As alcoholic beverage conglomerates like Molson Coors and ABInBev rake in profits by the dumper-truck-load, it’s easy to forget that much of what we spend on alcohol ends up in Uncle Sam’s pocket. But how much of what we’re spending on beer, wine, and spirits goes to those who make the drinks, and how much is claimed by the government in the form of Federal or State Tax?

As you may have guessed, the value varies from state to state. Thanks to these handy maps produced by the Tax Foundation, you can easily find out what percentage of dollars per gallon of alcohol ends up in government coffers:

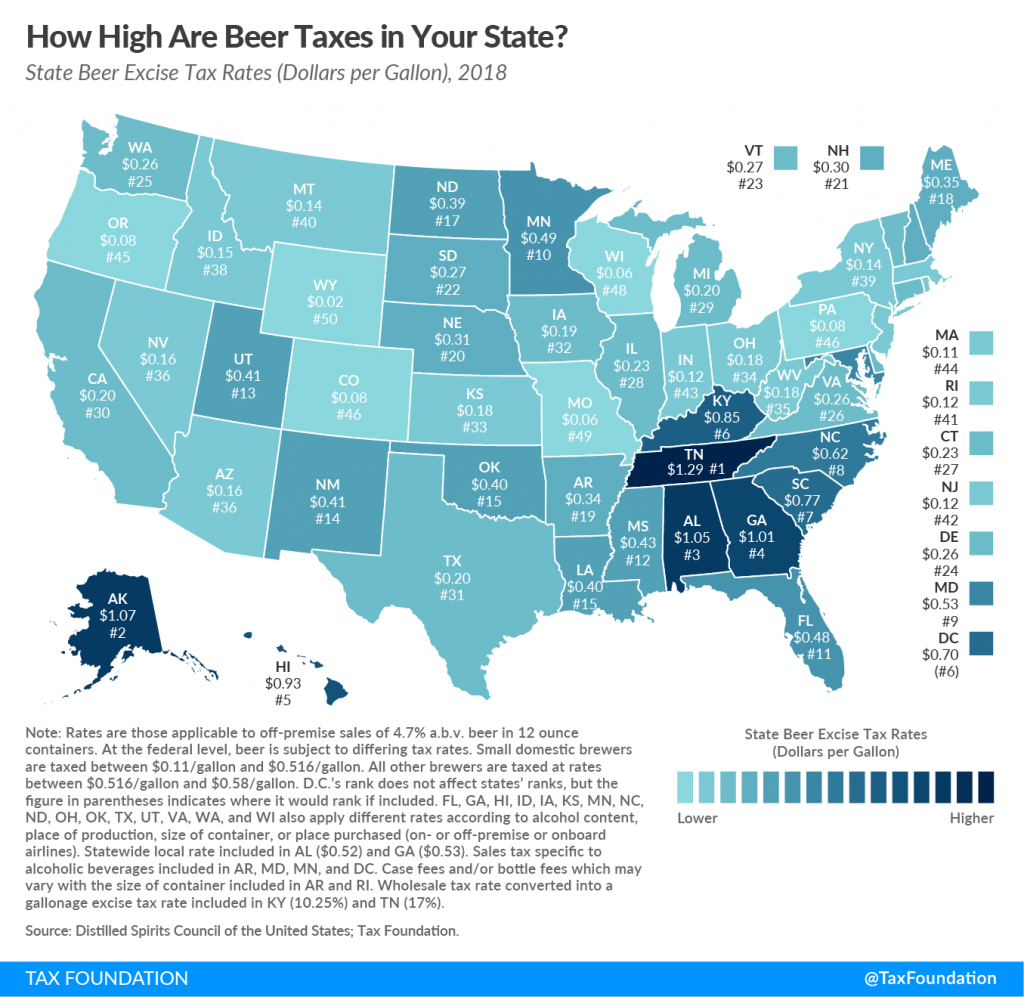

BEER

According to the Beer Institute, around 40 percent (!) of beer’s retail price goes towards covering all applicable taxes. “Taxes are the single most expensive ingredient in beer,” it says, “Costing more than the labor and raw materials combined.”

