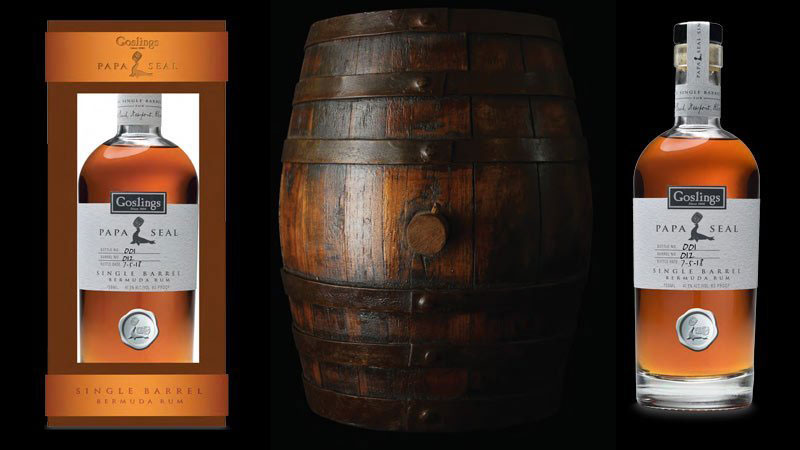

Rum brands — particularly dark rum — are eager to replicate the recent successes of other dark spirits. Among those trying to capture lightning in a bottle are: Bermuda-based Goslings, which released a limited-run, 15-year-aged bottling in January 2019; Trinidadian distiller Angostura, which debuted a limited-edition, Oloroso-sherry-cask-aged rum in September 2018; and Jamaica’s Appleton Estate, which released 4,000 bottles of 30-year-aged rum at $495 each.

Bacardí added a premium collection of aged rums to its lineup in April 2018. In 2013, it launched its “Facundo” line, named for the brand’s founder, Don Facundo Bacardí Masso. The exclusive series includes three aged dark rums, ranging from $60 to $250 a bottle.

With vanilla, caramel, and barrel spice notes, dark rums are well positioned to entice bourbon drinkers. The brands are well aware of this: “Premium dark spirits consumers” are the target market for Appleton Estate, according to Melanie Batchelor, vice president of marketing at Campari America, Appleton’s parent company.

Rum drinks were largely left out of the early 21st-century classic cocktail revival, which brought Negronis and Old Fashioneds out of retirement and into millennials’ glassware. Now, however, Daiquiris and rum-centric tiki drinks are resurging. “When [bartenders] begin to champion your brand, that’s half the battle,” Robert Nieves, a NYC bartender and Facundo brand ambassador, says.

Darnell Holguin, beverage director at Las’ Lap, typically serves high-end, aged dark rum neat. But if he’s mixing up a “super-premium” cocktail, he opts for Bacardí 10 on the rocks, with a dash of bitters. The drink is essentially a rum Old Fashioned, a cocktail Nieves has spent the last two or three years championing. Dark rum has enough natural sweetness that you don’t need to add simple syrup or sugar, Nieves says. Besides, there’s absolutely nothing wrong with enjoying a little sugar in your booze.

“People like sweet things, they just don’t want to admit it,” Ed Hamilton, a longtime rum importer and author of multiple books on the spirit, says. “Ask a whiskey drinker if they like sweet, and they’ll say ‘no,’ but you give them a sweet bourbon or a sweet whiskey and they like it. Same thing with wine.”

Another challenge for rum producers is transparency. “If you buy a bottle, you want to be sure of what’s in it, especially when it is a certain price,” Nadège Perrot, international senior brand manager for Martinique-made rhum agricole Saint James, told Liquor.com in 2018.

“Unlike bourbon, which is highly regulated, rum is very fragmented,” Batchelor writes. Around 70 countries produce rum, each via different methods and raw materials. Some are stricter than others when it comes to labeling. The age statement on one bottle might represent that of the youngest spirit, while on another, the number represents the oldest. For some, that number might be a complete work of fiction.

To combat this, Jamaica is currently working toward a Geographical Indicator (GI) for its rums. “Only Jamaican rum made to strict quality control standards can claim the origin name,” Batchelor writes. “Key components of the GI protection include minimum aging standards and also ‘no added sugar’ to affect the taste or aroma profiles.”

Ultimately, quality will prevail. “[We’re seeing] bottlings now that I think will carry the torch for the category,” Warren says of distillers like Neisson, Worthy Park, Hampden Estate, and Foursquare (the latter has been described as the “Pappy of rum”). Each retails for less than $100 but regularly fetches hundreds of dollars on the secondary market. For those of us who didn’t board the Pappy ship before it set sail, super-premium dark rum might just be the next best bet.