With the heat of the summer upon us, it’s the perfect time to grab a cold beer while enjoying the great outdoors. But as a new report details, the price you pay for a brew varies notably depending on where you live, with one of the main contributing factors to the discrepancy the amount of tax levied by local governments.

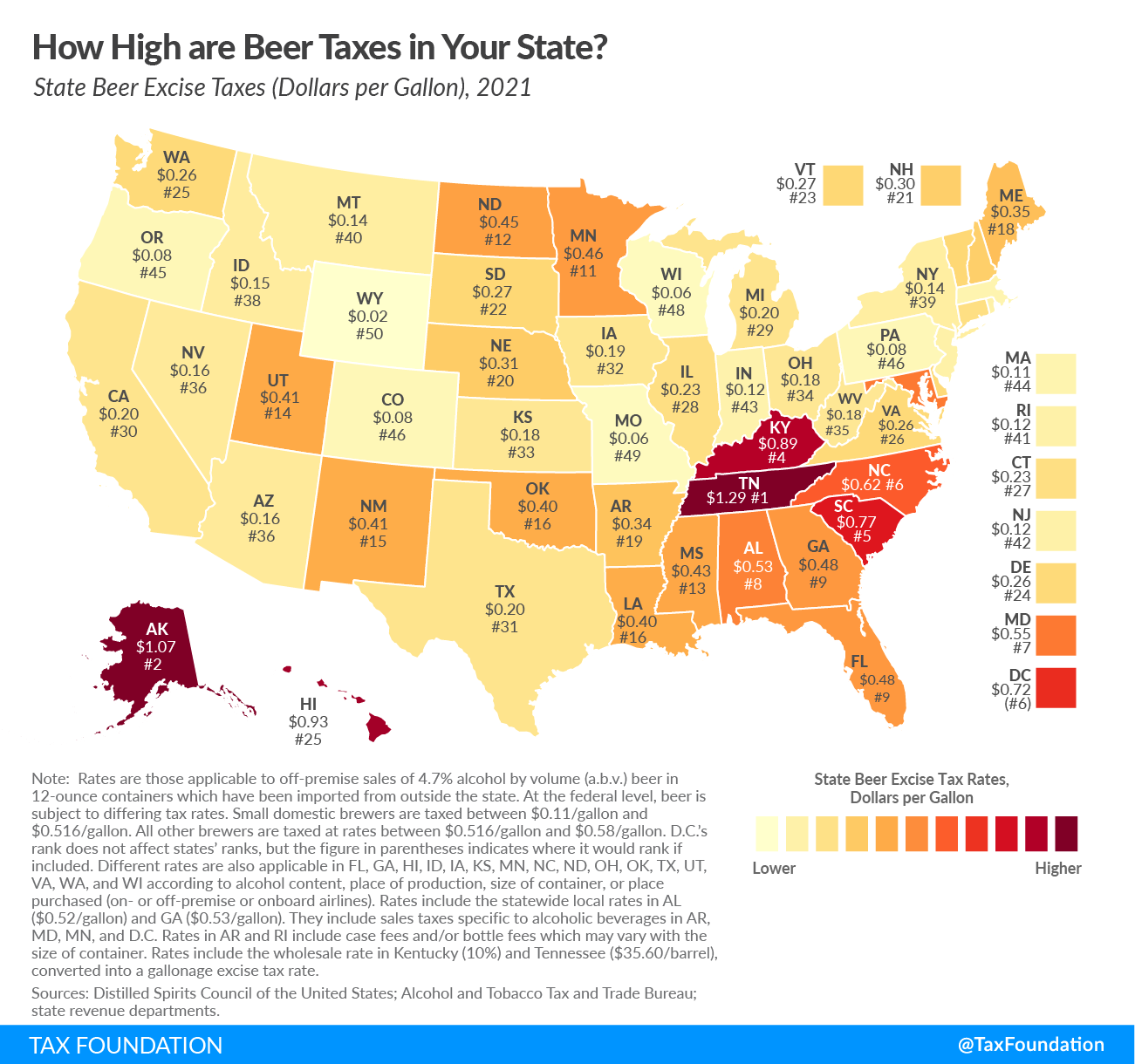

Independent tax policy nonprofit The Tax Foundation recently published a map documenting the disparity in excise taxes charged by each state. Tennessee leads the nation with $1.29 per gallon tariffs on beer, with Alaska a distant second ($1.07).

Residents of Wyoming ($.02) can celebrate having the lowest excise tax in the country, and Missouri and Wisconsin can join the party tied for second-lowest ($.06), with very little tax paid.

As with all things related to taxation, a host of variables complicates the calculations and makes a straightforward comparison seemingly impossible. The size of the container, location, quantity, and content of the alcohol all face varying rates depending on local ordinances, and licensing fees and fluctuating sales taxes further obscure simple analysis.

For those looking for a fun road trip this summer, this is a great guide to exploring the country while enjoying cold beer and saving a few dollars for gas along the way.

Check out the map below for the full details and to see how your state compares.

![How Much Every State Taxes Beer (2021) [Map] How Much Every State Taxes Beer (2021) [Map]](https://vinepair.com/wp-content/uploads/2021/07/beertax_card-375x450.jpg)