Two years ago last month, marketing wunderkind and recently minted Molson Coors Beverage Company chief commercial officer Michelle St. Jacques stood on a stage in Orlando, Fla., and delivered a triumphal assessment of the firm’s position to the wholesalers it had assembled there for its annual confab.

“For the first time in a very, very long time, Molson Coors is coming to this convention with true momentum,” she said, according to a report from the event by Brewbound. “And I mean game-changing momentum.”

The scoreboard said likewise. Molson Coors’ (MC) arch-rival, Anheuser-Busch InBev, was then staggering through what would turn out to be the most severe stretch of the Bud Light fiasco. While it reaped the whirlwind of its disastrous crisis mismanagement, other macrobrewers were reaping the benefits. Constellation Brands’ ongoing success with Modelo Especial earned the most attention from the mainstream media in 2023, which (incorrectly) covered its brief ascent to the top of the off-premise dollar sales chart as a coronation of a new national best-selling beer. But MC’s portfolio was also riding high at its rival’s expense. Miller Lite and Coors Light were both growing their volumes by double-digit percentages compared to the year prior; Coors Banquet was up a shocking 30 percent; its bottom-shelf brands (Keystone, Icehouse, etc.) were taking share from Busch Light. In retailers’ fall shelf resets that year, “MSJ” told MC’s distributors, its brands were winning “the lion’s share of our competitor’s [lost] space.”

A month after St. Jacques’ spiel, the company would announce a plan to buy back $2 billion of its own stock over the following five years. “They have actively been paying down debt and putting themselves in a better liquidity position, which has allowed for their free cash flow to increase generously over the prior quarters,” Andrew Nadeau, a certified financial planner and senior wealth advisor at Bigelow Investment Advisors, told Hop Take at the time. Things were clicking. The perennial second fiddle of the American brewing industry was, as St. Jacques put it, “winning.”

Alas, the game has since changed again. The momentum that MC was riding in 2023 has since swung, if not fully against it, certainly out of its favor. Earlier this week, the Chicago company announced plans to cut around 400 salaried positions by December, a mix of open roles and “voluntary severance” offers that, all told, represents a 9 percent workforce reduction. “To win with our customers and consumers and return to growth, we must move with urgency and make bolder decisions,” said Rahul Goyal, the newly seated successor to longtime MC chief executive and president Gavin Hattersley, in a press release. St. Jacques, for her part, is slated to exit the company in mid-November: Goyal’s restructuring scheme includes the dissolution of the business unit she’d previously overseen at the brewer beverage company.

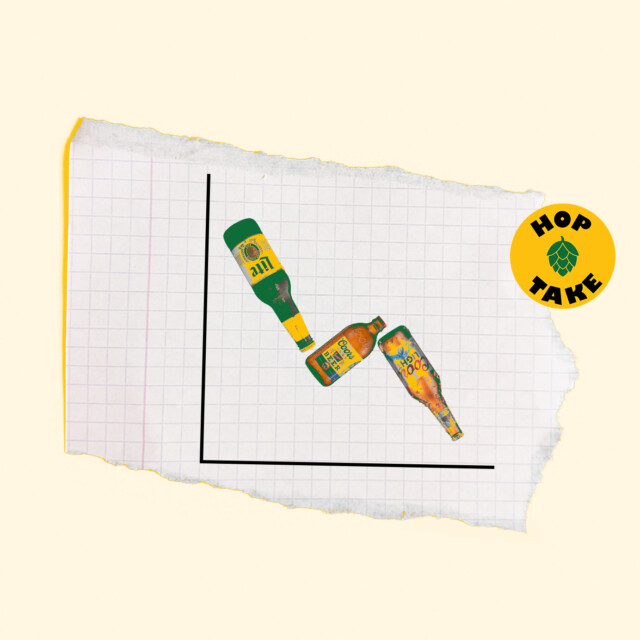

The last couple years have been unkind to the U.S. beer business in general, and MC hasn’t dodged the dings. The massive gains Miller Lite and Coors Light made in 2023 and into 2024 have not stuck. The Blue Moon refresh that St. Jacques touted on the stage in Orlando back in 2023, while promising, has not reversed the struggling craft brand’s fortunes; MC sold the rest of its craft portfolio to Tilray Brands in 2024, incurring losses between $95 and $115 million in the process. (Except for Leinenkugel’s: it’s still in the mix, but six-ish months before his departure, Hattersley ceased production at its historic, 157-year-old brewery in Chippewa Falls, Wisc.) Happy Thursday, the “spiked refresher” (read: bubble-free Zoomer juice) that MC launched that October, has been a nonfactor in the intervening two years. And so on. Coors Banquet continues to soar, and Peroni — now brewed for the American drinking public in Albany, Ga. — isn’t far behind, but even combined, those brands can’t offset the losses of the dual flagships, let alone MC’s portfolio writ large.

