Last August, the tech journalist Charlie Warzel filed a column at The Atlantic exploring a dismal middle-road future shaped by generative artificial intelligence programs like ChatGPT. What if generative AI isn’t God in the machine or vaporware?” he wondered. “What if it’s just good enough, useful to many without being revolutionary?”

This was a disturbing vision to my colleague. Warzel continued:

Good enough has been keeping me up at night. Because good enough would likely mean that not enough people recognize what’s really being built — and what’s being sacrificed — until it’s too late. What if the real doomer scenario is that we pollute the internet and the planet, reorient our economy and leverage ourselves, outsource big chunks of our minds, realign our geopolitics and culture, and fight endlessly over a technology that never comes close to delivering on its grandest promises?

Don't Miss A Drop Get the latest in beer, wine, and cocktail culture sent straight to your inbox.

In other words, the technology may raise the floor on some things, at the expense of lowering the ceiling on everything. A grim outcome, indeed. Of course, the United States’ brewing industry has little in common with Silicon Valley. Or does it? In the mad rush to build the colossal data centers required to satisfy gleeful users’ appetites for grievance-reinforcing slopaganda, “agentic” personal assistance, and hyper-personalized psychosis, isn’t there an echo of last century’s race among macrobrewers to build mega-plants proximate to population centers thirsty for their increasingly bland, commodity lagers?

Here’s a more direct comparison. A decade ago, when the hype cycle around the craft-brewing segment was reaching its zenith, there was much gnashing of teeth and rending of flannels about the supposedly exterminatory intentions of the Big Beer interlopers that were then buying any brewery with a business plan at insane premiums. On the flip side, there was an emergent minority of more business-oriented “operators” that were extremely, laughably sanguine about Anheuser-Busch InBev (ABI), Molson Coors (MC), and Constellation Brands muscling their way into the segment with barrelfuls of cash. In this telling, the macrobrewers’ interest was either a cold-blooded inevitability of business, or de facto good for drinkers and small, independent brewers, which would benefit from more access to craft beer and more legitimacy in the eyes of distributors and retailers, respectively.

What if neither of those two outcomes came to pass? What if Big Beer neither totally tanked the segment like true believers feared, nor built it up like they promised? You would wind up in a market where “good enough” was, well, good enough. In it, companies short on artisanal provenance and rebellious ethos, but very, very long on economies of scale and distribution prowess — in a word, macrobrewers — would be in position to capitalize.

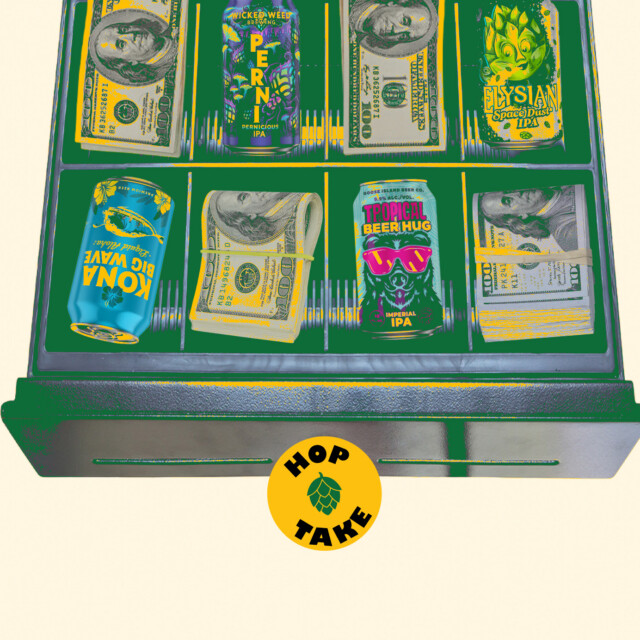

And so: In another mediocre year for craft beer writ large, ABI’s portfolio of craft breweries did pretty damn well. Multi-outlet grocery, mass retail, and convenience store scan data through Dec. 28, 2025 tracked by market research firm Circana shows the firm capturing eye-popping growth against the backdrop of a segment that the Brewers Association projects to be down more than 5 percent in volume for that year. Kona Big Wave Golden Ale, the firm’s heaviest craft hitter in the nation’s beer aisle, was relatively flat year-over-year for 2025 at 0.7 percent in dollars and 1.9 percent in volume. Flat ain’t bad in a bad year, but it looks bad next to some of the numbers posted by other ABI craft marques. Here’s Elysian Space Dust India Pale Ale up 7.3 percent dollars and 6.9 percent volume; here’s Goose Island Tropical Beer Hug DIPA up 26.4 percent and 22.9 percent; here’s Wicked Weed Pernicious IPA up 20.7 percent and 21.1 percent. Of the top 20 Circana-tracked craft brands by volume, ABI owns four. Only New Belgium Brewery — itself a subsidiary of Kirin Holdings via Lion Little World Beverages — can say the same.

You could be forgiven for assuming first-wave craft brewers’ Big Red Menace could never pull this off. Even while its historic shopping spree was still unfolding, it was obvious the company’s executives had no real plan beyond buying shiny new things and figuring out what to do with them later. This proved extremely lucrative for the dozen-ish brewers that sold to ABI during that frothy sprint, but frustrating, and at times borderline disastrous for the people tasked with actually running them under the corporate umbrella. Critics went from wondering when the company would roll out versions of Goose Island’s 312 Urban Wheat for every zip code in the country to wondering how the biggest brewer in the world could possibly be so careless as to sell infected bottles of the Chicago outfit’s vaunted Bourbon County Barrel Stout. Employees endured at least three reorganizations and the layoffs that inevitably came with them. (If memory serves, the division was branded as The High End, rebranded as The Brewers Collective, and then re-rebranded as The High End, its current moniker.) Things looked especially grim for the portfolio after the last big round of cuts, which came in early 2023.

