In June, Anchor Brewing launched its flagship Steam Beer in cans for the first time in its 122-year history. Its vessel of choice? Tall and handsome 19.2-ounce cans, also known as “stovepipe” cans.

“We wanted a single-serve option, and we saw a lot of other breweries moving into the 19.2,” Scott Ungermann, Anchor Brewing brewmaster, told VinePair. “These cans have been popping up more and more, and they’ve got their own little section in many stores.”

The increasing popularity of this can is a shiny symbol of craft breweries’ fight for our dollars, no matter the cost. Brewers able to invest in the unusual can size (approximately the height of a 24-ounce can and the diameter of a 16-ounce can) are usually those large enough to own their own canning lines, and experimenting with packaging and distribution requires financial security. Several of the labels embracing the size are owned by global brewing companies like Anchor (owned by Sapporo), Lagunitas (owned by Heineken), and Founders (partially owned by Mahou San Miguel).

Similar to the 15-pack, the stovepipe can demonstrates how craft beer wants to segue into the “value” section of our supermarkets — and minds. Sure, a craft can might be a limited-release item you wait in an epic line for; but it could also be a single-serve vessel you grab at the gas station on your way to a party.

While some industry analysts believe this democratic shift will ultimately damage craft beer’s bottom line, others say low-price beers are the only segment growing. In fact, market research firm IRI found the 19.2-ounce can comprised the largest growth in packaged beer sales from 2015 to 2017, with Oskar Blues and Terrapin leading the charge.

Like many craft packaging innovations, stovepipe cans were introduced by Oskar Blues. In 2012, the brewery debuted its Dale’s Pale Ale in 19.2-ounce cans at the Great American Beer Festival.

“We are trying to push the boundaries of what people expect from a can,” Chad Melis, then-spokesman for Oskar Blues, told Brewbound at the time.

And it did. The towering can, in its single-serve format, broke beers free from the 16-ounce 4-pack and brought them (literally) up against mass-produced, 24-ounce competitors. For consumers on the go in convenience and liquor stores, “the single-serve grab is not a huge commitment, and it creates a sampling opportunity in those single-serve doors that didn’t previously exist,” Melis said.

Six years later, more breweries are finally catching on. In the last six months, Anchor, New Belgium, and Sierra Nevada have launched beers in 19.2-ounce cans. Founders released its All Day IPA in 19.2-ounce cans in 2017 and plans to launch its Solid Gold premium lager in the format by the end of the year. Also in 2017, Revolution Brewing debuted its Anti-Hero IPA in 19.2-ounce cans in December, and Dogfish Head released its SeaQuench Ale and 60 Minute IPA in stovepipe cans in May. Upslope Brewing has been packaging its Taproom Series in 19.2-ounce cans since 2016. The list goes on.

Their rising popularity is a mix of marketing, economics, and logistics.

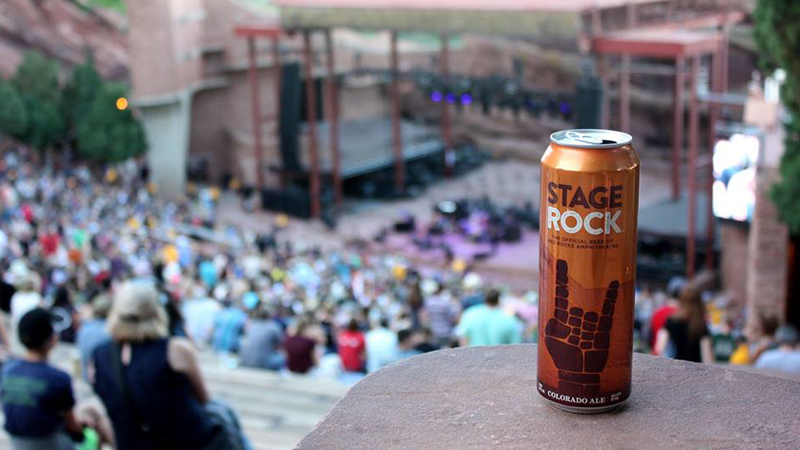

Along with less glamorous locales like gas stations, stovepipe cans are popular choices in music venues and baseball stadiums. In July, with the release of its Stage Rock Colorado Ale in stovepipe cans, New Belgium became the official craft brewery of Red Rocks, a legendary Colorado venue.

“The 19.2-ounce was a great solution for venues where you have paid for entertainment and don’t want to have to stand in line to get additional beers,” Jeremy Rudolf, operations manager for Oskar Blues, told Porch Drinking that month. “In a venue like [Red Rocks] where the room can be sold out, the can is a better vessel while you are shoulder to shoulder with an energetic crowd.”

The 19.2-ounce size — “essentially a beer and a half,” Ungermann says, that is “big enough to share, but not so big as to be too intimidating” — also plays into recent trends toward lighter, easy-drinking beers. According to IRI, sales of craft golden ales increased 13 percent year-over-year through August 12, and sales of craft lagers rose 55 percent.

“To put Steam next to those other beers is a great place for Steam to be,” Ungermann says. Other beers embracing the format include Sierra Nevada BFD (Beer for Drinking), a 4.8 percent ABV golden ale; Upslope Craft Lager, a 4.8 percent ABV lager; and Lagunitas’s Sumpin’ Easy and 12th of Never ales, two low-ABV (5.7 percent) options that are among the top three best-selling 19.2-ounce cans in the country, according to Nielsen data.

At face value, stovepipe cans aren’t necessarily cheaper than their 24-ounce macro shelfmates. Anchor Steam’s 19.2-ounce retail target is $2.49, Sierra Nevada BFD sells for $2.99, and Upslope Craft Lager retails for $3.99, while a 24-ounce can of Pabst Blue Ribbon or Miller High Life retails for $1.99. The value lies less in per-ounce cost than in convenience for both consumers and brewers.

“Once you get [19.2-ounce cans] running, you’re filling a beer and a half in the time you were filling a beer,” Ungermann says. For those who can afford the equipment, taller cans mean more beer out the door.

Finally, there’s the visual appeal: 19.2-ounce cans just look cool. “When you look at it from a pure artistic standpoint, there’s a lot of real estate,” Ungermann says. “I always wanted a can with a big, badass anchor on it.”