I have a Google Alert set up for dozens of spirits categories – gin, craft gin, bourbon, even more obscure categories like aquavit – but recently there’s been a lot of buzz about one spirit in particular: Irish whiskey. Rumor would have it that Irish whiskey, specifically craft Irish whiskey, is experiencing a massive revival. The numbers would appear to back this rumor: Irish whiskey has been increasing in volume and sales in the US and abroad over the past 15 years. This has resulted in new craft Irish brands popping up left and right. Craft Irish whiskey is taking off.

Right?

The answer is yes. Well, sort of. While it’s true that smaller producers of Irish whiskey are beginning to take shape, this didn’t happen out of a vacuum. People didn’t wake up one morning and decide they were really missing out on all that Irish whiskey had to offer. Rather, small Irish producers can thank Jameson (and Americans) for putting them on the global booze map.

If more people are exposed to Irish whiskey, there’s definitely a better chance they’ll eventually seek out a craft Irish spirit than if they’d never been exposed to Irish whiskey at all.

What do Urban Outfitters and Jameson have in common? They’re big brands making small brands look cool. When you walk into an Urban Outfitters store, you’ll find clothing that looks distressed, like it came right out of your grandmother’s closet or a second hand store. While many who shop at Urban Outfitters might never show face at a Goodwill, some will be inspired to swap their retro-inspired clothes for actual retro clothes – just ask Macklemore. The same goes for Jameson. Jameson made Irish whiskey a viable category in the US. Here’s how:

Irish whiskey has a long, rich history. Distilling was brought over by monks in 600 AD, and by 1405, the first mention of Irish whiskey was documented. It didn’t take long for the beverage to take off. In the 18th century, the distilling companies Jameson and Powers (two Irish brands you may recognize today) were established and by 1880, a relatively small population of only about 3 million were enjoying more than 160 distilleries producing over 400 brands of Irish whiskey. That’s roughly one distillery for every 19,000 people.

Irish whiskey enjoyed success abroad as well, and there’s no mystery as to why the spirit enjoyed success in America. Irish whiskey is sweet, mild, gentle – much more similar to bourbon than Scotch, and therefore much more suited to the American palate. Ireland needed American consumers to support all those distilleries. 19,000 people wasn’t enough to keep a distillery in profitable business.

Process that for a moment. The American market turned its back on Irish whiskey, and 400 brands basically turned into three: John Jameson & Son, John Power & Son, and Cork Distillers.

That’s why when Prohibition rolled around in 1919, Irish whiskey took a staggering hit. When the bans were lifted in 1934, the Irish whiskey market didn’t recover – there were other detractors from Irish whiskey’s growth as well, such as grain shortage during World War II and Ireland’s own temperance movement – but Prohibition was the major gut punch.

That’s why when Prohibition rolled around in 1919, Irish whiskey took a staggering hit. When the bans were lifted in 1934, the Irish whiskey market didn’t recover – there were other detractors from Irish whiskey’s growth as well, such as grain shortage during World War II and Ireland’s own temperance movement – but Prohibition was the major gut punch.

Process that for a moment. The American market turned its back on Irish whiskey, and 400 brands basically turned into three: John Jameson & Son, John Power & Son, and Cork Distillers. In 1966, these remaining distilleries formed the Irish Distillers Group, and 22 years later they were bought by French alcohol megabrand Pernod Ricard. Pernod Ricard focused on pushing Jameson specifically to Americans, and it worked. Fast forward to 1996, and one million cases of Jameson had been sold worldwide. By 2012, that number increased to four million cases. When you think about it, that’s fairly recent. Irish whiskey has only held strong in the 20th century since 1996 – and it’s in large part due to Pernod Ricard pouring us shots of Jameson. Jameson wanted America back, and the US welcomed them back with open arms.