“The consensus was like: Craft means nothing to AB,” one anonymous former employee told reporter Kate Bernot, writing for Good Beer Hunting in March of that year. “We’re not just a cog in a wheel being a craft brand, we’re a cog in a wheel in a cog in a wheel in a cog in a wheel. We don’t move the needle in any way.” Those layoffs, which affected an unspecified number of employees across Blue Point Brewery (acquired 2014, based on Long Island, N.Y.), Devils Backbone Brewing Company (2016, Nelson County, Va.), Golden Road Brewing (2015, Los Angeles), Karbach Brewing Co. (2016, Houston), Wicked Weed Brewing (2017, Asheville, N.C.), and Veza Sur (Miami, launched in 2017), as well as its corporate headquarters in New York City, set the stage for a more stunning admission that mighty ABI had bitten off more craft breweries than it could chew. In August 2023, Tilray Brands — then the owner of SweetWater Brewing Co., Green Flash/Alpine, Breckenridge Distillery, Red Truck Brewery, and Montauk Brewing Co. — announced plans to buy seven of the larger company’s craft brands. For the bargain-basement price of just $85 million, the Canadian vice conglomerate also picked up a defunct energy-drink brand, Hi-Ball. ABI had reportedly pumped something like $730 million into its craft portfolio to that point; it parted with about half those brands for an average of $10.6 million apiece. The fire sale vibes were hard to miss.

As I noted at the time, ABI’s remaining craft portfolio was showing some promising green shoots. To its credit, it got a lot more focused on those in the intervening years, and they’ve really blossomed. Which is why last week, even though North American chief executive Brendan Whitworth told distributors at the company’s tone-setting annual sales meeting that it was “very far from taking a victory lap on anything,” The High End’s president Andy Thomas kinda-sorta sounded like he was taking a victory lap. The macrobrewer had “totally transformed our craft business to compete in today’s market place,” he said, per a report from Beer Marketer’s Insights, and it is now showing “its most meaningful profitability … in nearly a decade.”

What gives? For one thing, better discipline. The company finally shook off its hangover from the buy-buy-buy mania of last decade and started making smarter moves. Stacking chips behind Kona Big Wave, a strong vacation-vibed “lifestyle platform” (in the jargon) was a smart move. Ripping off Voodoo Ranger’s branding and flavor profile, so dominant for so long in convenience store-friendly stovepipes, with Goose Island’s Beer Hug was a smart move. Culling its craft portfolio of 75 percent of its SKUs to leave only the battle-hardened brands with the broadest possible appeal with the American drinking public and the least possible overlap with one another — or as Thomas put it at SAMCOM, “to optimize our portfolio and make it more efficient” — was a smart move.

“Sometimes a cigar is just a cigar; sometimes corporate flailing is just corporate flailing,” I wrote nearly three years ago, commenting on what appears to have been the pivotal round of layoffs at The High End. “Not everything that has befallen craft brewing is ABI’s fault.” Likewise, ABI’s recent success with its pared-down craft portfolio is not entirely of its own making. It’s not a coincidence that its eye-popping growth is coming at a time when the segment’s innovation pipeline has stagnated, its drinkers are indulging their omnibibulousness, and its shelf space is has been whittled away by everything from malt-based hard seltzers to vodka-based hard iced teas.

The pendulum of American culture has swung precipitously away from the shaggy, stomp-clap earnestness of craft and towards the convenient alienation of commodity. In this zeitgeist, seeking out specific, challenging new craft beers to taste and learn about is unimaginably uncool compared to just grabbing whatever is available in your chosen wheelhouse. That dynamic is ABI’s chosen wheelhouse. It could never destroy craft brewing, and it was never going to be a rising tide that lifted all boats within the segment. Grand promises in either direction remain unfulfilled. But now that it’s finally gotten out of its own way, it’s making craft beer that’s good enough. And there’s a lot of money on that floor.

🤯 Hop-ocalypse Now

Everybody knows the market for craft beer is in the toilet these days. But what about the market for craft beer toilets? Ah, so glad you asked. Last week, Brewbound caught a whiff of an unusual auction lot in Boston, where Trillium Brewing is vacating its beer garden outpost on the Rose Kennedy Greenway. More like Poo-bound, amirite?! (Respectfully.) For sale, heavily used: “the Bentley of outhouses,” a modular crapper that the brewery claims to have spent more than $200,000 to commission half a decade ago. The opening bid is set at just $5,000, but at publication there were still no takers. There’s a sweet deal to be had for anybody feeling, well…flush.

📈 Ups…

We all know hard soda flopped, but Owl’s Brew is giving it another spin with a malt-based “spiked pop” line… NIQ data shows that almost three-quarters of buyers of adult non-alcoholic drinks last year were first-timers, suggesting there’s still opportunity for brands on the longtail to find traction… Non-alcoholic comer Bero says it sniffed $10 million in sales in 2025 and hopes to triple that in 2026… Draft IPA was down but draft lager was up in 2025 per BeerBoard’s annual review, and I think that’s beautiful …

📉 …and downs

Rogue Ales & Spirits’ assets will be auctioned off in early March as the company staggers through Chapter 7 bankruptcy proceedings after abruptly shuttering late last year… Athletic Brewing Co. is one of 16 (!!!) sponsors of the 2026 Puppy Bowl, I say give those hounds the hard stuff… New Belgium Brewery laid off an unspecified number of business administration employees totaling around 1 percent of its workforce… Oh cool, Ball Corporation is already sold out of cans through 2027…

This story is a part of VP Pro, our free platform and newsletter for drinks industry professionals, covering wine, beer, liquor, and beyond. Sign up for VP Pro now!