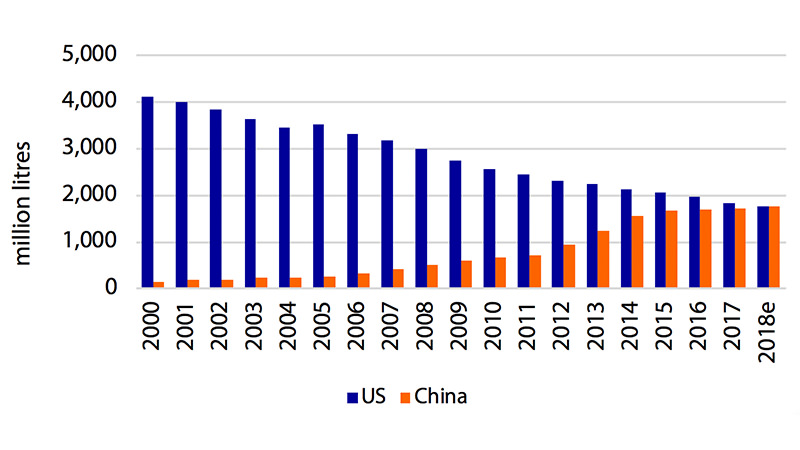

Budweiser sales in China have officially surpassed the brand’s sales in the U.S., according to a recent report. In fact, Chinese beer drinkers are now consuming more Budweiser than anyone in the world.

According to BeverageDaily, in 2000, domestic beer comprised nearly 88 percent of total beer consumption in the U.S. By 2017, that number plummeted to less than 68 percent. Sales of foreign imports and craft beers jumped from 12 percent to 32 percent in the same period.

A report from Rabobank, a multinational financial services firm based in the Netherlands, details that as Americans forgo domestic brands like Budweiser for imports like Corona, the same is happening in China, as well as around the world.

Francois Sonneville, senior beverages analyst at Rabobank, points to interest in foreign imports, migration, expanded beer options, and global brand presence for the shift.

“Whether it is nostalgia for a beer drank back home or on holiday, or a longing for a product with authenticity of a country far away, consumers see foreign beer as a premium product,” Sonneville writes.

He adds beer and food pairings to the mix, as consumers yearn to match foreign meals with foreign beers (like, perhaps, a burger with a Bud).

Furthermore, young adults in China have more disposable income than their parents did at this age, allowing millennial drinkers to “upgrade from cheap Chinese beer to the more expensive foreign imports,” BeverageDaily reports.

The report comes two weeks after Heineken announced a 40 percent stake in China’s biggest beer company, China Resources Enterprise (CRE) and China Resource Beer (CR Beer), for $3 million. That partnership angles Heineken to grow its brand in China, the world’s biggest beer market. Meanwhile, the Brewers Association’s Export Development Program saw craft beer export volume increase by 3.6 percent in 2017, to 482,309 barrels valued at $125.4 million. The most growth was seen in the Asia-Pacific region, which grew 7.4 percent.