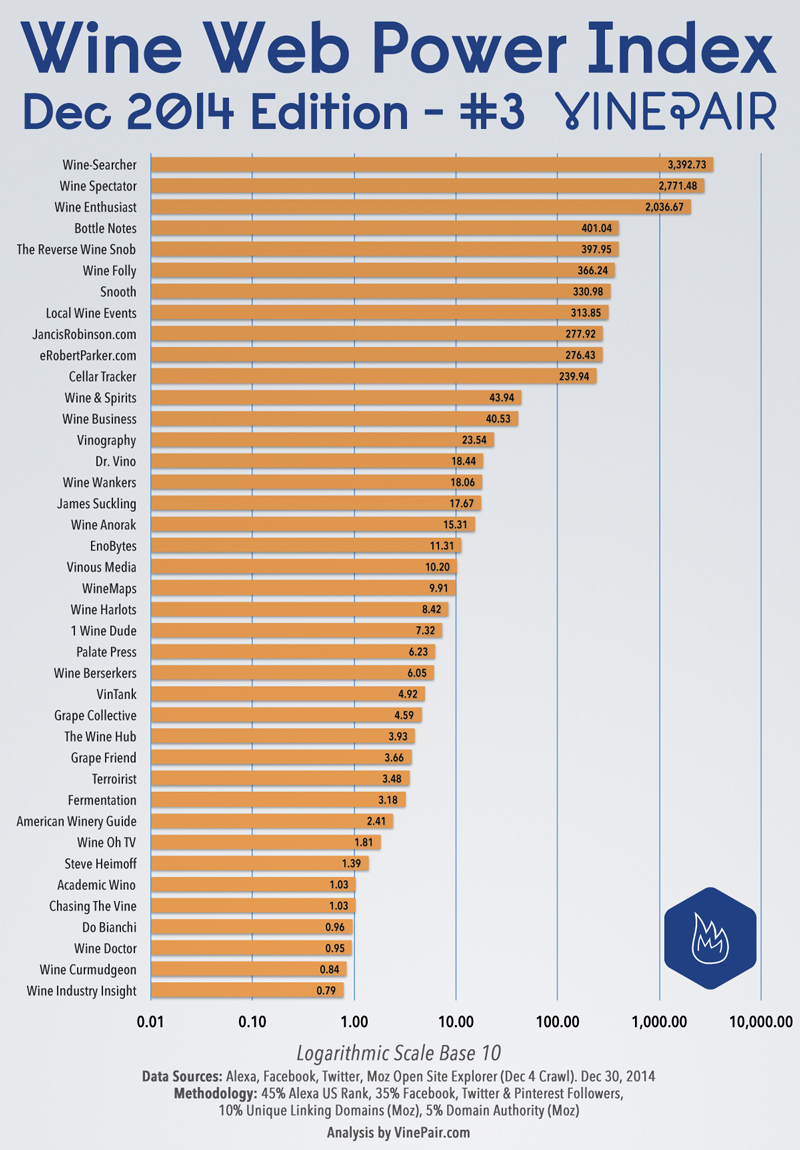

The new year brings new wine, new trends, and the newest release of our look at who is shaping America’s wine culture. If you haven’t seen the previous editions of this project, The Wine Web Power Index is our attempt to objectively identify and measure the influence of the people who play a large role in determining what is in our collective wine glasses. While no one is more important than the winemakers themselves, and big brands can always spend their way into your glass, those efforts are always channeled through — an increasingly democratic — group of writers and wine-focused publications. As we did in December 2013 and again in June 2014, we present The Wine Web Power Index — our attempt to bring order to the wine voices online as we continue to grow as a community and improve America’s wine culture.

A description of our methods and reasons for analyzing the sites and writers we chose is provided below the chart. As creators of the index, we have always excluded VinePair from the project.

Our Observations

- There was little change at the top, with Wine-Searcher, Wine Spectator and Wine Enthusiast (despite a switch to their editorial web domain — see below) maintaining their respective positions.

- While many scores rose from the summer edition, for some of the larger properties this is a simple seasonality effect returning them to where they stood, score-wise, a year ago.

- Back in July we wrote that “with a book on the way for The Reverse Wine Snob, we’d guess Mr. Thorsen’s growth will continue,” and we were right. With a gain of 128%, The Reverse Wine Snob has moved into 5th place.

- Snooth, JancisRobinson.com and Wine Folly all grew, but The Reverse Wine Snob’s momentum was such that he moved past them. And his book still is yet to debut. We’d like to say this continued momentum is a clear sign of the democratization of consumer interest in wine. Score one for the 99%.

- As Robert Parker continues to represent his former property, we have used his personal Twitter account to produce the eRobertParker/The Wine Advocate’s score. As we noted in the previous update, “if we used the @Wine_Advocate account, or new EIC Lisa Perrotti-Brown’s account, eRoberParker’s score and rank would have been far lower.” Nothing has changed in the intervening six months. One would think point-pushers would appreciate an attempt to objectively measure things. Or not. Anyway, we’ll be watching. N.B. to buyers of personality-driven publications — personal Twitter properties should be in your purchase agreement.