Pernod Ricard made Irish whiskey an option, as long as that option was Jameson. They advertised and continue to advertise brilliantly – never branding themselves as a “mixology” whiskey, but rather as a whiskey to be shot. Their 2015 #LongLiveTheShot St. Patrick’s day campaign showed that Jameson wasn’t interested in overcomplicating themselves as a brand. As a piece in Bloomberg put it, “bartenders have started using Jameson as a buyback… an on-the-house thank-you quaff for considerate tippers.”

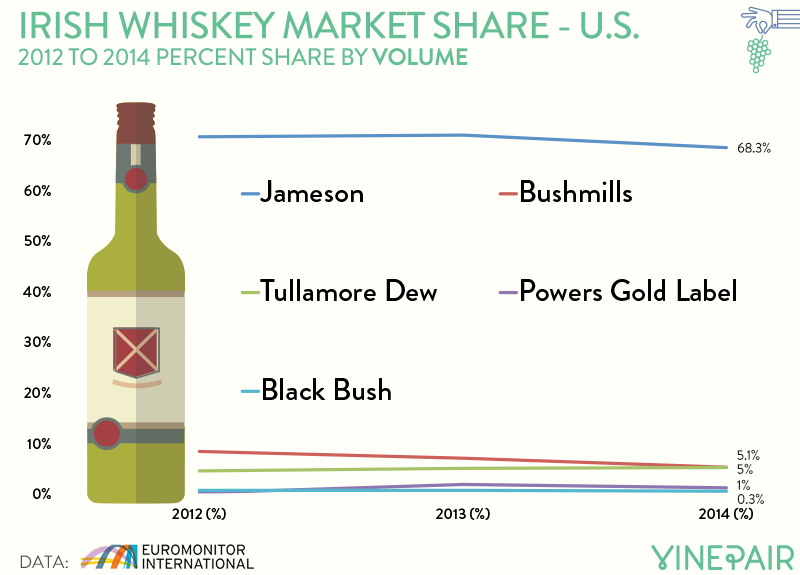

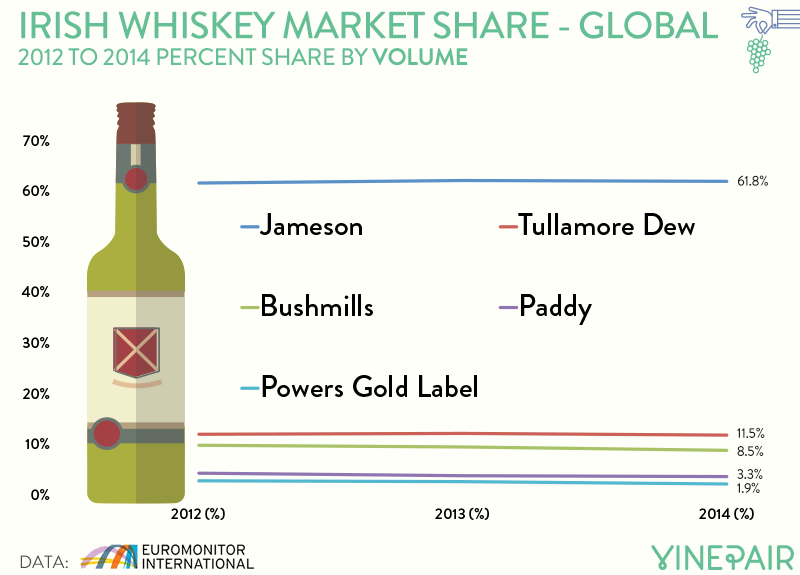

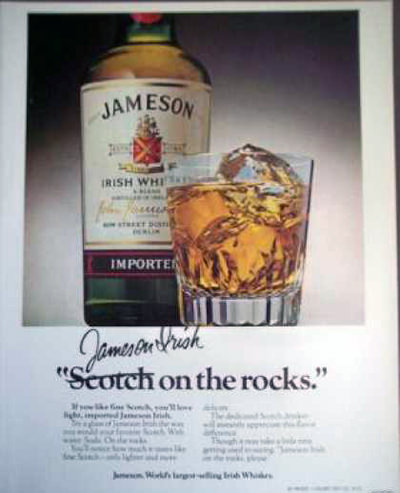

Another thing Jameson plays up is their Irish heritage. One Jameson ad early on showed a pour of Jameson with the words “Scotch on the rocks” above the glass. The word Scotch was marked out and replaced with the words “Jameson Irish.” Jameson was the Irish whiskey, and Americans had and still have an affinity for Ireland or perceived Irish culture. Accurate or not, Ireland is seen as a warm, jocular place to drink; one look at the widespread American celebration of St. Patrick’s Day will tell you that. As an article in The Atlantic stated, “Irish whiskey’s fate has always been tied to the whims of US drinkers, and just like American prohibition helped to cripple the industry in Ireland, American demand is largely responsible for reviving it.” Inflammatory or not, without America, the current strength grip the Irish whiskey category has over spirits growth is tenuous. Furthermore, without Jameson – who’s responsible for 70% of global Irish whiskey sales – the theory that the category of Irish whiskey is rapidly growing both worldwide and in the US is moot, as well.

Let’s contextualize this a bit. In 2014, according to data provided to VinePair by Euromonitor, the Irish whiskey market was worth $4.2 billion. $1.8 billion of that went to the American market alone – that’s nearly half of the entire world whiskey market. And Jameson is responsible for almost all of that revenue. The brand sold nearly 18 million liters in the US, and 37 million total in 2014. The next best-selling brand? Bushmills, which only sold 1.3 million liters in the US, and just 5 million worldwide. Perhaps that’s why Diageo, one of the most powerful liquor giants in the world, nixed the brand from their portfolio and traded with Casa Cuervo for Don Julio. Jameson is simply too much of a behemoth for even enormous brands with rich histories to think they can be competitive.