Not only is it subject to federal excise tax, all 50 states and the District of Columbia also collect their own tax on beer. Rates vary by state, with Wyoming claiming the least of all, $0.02 per gallon. Tennessee, on the other hand, pockets a whopping $1.29 per gallon.

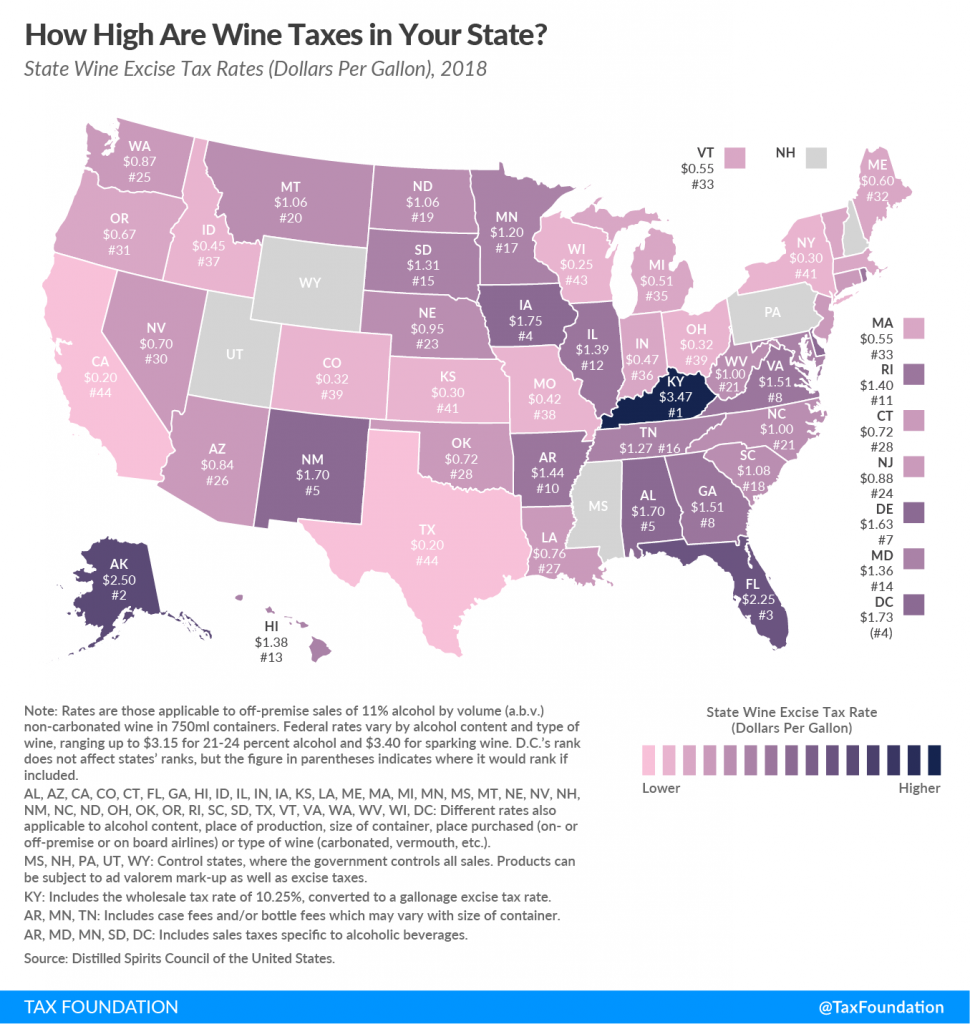

WINE

Wine tends to be taxed at a higher rate than beer, because of its alcohol content. For this reason, it is also taxed at a lower rate than distilled spirits. Wine drinkers might look to avoid Kentucky, which has the highest wine excise tax rate at $3.47 per gallon. Instead, they should probably head to California and Texas, each of which only charges $0.20 per gallon. New York, astronomical in other areas of tax, isn’t too far behind, with a $0.30 per gallon wine excise tax rate.

