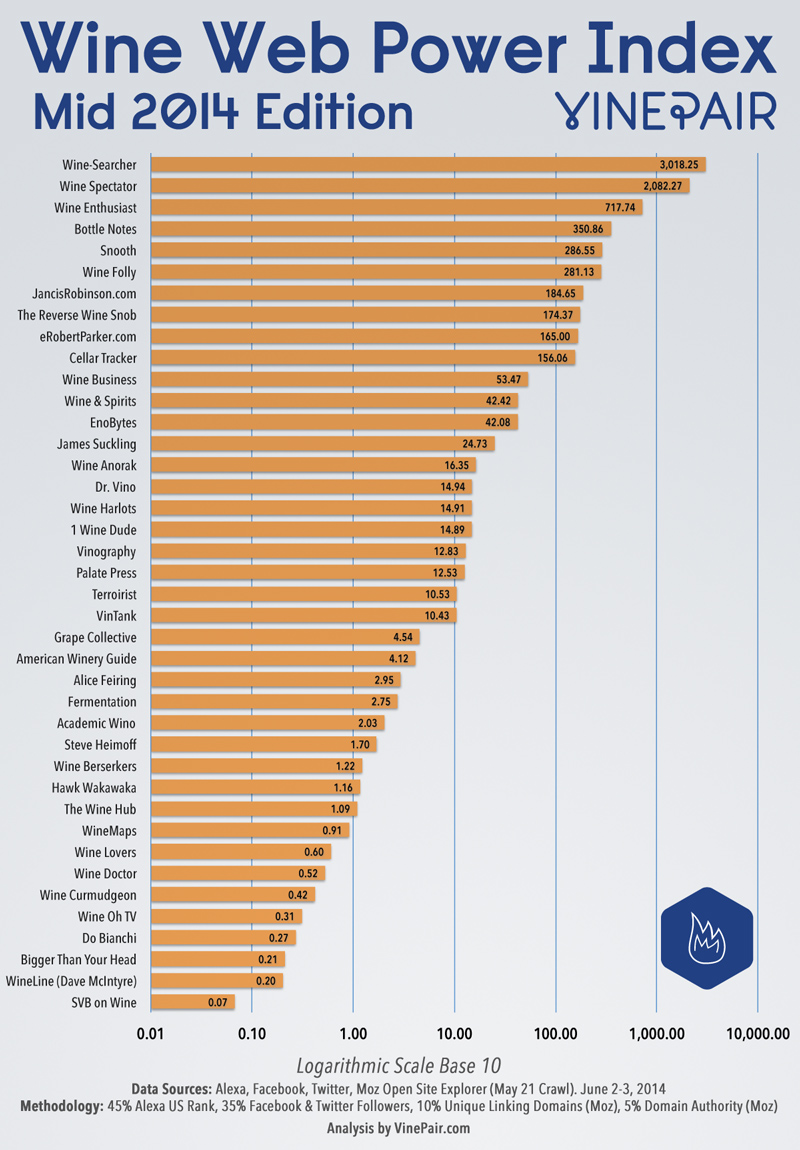

The US wine world is always evolving. As our wine culture continues to grow, it seems every day there is a new wine to try or new people looking to learn more. Because, relatively, we are still young and inexperienced when it comes to wine, we decided to look at who was responsible for influencing US wine consumers the most. We wondered: who is molding the palates of future wine drinkers, and who is responsible for our getting excited about things such as Orange Wine? As we did in December, we present The Wine Web Power Index — our attempt to bring order to the wine voices online as we continue to grow as a community and improve America’s wine culture.

A full description of our methods and reasons for analyzing the sites and writers we chose is provided below the chart. As creators of the index, we chose not to include VinePair in the project.

Our Observations

- As we did on the previous release, we used a log scale to visualize our data, as the big players truly exist in a league of their own. Within the upper reaches of the list we can see some interesting traffic trends. Wine Enthusiast and Wine Spectator clearly saw traffic surges in the fourth quarter, due to the holidays, which would account for their better numbers in the previous release of the index.

