Wine aficionados know that the price of a bottle can vary greatly depending on where it’s purchased, and new data indicates that the state one lives in has a significant impact on the overall cost, as well.

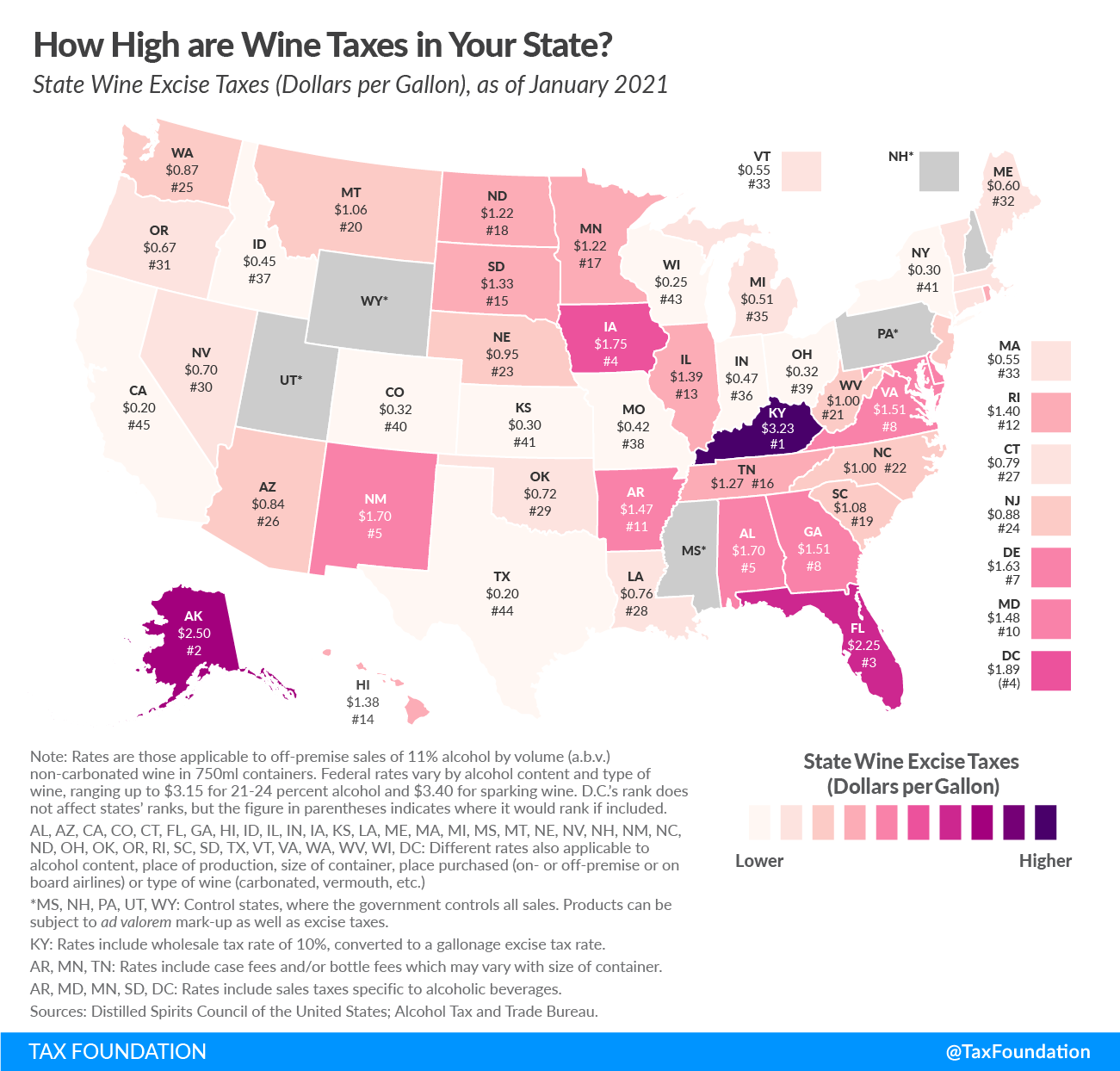

Nonprofit tax policy group The Tax Foundation recently published a map based on the excise taxes each state charges per gallon of wine. Residents of Kentucky are taxed the most ($3.32/gallon), Alaskans a distant second ($2.50/g), while Californians and Texans pay the lowest amount in the nation ($.20/g).

For the majority of states, taxes are based on volume produced, but the matter is complicated by a number of factors including the diversity of regulations imposed. Some states escalate taxes on sparkling wine, higher alcohol wines face stiffer levies in others, and the issue of sales tax calculations in control states further muddies the water.

Wine excise taxes are substantially lower than spirits but more than beer, as most states base taxation on alcohol content.

Those in areas with the lowest tariffs have a great excuse to uncork a bottle in celebration, and those on the opposite end of the spectrum have an excellent reason to plan a vacation this summer. See the map below for the full details.

![How Much Every State Taxes Wine 2021 [Map] How Much Every State Taxes Wine 2021 [Map]](https://vinepair.com/wp-content/uploads/2021/06/WineData_Card-375x450.jpg)