With the meteoric rise of meme stocks, markets flirting with record highs daily, and valuations vaulted at multiples never before seen, seemingly everyone wants a piece of the investment action these days. Conscious of this inrush, savvy investors are increasingly seeking less traditional asset classes to put their money into, and the diversification strategies to do so are progressively becoming more unique.

It is estimated that $70 trillion of wealth will be transferred from baby boomers to Millennials and Gen Z in the next 25 years, which means a younger generation of people with a lot of money to invest in things they care about. And the ability to make profitable investments based on passionate desires, be they altruistic (socially responsible investing) or egoistic (chasing returns with a fear of missing out mentality), is a motivating factor leading many newly minted investors to evaluate alternative strategies. Whether looking for endeavors that contribute to equitable social evolution or a hedge against inevitable corrections to traditional financial markets, investors are flocking to a host of non-traditional, tangible commodities.

Which is where fine wines and brown spirits come in. While in the past investors have shied away from alternative assets, like coins and antiques, due to fears of illiquidity and opaque valuations, the emergence of wine and whiskey investment portfolios — and really the sheer variety of fractional, democratized investment opportunities created in the last few years — underlies a greater shift to financialize pretty much everything, and signifies a newly defined approach to investing. But are they really the safer bet?

Wine Portfolios Take Liquidity to Another Level

Fine wine is an area that has witnessed significant growth recently, and the sector is poised to break out, as a number of firms and investment gurus, after eyeing several years of compelling returns, are expanding their holdings.

London-based Liv-ex promotes itself as the global marketplace for wine. The firm produces reports detailing market movers and valuations, documenting record growth in sales volume and value in the past year. With the renewed interest in wine collecting and investing spurred by the pandemic, certain varieties and vintages have seen values skyrocket. Not surprisingly, Champagne and Burgundy remain two of the most sought after and best-selling in the investment sphere. And the most traded fine wines of the last year, according to Liv-ex, included Lafite Rothschild, Petrus, Screaming Eagle, Mouton Rothschild, Sassicaia, and Taittinger.

In a 2020 article suggesting that investing in wine was essentially a way to ‘Covid-proof’ a portfolio, Forbes reported that $100 invested in wine in 1952 would be worth $420,000 today, while the same amount placed in the stock market would equate to $100,000. The numbers are impressive, but the claim begs the question of whether storage costs were taken into account, and these returns are likely based on assumptions that the proper labels and vintages were purchased.

Wine investment firms like Vinovest are well aware of the issues at hand when it comes to managing fine wine portfolios. The company, founded in 2019, handles all acquisition and sales responsibilities, storage, insurance, and portfolio management for a 2.85 percent annual fee, a number that drops to 2.5 percent with a $50,000 commitment.

Like other apps aiming to simplify investing, Vinovest offers access to the wine investing world through algorithmic mechanisms that take into account a client’s risk aversion and market fluctuations to identify strong investment portfolio strategies. The company is working to release a wine value index tool, comparable to the S&P, which offers live valuation indices.

When asked about the motivating factors drawing investors into asset classes such as fine wine, Vinovest co-founder and CEO Anthony Zhang says that three issues are driving interest: “diversification and low correlation during downturns” combined with “double-digit annualized returns over the past couple decades” and younger generations’ commitment to investing in ideas and products that they are passionate about.

The Returns on Rare Whiskey

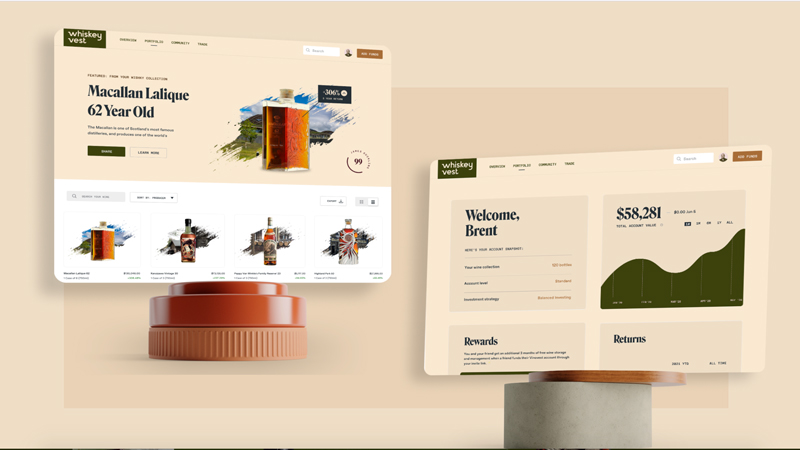

After striking liquid gold with Vinovest, the team recently turned to another liquid venture, Whiskeyvest. Currently accepting members by invitation only, the company promises to “make investing in rare whiskey simple and accessible.” Focusing on exclusive bottles, Whiskeyvest highlights The Macallan’s 62-year-old single-malt Scotch — and its recent 143 percent appreciation — on its landing page.

Investing in whiskey and Scotch is a hot topic, and while the opportunity was traditionally only available to distillers and producers, investment groups are now purchasing casks, aging them in distillers’ bonded warehouses, and selling shares to the public. Scotch whisky investment firm WhiskyInvestDirect reports that Scotch has realized annual returns of 15.4 percent annually over the past decade.

Rare Whisky 101, the Scotch industry leader in valuation tools, compiled data covering 64,201 bottles and 727,268 transactions since 2003. The statistics indicate that Scotch has consistently outperformed the S&P.