- Wine-Searcher and Cellar Tracker saw a similar holiday jump, though Wine-Searcher’s traffic appears to be on a steadier uptrend. The seasonality of wine interest really shows up over at Google Trends. Ranking well organically and via AdWords for wine terms and specific wine brands/vintages/etc. paid big dividends in Q4.

- Wine Folly (up 150%) and The Reverse Wine Snob (up 135%) jumped past some of the largest ‘names’ in the wine business. The properties are very different in focus and audience, but both are growing quickly, and reaching wider audiences than many well-known wine critics. With a book on the way for The Reverse Wine Snob, we’d guess Mr. Thorsen’s growth will continue.

- The 9th place rank for eRobertParker, as well as the traffic driven drop (we believe induced at least somewhat by seasonality), may be even more significant than they appear. As we note below, despite the fact that Mr. Parker has stepped down as Editor in Chief post-sale, we used his personal Twitter account for the property’s ranking. If we used the @Wine_Advocate account, or new EIC Lisa Perrotti-Brown’s account, eRoberParker’s score and rank would have been far lower. Today, Mr. Parker is still the face of his brand. As that changes we will likely exclude his personal account from consideration. As more than a few people have noted, this is a serious challenge for The Wine Advocate going forward.

- The highest ranking additions to the list from the ‘tasting notes/user generated content (UGC)’ category are Bottle Notes and Cellar Tracker. As the data shows, Cellar Tracker pulls in a ton of traffic to their website, but for its size, has a relatively small social presence. We’ll repeat, a ton of traffic, as their CEO is quick to point out. As Cellar Tracker does not paywall the vast majority of its UGC (which has major SEO benefits), it would seem there are opportunities to increase their social numbers and reach new audiences. At the same time there is clearly tremendous value in keeping your community active on your own servers if you can, given the tollbooth Facebook has been busy erecting in front of most brand’s Pages.

- One of the biggest gainers in the middle of the pack was Terroirist. While David White’s blog only moved up two places in rank, his score surged 198%. Terroirist saw strong growth across the board. VinTank faired similarly, jumping 152%, with most observed metrics improving. There were slight decreases for both sites in the Moz data. We saw this for a number of properties where we expected to see rising numbers, though this did not meaningfully impact their scores, as illustrated by the rise of Terroirist and VinTank

- The mean score fell from 207.44 to 192.8, driven by seasonal traffic declines on some of the larger properties. The median score rose by roughly half a point, reflecting that concentrated decline. On the social networks we saw mostly rising numbers. The mean number of Twitter Followers rose to 27,262 from 22,536, while the median increased to 10,643 from 9,224. The mean number of Facebook Fans rose to 22,166 from 17,892, while the median slipped to 1,483 from 1,595.

- Although Alexa’s data for Wine Lovers Page is consistent with every other data source we cross-referenced, the activity on the forum there indicates that the site’s traffic is probably being undercounted.

- Chasing The Vine and Wine Terroirs slipped off the list. The previous, consolidated list included 39 websites and mobile apps. Going forward we will always include 40 properties.

Our Influence Formula

The VinePair Wine Web Power Index measures the influence of selected wine websites within the United States. We looked at web traffic, social media influence and organic search relevance to produce our scores. The first edition (December 2013) of the VWWPI analyzed 39 wine-focused publications, forums and mobile applications. This release marks the first update of the VWWPI. The next update will be released in December 2014.

While our influence formula remains the same, we made three changes to sites that qualify for inclusion. Community tasting note websites such as Cellar Tracker were added. Mobile Apps and retailers (e.g., flash sellers and clubs) were removed. See the note on inclusion below our observations for more on these changes.

Choosing the data weighting is inherently subjective. We believe that social media, at least in terms of consumer (and to a lesser extent industry) influence, is extremely important, hence the relatively high weighting.