- Looking at the strong Hong Kong showing within James Suckling’s web traffic it would seem he’s thrown in his

hat“LALIQUE James Suckling 100 Points – Salvatore Feragamo Leather Briefcase” (sic) with Mr. Parker’s “Asian Strategy.“ - Five properties, which represent very different aspects of the wine industry, joined this edition of the index. A bit of insight about each property follows:

- In 8th place we see Local Wine Events, the web’s largest directory of wine events, that also produces a lot of original content. As we include both industry publications and user-generated content platforms we decided Local Wine Events makes sense as an addition.

- The Wine Wankers, working out of Australia, arrive at 16th place. In the past we did not see enough U.S.-focused traffic and activity from them, but as that has changed we now believe they are an appropriate entry.

- Vinous Media, fresh off the acquisition of Stephen Tanzer’s International Wine Cellar, appears at #20. We’re interested to see where this pay-walled high-end property will end up as The Wine Advocate rides off into Asia.

- At #29 we see Grape Friend, a uniquely pop-culture driven wine personality. While the Grape Friend website draws a bit of traffic, her focus is on social. Among all the surveyed properties Grape Friend had the highest number of Pinterest followers, followed by Wine Harlots.

- And last but not least in 40th place, Wine Industry Insight, the essential daily email newsletter for all things wine business and more. If we had to guess, the Wine Industry Insight newsletter itself has an outsize influence that isn’t measured by this index.

- Wine Maps (992%) saw a massive score increase as we were able to record a U.S. Alexa rank. Wine Berserkers’ dramatic Alexa-driven shift (397%) appears to be more the result of seasonality as confirmed by other traffic measurement sources.

- Previously listed sites that moved below the 40-position cut-off include: Wine Lovers Page, Hawk Wakawaka, Alice Feiring, Bigger Than Your Head, SVB on Wine, WineLine (Dave McIntyre) and Wine Terroirs.

Our Influence Formula

The VinePair Wine Web Power Index measures the influence of selected wine websites within the United States. We looked at web traffic, social media influence and organic search relevance to produce our scores. The second edition (June 2014) of the VWWPI analyzed 40 wine-focused web properties. This release marks the second update of the VWWPI. The next update will be released in summer 2015.

We have added Pinterest Followers to the Social Score subsection, as we indicated we would on the previous release. If a property does not have a Pinterest presence they are not penalized; the Follower count is simply added to the aggregated Facebook and Twitter counts. Approximately half of the included sites had either an active or placeholder Pinterest presence. Our rationale for adding Pinterest vs. other social channels such as Google+ is simple: we believe (along with many other observers of these sorts of things) that Pinterest has surpassed all but Facebook and Twitter (and perhaps Twitter as well) as the place where consumers engage with brands.

Choosing the data weighting is inherently subjective. We believe that social media, at least in terms of consumer (and to a lesser extent industry) influence, is extremely important, hence the relatively high weighting.

We are well aware of the issues with Alexa data (see caveats below), which is why we also included the data points from Moz’s Open Site Explorer web crawl.

Please see the section “How We Selected Who To Include” in the 1st Half 2014 release if you would like to read more about our index selection process.

Our Data Sources

We used publicly available data, collected on December 30, 2014. The Moz Open Site Explorer Data is from the Dec 4, 2014 crawl. Data was manually collected.

[toggle hide=”yes” border=”yes” style=”white” title_open=”Raw Data & Feedback” title_closed=”Raw Data & Feedback”]In the table below you can see our raw data. Have a better way to weight the data, or more to include? We’d love see what you have in mind. If you do produce a different set please let us know.

[/toggle][toggle hide=”yes” border=”yes” style=”white” title_open=”Caveats” title_closed=”Caveats”]

- When a property does not have an Alexa US rank we use their global rank. For this index computation the only property affected by this sampling issue was Academic Wino, whose geographical traffic distribution is confirmed by other sources as being within the limits of consideration.

- While we do not include other traffic data than that collected by Alexa in our ranking formula, we examine and compare many of the properties using other tools and data sources. Based on that analysis we are once again satisfied with the Alexa data.

- After careful consideration, we decided to shift Wine Enthusiast’s Alexa/Moz data to winemag.com from wineenthusiast.com to better reflect the editorial influence goals of the index.

- We recorded data for dozens of other properties that did not make the cutoff at 40th place. If you don’t see a site (aside from categories which we have stated in previous releases we are excluding), chances are we did evaluate it, though feel free to email us if you believe that is not the case.

- A number of properties that do not have a Facebook/Twitter/Pinterest presence, do have a public, personal presence belonging to the owner of the property. When appropriate and available we used the number of their Followers from each service.

[/toggle]