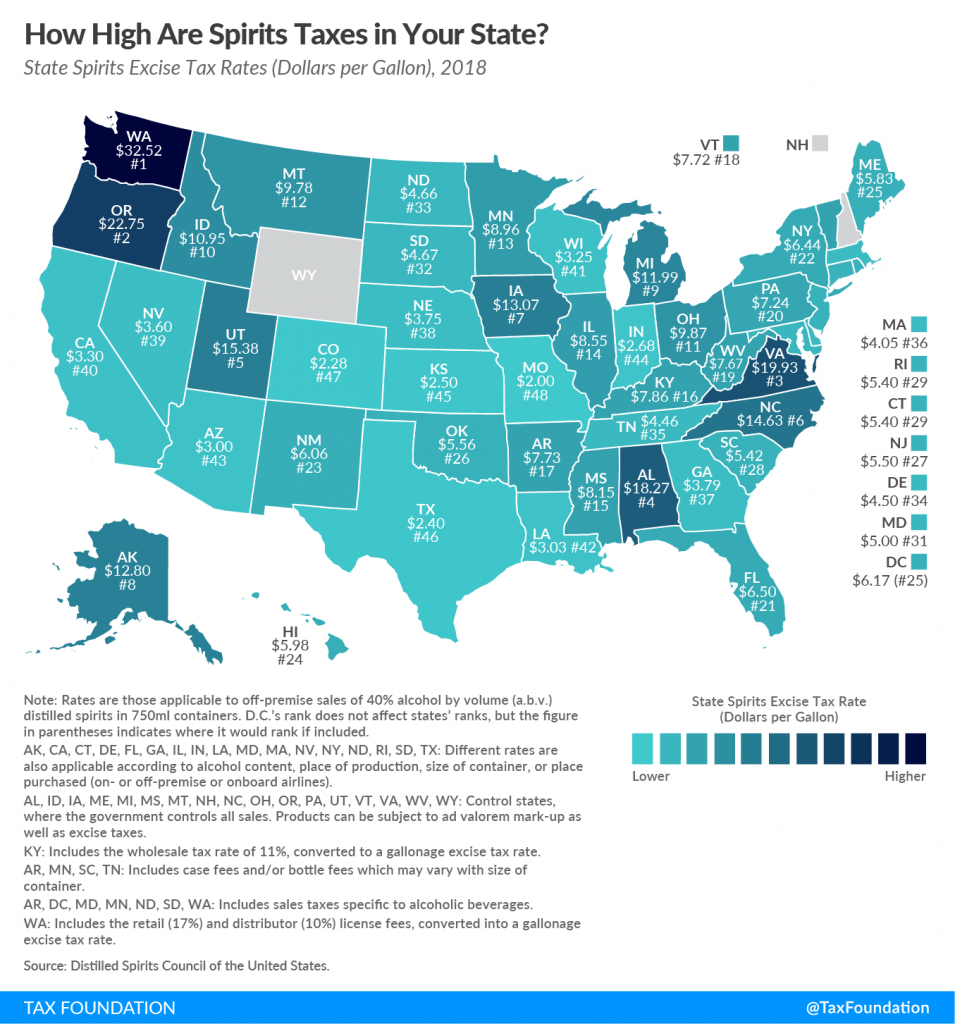

SPIRITS

Spirits are taxed at the highest rate of all alcoholic beverages. If you’re a cocktail lover, Washington state is probably not the place to be drinking, as spirits here are taxed at a massive $32.52 per gallon. Once again, Texas is a good state to drink in, with one of the lowest rates of $2.40 per gallon — more than ten times cheaper than Washington state. In Wyoming and New Hampshire, meanwhile, the sale of liquor and spirits is state-controlled. Here, “Government-run stores have set prices low enough that they are comparable to having no taxes on spirits,” according to the Tax Foundation.