But while Jameson’s monumental place in the Irish whiskey world might have frightened many of the other mega brands, it hasn’t discouraged craft Irish producers from churning out product. Interestingly enough, this is a situation where a big brand has paved the way for smaller producers to actually have a place in the market, while also keeping their larger competitors out. While large companies may not stand a chance against Jameson’s mass market appeal, that’s not who independent producers are going after. Rather, the craft cocktail renaissance has encouraged younger, conscientious consumers to focus on purchasing more “hand-crafted,” “small-batch” products. In general, America now knows what Irish whiskey is, and those who are hipper want it with a side of artisanship.

There are now a handful of craft brands to choose from, with whiskey company Teeling being the most arguably well-known. Teeling whiskey, which is available in the US, has received widespread acclaim and recognition, and they’re due to open a Dublin distillery this month. People love their craft appeal, and craft cocktail bartenders have become big fans. These are also the same people who have penned the many articles announcing an Irish whiskey boom thanks to craft distillers.

But despite this triumph for small brands, it’s important to note that even many of the craft Irish whiskey brands currently gaining acclaim are owned by larger, non-Irish conglomerates. These companies also see an opportunity in the craft brand positioning – the only segment of the market where Jameson seems willing to allow entrants. A good example of this is Cooley, a “craft” distillery that is actually owned by Beam Suntory. It’s almost as if these brands are doing business at the pleasure of Jameson. Right now they’re okay with it. But who knows how long they will be?

There’s still a lot to be optimistic about. But we can’t lose site of the fact that Pernod Ricard – a huge company – controls most of the Irish whiskey category. However, growth is still a good thing for the small producers. If more people are exposed to Irish whiskey, there’s definitely a better chance they’ll eventually seek out a craft Irish spirit than if they’d never been exposed to Irish whiskey at all. Now it’s just up to these craft distillers to figure out how to steal more of Jameson’s market share. We’ll have our glasses ready.

Header image courtesy of drserg / Shutterstock.com