Through the first half of the year, its shipments to wholesalers were down 10.1 percent, and its depletions 6.4 percent, according to its second-quarter earnings report in August. The firm has lowered its financial guidance to investors not once but twice this year; its stock is down around 18 percent year-to-date. Hattersley, in his final earnings call after half a dozen years at the helm, told analysts MC is “not expecting to see significant activity” in terms of shelf gains this fall. So.. ah… best of luck, Goyal!

That MC’s new CEO would restructure the organization after just weeks on the job isn’t a sign of trouble in and of itself, mind you. As I noted in a column late last month, Goyal has been with MC or one of its predecessor companies for a quarter-century. No interloper, he’s in a position to have an informed vision for the company’s future. Maybe he does! But you can’t cut your way to growth, as the old management saw goes. And each one comes with an upfront cost — not just to workforce morale, either. In the release announcing the corporate shrinkage, MC projected a $35 to $50 million outlay of “primarily cash severance payments and post-employment benefits to be incurred in the fourth quarter of 2025.” That’s a lot of High Life to bet on a reorganization. Or, as Goyal put it in his statement, “a long-term, achievable strategy that continues our journey to become a total beverage company … on the path to sustainable growth.”

And what of that $2 billion stock buyback? You might expect a company in the midst of erasing nearly one in every 10 jobs from its org chart to put a pause on such shareholder-enriching stock schemes. Indeed, within the beverage-alcohol industry alone, Treasury Wine Estates just did likewise as it continues to grapple with the fallout of Republic National Distributing Company’s chaotic collapse in California. (Tilray Brands also paused a reverse stock-split earlier this summer, though that one was designed to stave off getting delisted from the NASDAQ. The vagaries of financial engineering, man.) But as far as I can tell, MC’s own repurchasing program continues apace. A Hop Take review of its financial disclosures indicates it has spent around $1.1 billion on its own stock since finalizing the program. The company did not respond to an inquiry as to whether Goyal’s 9 percent workforce cut would affect the pace or scope of the buyback.

Still, if you can’t cut your way to growth, you certainly can’t get there by running stock buybacks in perpetuity. The money has to come from somewhere, and for MC, it comes from selling drinks. Which brings us back to those portfolio woes. They continue apace: A recent Brewbound analysis of Circana scan data over the last 12 weeks of off-premise performance indicates no major brewer shed more share or posted bigger losses than MC. Whether the current market malaise is cyclical or structural, the company will have to find a way to shore up Miller Lite and Coors Light at least long enough to successfully diversify away from them. This is no mean feat, and despite referencing its successful forays into “beyond beer” sectors like energy drinks and nonalcoholic mixers, and promising to pursue more of the like, the firm has yet to land a transformative hit, well, beyond beer. (Wringing some bubble-free Zoomer juice out of so many focus groups doesn’t count.) Can it build one? Can it buy one? Can it coax bench players — Keystone, Blue Moon, hell, even Redd’s Apple Ale — to put more points on the board while its star light lagers try to rebound? And how much more cutting can it bear in the meantime?

If ever there were a time for game-changing momentum, now is it. Unfortunately for Goyal and company, sometimes it takes a bunch of losing to get back to winning.

🤯 Hop-ocalypse Now

Things are not going particularly well for Constellation Brands, for reasons we have discussed at great length. Execs have studiously declined to spell out the devastating effects of Trump’s deadly, cruel, racist reign of terror on Hispanic communities, but they’re manifest in Modelo’s sales figures and the firm’s stock price, which is down around 35 percent this year. At the National Beer Wholesalers Association’s annual conference last week, it was more circumspection from Constellation beer division lead Jim Sabia, who insisted to the crowd that it was the economy that was suppressing its core customers’ spending, rather than, y’know, the federal masked goons running kidnapping raids and making fascist hype videos of it. ¿Por qué no los dos?

📈 Ups…

After teetering on the verge of a hop glut for the past few years, the United States Department of Agriculture is now projecting the industry’s smallest harvest since 2015… Rhinegeist, the biggest craft brewery in Ohio, is moving into the THC drinks space even as the governor’s since-stayed emergency ban looms… Maui Brewing is winding down a contract-brewing arrangement in Colorado that serves less profitable demand across the country so it can focus on its lucrative West Coast business…

📉 …and downs

Heineken’s third-quarter earnings report brought more red ink, with the macrobrewer recording low double-digit percentage declines in revenue and shipments in the U.S. … Three of the top four off-premise beer suppliers in the country recorded no or negative growth in the last quarter’s-worth of Circana scans… ABI’s also-ran spiked tea Skimmers is the subject of a new lawsuit from segment leader Surfside…

This story is a part of VP Pro, our free platform and newsletter for drinks industry professionals, covering wine, beer, liquor, and beyond. Sign up for VP Pro now!