We are well aware of the issues with Alexa data (see caveats below), which is why we also included the data points from Moz’s Open Site Explorer web crawl.

Our Data Sources

We used publicly available data, collected on June 2, 2014 and June 3, 2014. The Moz Open Site Explorer Data is from the May 21, 2014 crawl. Data was manually collected. Change and previous rank use the final consolidated list we provided to Vineyard & Winery Management as the base. In the next update we will likely add Pinterest to the formula and weigh the social networks individually.

How We Selected Who To Include

Putting together an index like this is inherently subjective. If you believe we’ve excluded a property that belongs in the list, please let us know. Without diving into the why or why not of every wine-related website on the Internet, we’ll address some exclusions as well as the changes to site categories that we made on this release:

- Tasting Note Properties – Cellar Tracker and Bottle Notes were excluded in the previous release. After reconsidering the role they play, we have decided to include UGC/tasting note websites moving forward.

- Flash Sellers & Other Wine Shops – These websites were removed as our goal is to measure consumer influence, not the production of content incidental to the selling of wine, or a complete lack of content. Although Grape Collective is an online wine shop, the volume and the quality of the content they produce, a lot of which is not tied to the wine they are selling, merits inclusion.

- Mobile Apps – We came to the conclusion that we cannot judge mobile apps fairly in the context of this list. MAUs/App Store rankings, links and photos published to Twitter and Instagram, and other statistics are far better indicators for mobile apps than the data we are collecting. That said, mobile apps like Vivino, Delectable, Drync, HelloVino and others play a huge role in wine discovery and sharing. If you are a winery we do believe you should be paying close attention to what your customers (and potential customers) are doing within these apps.

- Trade Focused Properties – We maintain an internal news feed that covers a wide swath of wine websites. Stories we see on trade sites often bubble up to many properties on this list, illustrating their indirect influence.

- Print Focused Wine Critics & Writers – Critics and writers who write exclusively or primarily for a single newspaper or magazine who do not have an active personal web presence were excluded. As we explained last year, publications where wine is not the primary focus are not comparable to wine-only/wine-first publications. Some of those publications are influential — we even sent a friend to study at Eric Asimov’s Wine School — but they are not the focus of this project.

[toggle hide=”yes” border=”yes” style=”white” title_open=”Raw Data & Feedback” title_closed=”Raw Data & Feedback”]In the table below you can see our raw data. Have a better way to weight the data, or more to include? We’d love see what you have in mind. If you do produce a different set please let us know.

[/toggle][toggle hide=”yes” border=”yes” style=”white” title_open=”Caveats” title_closed=”Caveats”]

- When a property did not have an Alexa US rank we used their global rank. Those ranks are italicized in the raw data table. All Alexa data was collected on June 3rd. The other data was collected on June 2nd.

- As we noted on the previous release, the December Alexa rank for Enobytes appeared to be incorrect. It now looks accurate, which accounts for their 2874% score increase.

- For the first release we attempted to account for any Alexa outliers by using Quantcast as a second traffic source, but the data was too spotty to be of use. While we do not include other traffic data in our ranking formula, we did examine and compare many of the websites using other tools and data sources. Based on that analysis we are satisfied with the Alexa data with the possible exception of Wine Lovers Page.

- We recorded data for dozens of other properties that did not make the cutoff at 40th place. If you don’t see a site (aside from categories which we have stated we are excluding), chances are we did evaluate it, though feel free to email us if you believe that is not the case. To everyone who emailed over the winter asking for consideration, we want you to know we evaluated all of those submitted properties. If they’re not on the list, they simply missed the cutoff.

- A number of properties that do not have a Facebook presence, do have a public, personal presence belonging to the owner of the property. When appropriate and available we used the number of their ‘Followers.’ We used personal accounts on Twitter for eRoberParker, Cellar Tracker’s CEO, and The Wine Lovers Page (Robin Garr).

[/toggle]