As the industry is in its infancy, a multitude of variables are at play when it comes to investing in rare whiskey. Producers are now limiting production and creating ultra-rare vintages in an attempt to capitalize on trends. How this affects the market in the future remains to be seen. With supply and demand lying at the heart of all financial transactions, the advantage of the product being consumable is a significant factor that is difficult to project.

Everything’s an Investment, Almost

As with wine and whiskey, those who emerged from the past year flush with cash are pouring excess reserves into a variety of innovative investment opportunities. Real estate, typically a safe haven for wealth, is on fire in terms of popularity and capital in-flight right now, and other assets including art, watches, handbags, jewelry, and luxury goods are appreciating handsomely with renewed financialization schemes.

Luxury handbags are the only sector to record better returns than fine wine last year (up 17 percent), according to the Knight Frank Luxury Index. Hermès handbags, specifically, are a status symbol, and some models qualify as the most difficult consumer products to acquire, with extremely limited production. Demand far outpaces supply, and second-hand bags routinely sell for substantial markups. Baghunter documented a 500 percent increase over 35 years, with annual returns averaging 14.2 percent. Startup RSE Archives, doing business as Rally Road, identified the unique position held by luxury handbags and is now offering investors the option of purchasing shares in crocodile skin Birkins. The firm is not new to the investment game and has been allowing clients to invest in rare cars and baseball cards in a similar fashion.

Fine art has long been considered a strong capital asset, but the recent trend toward increased financialization in the art world offers even more diversification strategies for creative portfolio managers. New York-based Masterworks developed an organized art market where investors purchase shares in blue-chip masterpieces. The company buys works of renowned artists, securitizes the pieces with the Security and Exchange Commission, and then sells shares to interested buyers. Investors have the option of holding for three to 10 years until the firm resells the appreciated item and profits are split, or shares can be traded freely on the secondary market.

Watches are a favorite option for high-rolling investors. The luxury watch market is highly speculative, but collectors typically believe value exists in classic lines such as Patek Philippe’s Calatrava and the Day-Date President Rolex. Rocker John Mayer has a world-class collection, and his whims influence the market in a similar fashion to how Elon Musk’s musings impact the cryptocurrency universe.

Speaking of cryptocurrencies, their explosion is shifting the foundations of financial markets. Uncertainty abounds, and the soon-to-be-announced Federal Reserve version is expected to upset current prices by drawing institutional capital to a more centralized crypto model, but to what extent is anyone’s guess.

Lastly, non-fungible tokens, or NFTs, have taken on a life of their own, with a host of companies, including BitWine, betting on the newly found market by combining digital art with iconic wines.

What Goes Up Must Come Down

While bubbles are lovely in Champagne, they tend to be quite dangerous in financial markets. Though the ride to the top feels good, and nobody ever likes to believe that it’s about to be over, the past 15 months have been a genuine rollercoaster testing the credulity of investors and the credibility of the markets as a whole.

From today’s perspective, with markets soaring and businesses reopening, it is easy to forget how dire the situation was financially last year, and how incompatible the current fiscal situation is in relation to common sense. (As reported by Current Market Valuation, the current price-to-earnings ratio is 37.1, a number that suggests the stock market is strongly overvalued, with the ratio measuring the stock price relative to gross revenues 89 percent higher than normal and 2.3 standards of deviation above average.)

Illogical valuations are being fueled by unprecedented capital injections meant to stymie pandemic-related losses and disruptions. The market crash that occurred in March 2020 spooked investors, routed 401ks, and created a crisis that allowed for fiscal policies that would have raised serious red flags in any normal situation. While the numbers don’t lie, an important question remains: When will the bubble(s) pop? While nobody knows exactly what will trigger the event or when, a new wave of financial wizards are allocating to uncorrelated assets like fine wine and whiskey to ride out the storm that many are forecasting. With captivating returns and the allure of owning rare vintages, the industry is set to continue its rise in popularity.

What remains to be seen is how uncorrelated these asset classes truly are. The common thread that ties the various instruments together is consolidation at the top of the scale. Inflationary pressures are exacerbating social stratification, and the best returns are being realized by investments that target the extreme high end of the luxury markets. With the majority of the population excluded from participating, the sustainability of the business models and the eventuality of a correction are two factors that will be unraveled as time goes on.

Vinovest’s Zhang believes that wine and whiskey will perform well, even if financial and equity markets experience precipitous declines. If recent downturns are any indication of future results, he just might be right. A peer-reviewed study published in 2010 found that wine valuations are “primarily related to economic conditions and not to the market risk.”

Valuations are a sticky, subjective topic, as an asset is only worth what someone will pay for it. If there is no buyer at the top, things can get ugly quickly (for example the 17th-century tulip mania craze). As Aaron Sorkin put it, “For the rest of us to profit, we need a greater fool — someone willing to buy long and sell short.”

With markets screaming higher and money flowing more freely than ever, it is easy to get caught up in the excitement. All investing carries risk, but it’s by balancing these risks and diversifying portfolios that financial masterminds work their magic. While there are practically limitless tangible assets and traditional securities to choose from, one of the advantages of investing in rare wine and whiskey is that even in the event that profits are not realized, losses can be toasted away with a pour from the portfolio.

This story is a part of VP Pro, our free platform and newsletter for drinks industry professionals, covering wine, beer, liquor, and beyond. Sign up for VP Pro now!