Kona Brewing Company is leaning even further into its island-adjacent image.

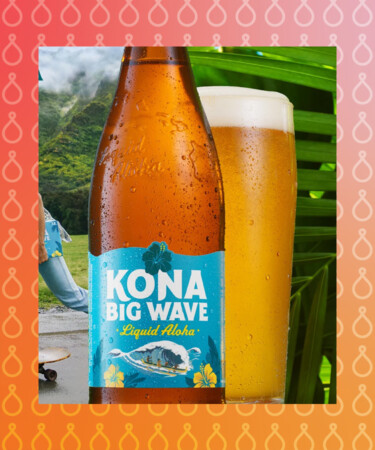

The brewery, known for its Hawaiian roots, is rebranding as Kona Big Wave after its core brew, according to a May 16 press release. The brand’s products have also undergone a packaging refresh.

Kona’s fresh image is “centered around a new brand world firmly rooted in Hawaii’s powerful aloha spirit,” per the release. The brand’s new logo and bottle design prominently feature the brand’s signature hibiscus flower alongside a brighter color palette.

Founded on Hawaii’s Big Island in 1994, Kona and its variety of brews (also known as “liquid aloha”) have seen immense growth amidst changes in ownership: Nielsen data indicates that Big Wave was the 17th best-selling premium-plus brand in off-premise retail in 2022, and it’s now sold in 40 percent of U.S. markets.

“Kona Big Wave has always been beloved for its authentic connection to the Hawaiian lifestyle and its easy-drinking, island-inspired taste,” said Meredith Ruskin, VP of Marketing for Kona Big Wave. “Now, with a modernized brand look and a new campaign that celebrates and shares stories of the Aloha spirit, we will be able to ‘Bring the Aloha’ to even more fans around the country.”

Kona’s marketing has consistently relied on offering a serene Hawaiian lifestyle to drinkers on the mainland, though that strategy hasn’t gone without criticism and legal implications: The brand settled a $4.7 million lawsuit in 2019 regarding consumers who felt “misled” over the craft beer’s hazy production origins. The brand’s headquarters, flagship brewery, and two restaurants remain in Hawaii while most of its brews are now produced in Oregon, New Hampshire, Tennessee, and Washington.

VP Pro Take

“It should come as no surprise that parent company Anheuser-Busch InBev (ABI) would lean further into Kona’s Hawaiian roots and vacation aesthetic, and opt for a name change centered around the brand’s most popular product: ABI execs have been particularly vocal about their hopes that Kona Big Wave has what it takes to disrupt the dominance of Mexican import lagers in the “lifestyle” beer space. For more context on that unfolding dynamic, read about ABI’s strategy for the brand — and industry experts’ takes on the chance of success — here.”