As savvy, drinks-loving travelers have probably noticed, liquor prices vary widely from state to state. As with fluctuating gasoline costs, the price does not reflect any change in the makeup or quality of the product. Instead, it is the amount of tax levied by the state that impacts the cost to consumers.

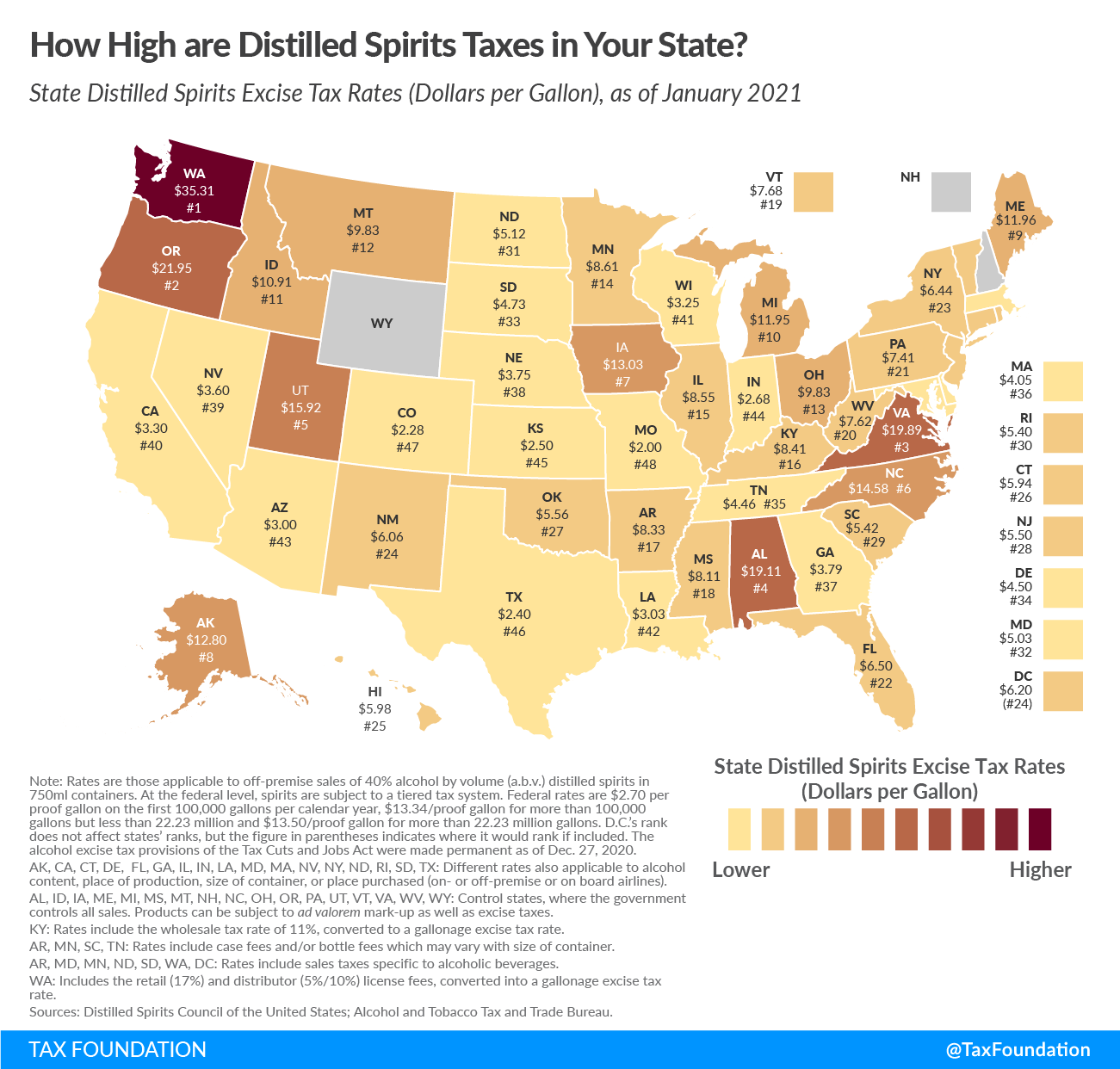

Highlighting just how broad those discrepancies can be, tax policy nonprofit the Tax Foundation recently published a map showing the total excise taxes charged per gallon in each individual state.

The Tax Foundation compiled the map using data recorded by the Distilled Spirits Council of the United States. The graphic reveals that Washington leads the nation in excise taxes, collecting $35.31 per gallon as of January 2021, with Oregon a distant second ($21.95/gal). On the opposite end of the spectrum, Missouri ($2.00/gal), Colorado ($2.28/gal,) and Texas ($2.40/gal) are the three lowest with stated spirits taxes.

Monopolistic control of alcohol distribution allows the states of Wyoming and New Hampshire to offset taxes with reduced markup at retail levels, making the calculations difficult to compare with the remaining 48 states. For this reason, the Tax Foundation decided not to include them in the ranking, noting “These two control states gain revenue directly from alcohol sales through government-run stores and have set prices low enough that they are comparable to buying spirits without taxes.”

Rules and regulations surrounding spirits distribution are as diverse as the tax structure, but interestingly, strict rules regarding sales in states such as Texas do not correlate with high taxation.

One thing’s for sure, knowing where taxes are lowest can help vacationers save money while they enjoy their drinks this summer. For more details, see the full results in the map below.

![How Much Every State Taxes Hard Liquor [MAP] How Much Every State Taxes Hard Liquor [MAP]](https://vinepair.com/wp-content/uploads/2021/06/LiquorData_Card-375x450.jpg)